The cryptocurrency market is once again at a turning point. After months of steady gains, traders are now watching for signals that could decide whether altcoins break out to new highs or lose momentum. Two major factors stand out: China’s potential economic stimulus and global investors’ response to rising recession fears.

At the heart of this discussion is liquidity, the amount of money flowing through global markets. When central banks increase money supply, risk assets like stocks and cryptocurrencies often benefit. A report by 21Shares in March 2025 highlighted this link, noting a remarkable 94% correlation between Bitcoin’s price and global liquidity, a stronger connection than with either the S&P 500 or gold.

With this in mind, all eyes are now on the People’s Bank of China (PBOC). As the country faces slowing growth, its next move could provide the liquidity boost that the crypto market has been waiting for.

China’s Economy Sends Warning Signs

Recent Chinese economic data paints a worrying picture. Retail sales in July fell by 0.1% compared to June, while fixed-asset investments dropped 5.3% year-on-year, the steepest decline since March 2020. Industrial production grew only 0.4% over the same month, while urban unemployment edged up to 5.2% from 5% in June.

These numbers reflect a slowdown in both consumer spending and industrial activity. Given that China accounts for nearly 20% of global GDP, its economic health directly influences global markets, including cryptocurrencies.

Economists from Nomura, Commerzbank, and Bloomberg Economics suggest that it is only a matter of time before the PBOC steps in with stronger support policies. Analysts Chang Shu and Eric Zhu even noted that stimulus measures could arrive as early as September.

If Beijing opts to expand credit, lower interest rates, or provide special financing, it could release billions into the economy liquidity that may spill over into global risk assets, including altcoins.

Recession Fears vs Market Optimism

While China’s situation is critical, global sentiment also plays a role. In the United States, consumer confidence has taken a hit. According to the University of Michigan’s survey, 60% of Americans expect unemployment to worsen over the next year, a level of pessimism last seen during the 2008–09 financial crisis.

However, markets are not yet reflecting deep fear. The S&P 500 has continued to set new all-time highs, and yields on five-year US Treasurys have rebounded from a three-month low. Normally, rising recession fears push investors towards safer assets like government bonds, lowering yields. But the recent uptick in Treasury yields suggests traders are less risk-averse than expected.

This resilience opens the door for a rotation into riskier assets if additional liquidity, especially from China enters the system.

What It Means for Altcoins

Altseason, the period when altcoins outperform Bitcoin, has historically relied on a combination of liquidity growth and investor confidence. With the US Federal Reserve already in focus, the spotlight is now shifting to China’s monetary policy.

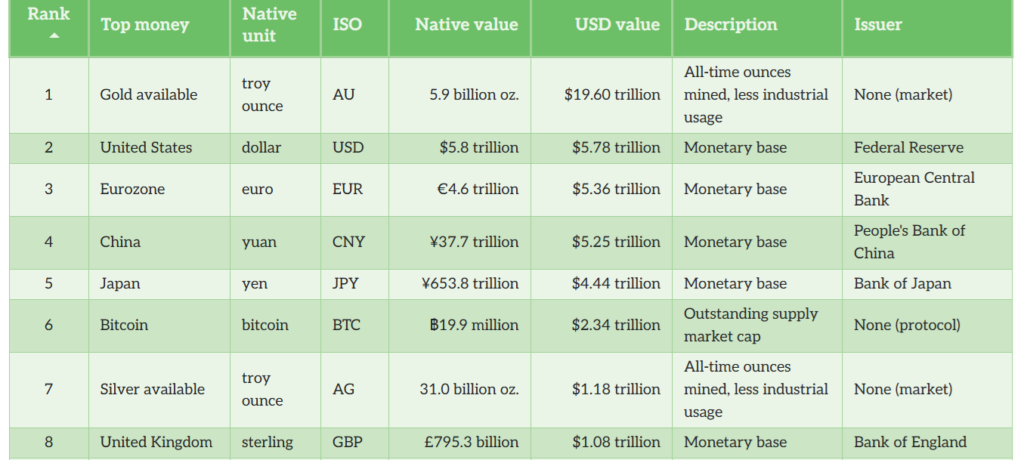

The US currently leads with an M0 monetary base of $5.8 trillion, followed by the eurozone ($5.4 trillion), China ($5.2 trillion), and Japan ($4.4 trillion). This shows that while the Federal Reserve dominates headlines, China’s influence on global liquidity is almost as significant.

If the PBOC launches meaningful stimulus in September, it could inject much-needed liquidity into markets. For crypto, this may act as the spark for altcoins to break past their previous highs. However, recession fears still linger. If global investors turn cautious, they may hesitate to pour money into high-risk assets like cryptocurrencies, even with fresh liquidity available.

The Road Ahead

For now, the future of altseason rests on a balance between two forces: China’s stimulus and global investor sentiment. If Beijing acts decisively and investors remain willing to take risks, altcoins could enter a powerful new rally. But if recession fears rise sharply, the rally may stall.

Either way, the next few months will be crucial. Traders will closely watch both Chinese policy announcements and global market reactions. Should liquidity rise and optimism hold, the stage could be set for cryptocurrencies not just Bitcoin, but altcoins as well, to reach fresh all-time highs.