XRP has surged past Bitcoin in performance this year, supported by a mix of technical indicators, legal clarity, and speculation surrounding new crypto products. The central question for investors now is whether XRP can sustain its dominance or if Bitcoin will reclaim leadership as the market cycle matures.

XRP Outpaces Bitcoin Since Trump’s Reelection

Since Donald Trump’s reelection in November, XRP has gained nearly 300 per cent against Bitcoin. The rally has been powered by Ripple’s partial settlement with the US Securities and Exchange Commission and growing expectations of spot exchange-traded funds tied to XRP.

XRP is currently trading at $2.96 while Bitcoin sits at $112,245. The XRP/BTC pair has been climbing steadily, and analysts suggest the upside momentum may not be over yet.

Inverse Head and Shoulders Points to More Gains

A bullish pattern has appeared on the XRP/BTC weekly chart. Traders have identified an inverse head and shoulders formation, widely viewed as one of the most reliable reversal signals in markets. The neckline resistance is currently near 3,145 satoshi.

If XRP closes decisively above this level, the move could confirm the pattern and potentially trigger a rally toward 5,700 satoshi by late 2025. Such a move would represent more than 100 per cent gains from current levels.

Reinforcing this outlook, XRP also printed a “golden cross” in August when its 50-week exponential moving average rose above its 200-week EMA. This crossover is a traditional signal of strengthening bullish momentum.

Breaking 2019 Resistance Could Unlock 250% Rally

Despite recent progress, XRP faces a strong resistance zone between 2,440 and 3,570 satoshi. This band has repeatedly blocked upward moves since mid-2019, largely due to regulatory pressure. Ripple’s partial settlement earlier this year has eased those concerns, improving the odds of a breakthrough.

Technical analyst Cryptoinsighttuk notes that a successful breakout above this range could drive XRP/BTC toward 9,000 satoshi. That would represent gains of up to 250 per cent.

Altseason Rotation May Boost XRP

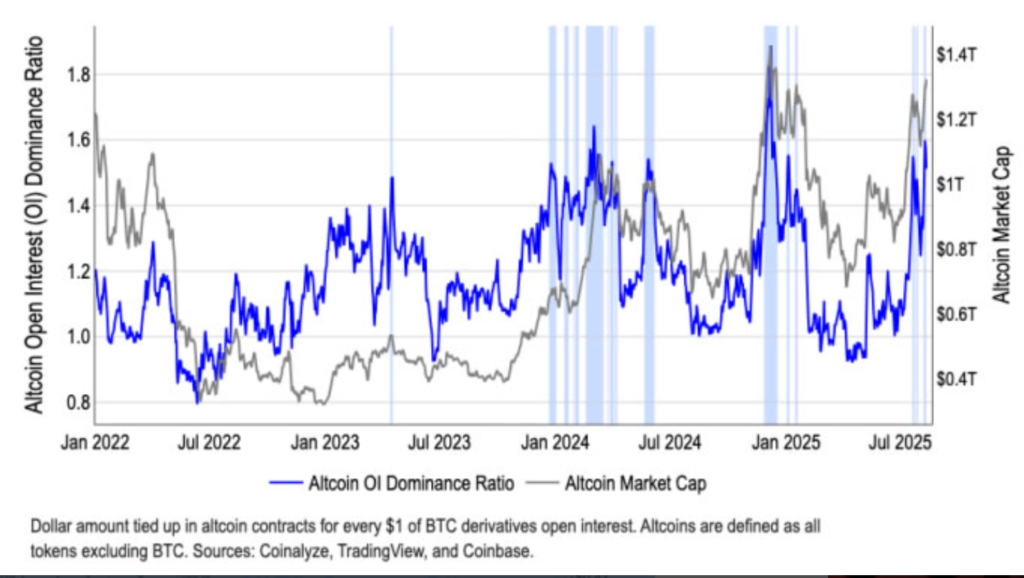

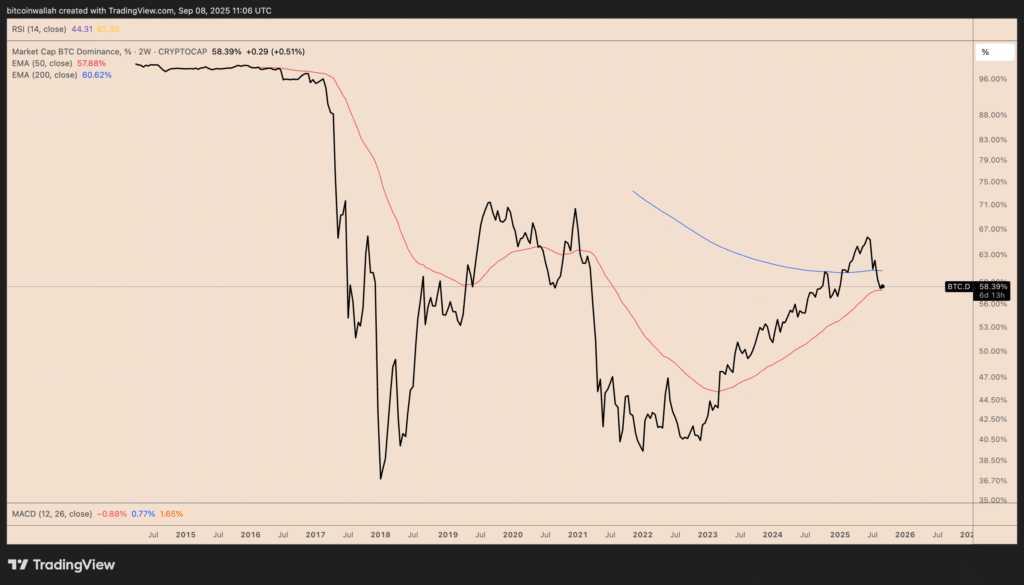

Market observers are also watching broader structural shifts. Coinbase Institutional’s head of research David Duong highlighted in August that conditions are aligning for a possible altcoin season. By Coinbase’s measure, such a phase begins when three-quarters of the top 50 altcoins outperform Bitcoin over a 90-day span.

Bitcoin dominance has already slipped to around 57 per cent, the lowest since January. A continued decline would signal further rotation of capital into altcoins, potentially positioning XRP as one of the largest beneficiaries.

Outlook Hinges on ETF Approvals and Market Sentiment

The timing of a full-scale altcoin season may depend on regulatory developments in the United States. Approval of additional cryptocurrency ETFs could serve as the spark for renewed capital inflows into the altcoin sector.

While XRP’s bullish signals are stacking up, history shows that Bitcoin often reasserts dominance as cycles progress. Whether XRP can defy that trend and maintain its lead remains one of the most closely watched questions of this bull market.