Crypto Exchange Seeks Transparency Over Regulatory Spending

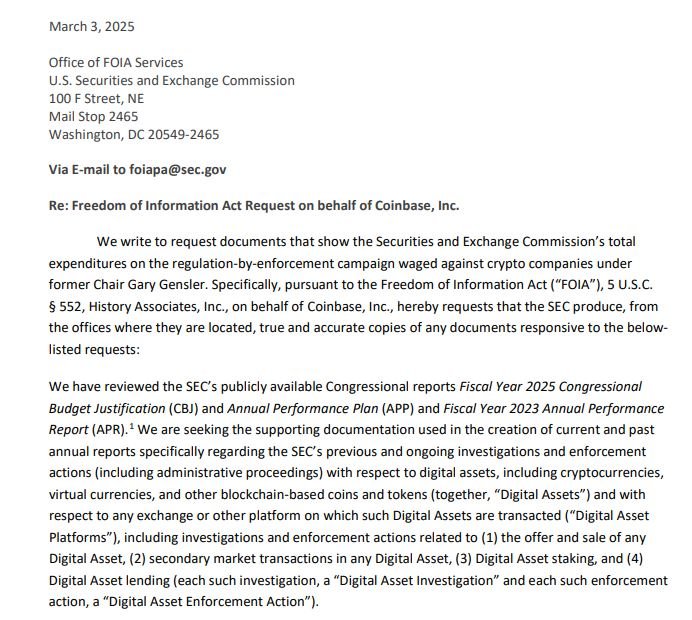

Coinbase has filed a Freedom of Information Act (FOIA) request to determine how much the US Securities and Exchange Commission (SEC) spent on enforcement actions against cryptocurrency firms.

Paul Grewal, Coinbase’s chief legal officer, announced the move on 3 March via X, stating that the exchange is committed to uncovering the financial costs of the SEC’s crackdown on the industry. The request seeks details on investigations and enforcement actions from 17 April 2021 to 20 January 2025, including the number of employees involved, third-party contractors used, and overall expenditure.

“We know the previous SEC’s regulation-by-enforcement approach cost Americans innovation, global leadership, and jobs, but how much did it cost in taxpayer dollars?” Grewal asked.

Focus on SEC’s Crypto Assets and Cyber Unit

Coinbase is also seeking information about the SEC’s now-disbanded Crypto Assets and Cyber Unit, which was replaced by the Cyber and Emerging Technologies Unit (CETU) on 20 February. The FOIA request aims to uncover the unit’s budget, workforce size, and cost of employee hours spent on crypto enforcement.

While acknowledging that the process may take time, Grewal assured that Coinbase is prepared to “do what it takes for as long as it takes” to obtain the requested information.

The SEC has declined to comment on the matter.

SEC Drops Lawsuits Following Gensler’s Departure

The move follows a significant shift in the SEC’s regulatory stance on crypto since the departure of former chair Gary Gensler on 20 January. Gensler, known for his aggressive approach to crypto regulation, spearheaded over 100 enforcement actions against firms in the sector during his tenure, which began in 2021.

His resignation coincided with the start of Donald Trump’s second term as US president. Trump, who had previously pledged to dismiss Gensler if re-elected, has been regarded as more crypto-friendly.

Since Gensler’s exit, the SEC has withdrawn multiple lawsuits against crypto firms. On 27 February, the commission voluntarily dismissed its case against Coinbase, which it had sued in June 2023 for allegedly failing to register as a broker, national securities exchange, or clearing agency. The dismissal was made “with prejudice,” ensuring the case will not be reopened.

The SEC has also dropped its lawsuit against crypto exchange Kraken as of 3 March, following the dismissal of cases against NFT conglomerate Yuga Labs and crypto exchange Gemini in late February. Additionally, the regulator has ended its investigations into Uniswap Labs, the developer behind the decentralised exchange Uniswap, and online brokerage Robinhood Crypto.

Coinbase’s FOIA request marks its latest effort to challenge the SEC’s past enforcement policies and bring transparency to the financial burden of regulatory actions on taxpayers.