Cardano (ADA) has seen a significant price recovery, bouncing 12.5% from its $0.857 low on January 28. At the time of writing, ADA is trading at $0.956, up 7% over the last 24 hours, supported by broader crypto market momentum and the approval of its Plomin upgrade.

Crypto Market Recovery Drives ADA Surge

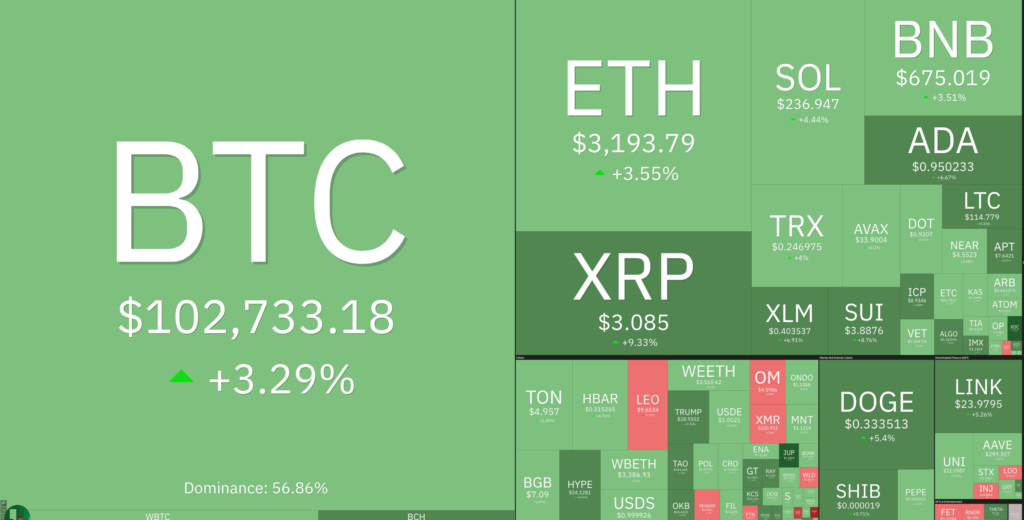

The rebound in ADA’s price mirrors a widespread recovery across the cryptocurrency market. Bitcoin (BTC) has regained ground, rising 3.3% in the past day to $102,733, while Ether (ETH) has climbed 6.8% to just below $3,200. Other major cryptocurrencies, including BNB, XRP, and Dogecoin (DOGE), have also posted significant gains.

The total cryptocurrency market cap has risen by 3.87% in the last 24 hours, reaching $3.51 trillion on January 28. The market’s recovery comes as participants await the outcome of the US Federal Reserve’s Federal Open Market Committee (FOMC) meeting, which is expected to keep interest rates steady at 4.25%-4.5%.

Plomin Upgrade Gains Approval

Cardano’s bullish performance is further supported by the approval of the Plomin hard fork. On January 27, the Cardano Foundation voted in favour of the upgrade, joining other key entities such as Input Output Global (IOG), EMURGO, and the Cardano Japan Council.

The Plomin hard fork is scheduled for January 29 at 21:45 UTC and is set to transform the Cardano blockchain into a fully decentralised governance model. ADA holders will be able to vote directly on governance actions or delegate their voting power to representatives.

The Cardano Foundation described the upgrade as “constitutional” and compliant with governance protocols, noting that it enables CIP-1694 governance and enhances Plutus primitives. Binance, the world’s largest cryptocurrency exchange, has also announced its support for the upgrade, further boosting investor confidence.

Technical Analysis Points to $1.90 Target

ADA’s price action forms part of a symmetrical triangle consolidation, which typically precedes a breakout in the direction of the prevailing trend. If confirmed, this technical pattern sets ADA’s long-term target at $1.90, representing a potential 96% gain from current levels.

In the short term, ADA faces resistance at $0.962, near its 50-day simple moving average (SMA), and at $1.13, the descending trendline of the symmetrical triangle. A strong breakout above these levels with significant volume could confirm the pattern and trigger further gains.

As the Plomin hard fork approaches and bullish market sentiment persists, ADA appears well-positioned for continued growth, with both technical and fundamental factors supporting its upward trajectory.