Stablecoin issuer Circle has contributed $1 million USDC to President-elect Donald Trump’s Inauguration Committee, CEO Jeremy Allaire announced on 9 January. The donation marks a significant moment for the cryptocurrency sector, signalling its growing acceptance in mainstream financial and political circles.

Allaire described the move as a sign of the maturation of digital assets, with the President-elect’s team welcoming the donation. Trump is set to assume office on 20 January, with industry leaders expressing optimism about potential pro-crypto policies under his administration.

Stablecoins: A Crucial Crypto Policy Focus

The stablecoin sector has become a key focus in the evolving landscape of cryptocurrency regulation. In April 2024, U.S. Senators Kirsten Gillibrand and Cynthia Lummis introduced the Lummis-Gillibrand Payment Stablecoin Act to provide a clear regulatory framework for these digital assets.

Senator Gillibrand emphasised the importance of stablecoins in maintaining the U.S. dollar’s dominance in global markets. Meanwhile, former House Speaker Paul Ryan argued that stablecoins could alleviate the national debt crisis and bolster the dollar’s role as the global reserve currency.

Ryan highlighted that issuers of overcollateralised stablecoins collectively hold more than $120 billion in short-term U.S. government securities, helping to drive demand for government debt. Building on this momentum, Senator Bill Hagerty introduced the Clarity for Payment Stablecoins Act in October 2024. The legislation proposes state-level regulation for stablecoin issuers with a market capitalisation below $10 billion, while larger players would remain under federal oversight.

The Growing Market for Stablecoins

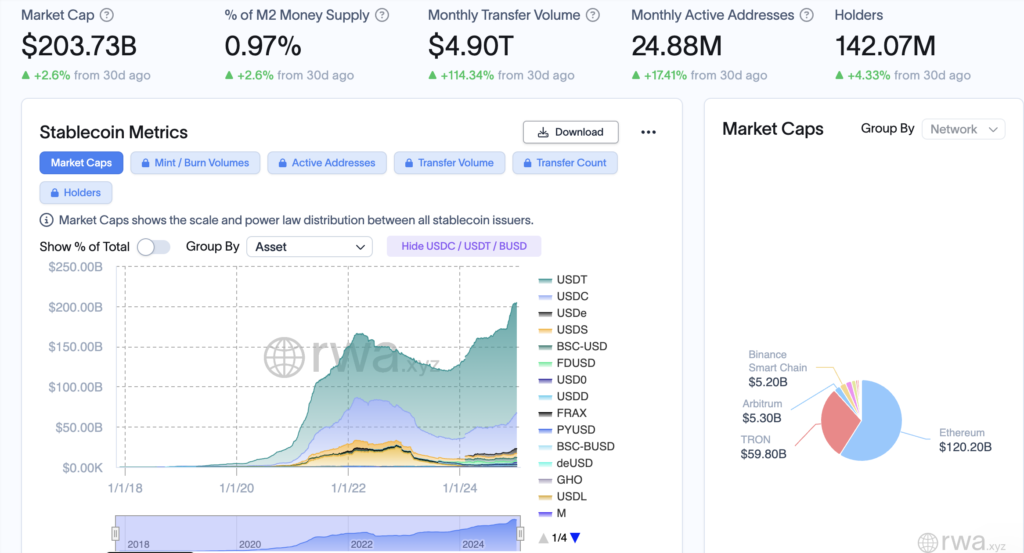

The stablecoin market has witnessed rapid expansion, with a current market capitalisation of approximately $203 billion. Circle’s USDC accounts for $44 billion of this total, according to data from RWA.XYZ. Industry experts predict further growth in the sector, with Guy Young, founder of Ethena, forecasting a market cap of $300 billion by 2025.

This growth is expected to be driven by leading issuers like Tether and Circle. Venture capitalists are also increasingly focusing on the stablecoin sector as a promising investment opportunity.

Stablecoins in Emerging Markets

Deng Chao, CEO of institutional asset manager HashKey Capital, noted that stablecoins have proven to be an effective solution for providing banking services to the unbanked population in emerging markets. This use case is drawing significant interest from venture capital firms, positioning stablecoins as one of the most attractive digital asset classes in 2025.

As stablecoins continue to gain prominence, their role in shaping financial systems and policies worldwide is becoming increasingly clear. Circle’s donation to Trump’s Inauguration Committee underscores this growing influence, marking another step towards the mainstream adoption of digital assets.