Cryptocurrency exchange and media company Bullish is making headlines with its ambitious plan to go public in the United States, seeking a valuation of up to $4.2 billion. Backed by financial powerhouses BlackRock and ARK Investment Management, the company’s IPO comes amid a broader wave of crypto listings fuelled by renewed institutional interest and regulatory progress.

IPO Aims for $629 Million Raise

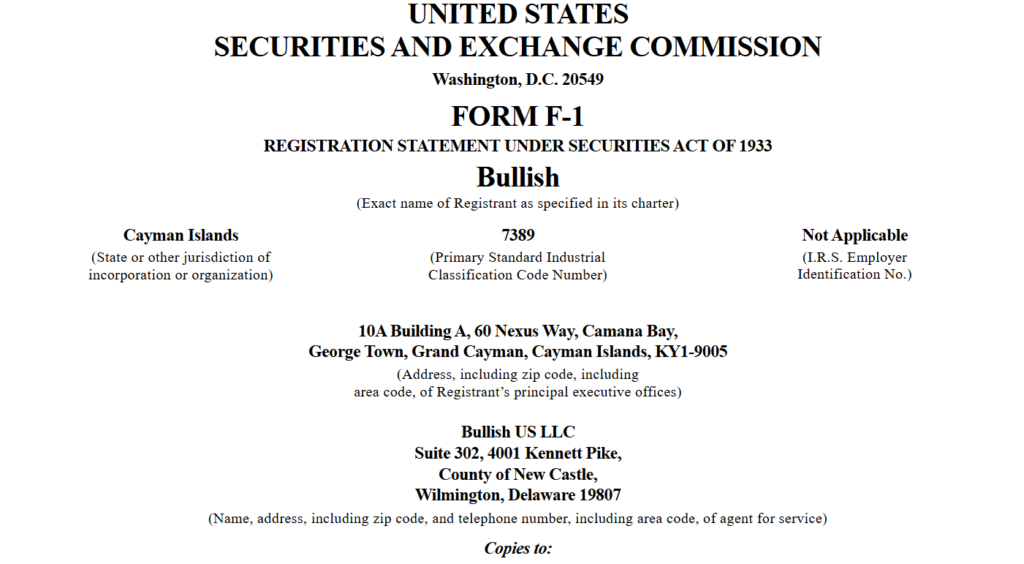

According to an updated F-1 filing submitted to the U.S. Securities and Exchange Commission (SEC), Bullish plans to offer 20.3 million shares priced between $28 and $31 each. This would raise between $568 million and $629 million, positioning it as one of the most high-profile IPOs in the crypto space this year.

If approved, Bullish shares could begin trading on the New York Stock Exchange as early as August 12, according to sources familiar with the matter. The offering has already attracted the attention of major institutional investors. Investment vehicles managed by BlackRock and ARK Invest have expressed interest in purchasing up to $200 million worth of shares at the IPO price.

Strategic Use of Proceeds and Media Expansion

Bullish disclosed in its filing that a portion of the IPO proceeds will be converted into U.S. dollar–denominated stablecoins, aligning with its strategy to enhance on-chain liquidity and digital asset operations. The company, which serves institutional clients across over 50 jurisdictions (excluding the U.S.), has steadily expanded its offerings in the past year.

In November 2023, Bullish acquired CoinDesk, a leading crypto news platform, for $72.6 million from Digital Currency Group. CoinDesk is currently the second-largest crypto media outlet by readership, attracting an average of 4.9 million unique monthly viewers in 2024. The acquisition marked a strategic move to control both infrastructure and narrative within the crypto ecosystem.

Bullish Momentum in Crypto IPO Market

Bullish’s IPO filing is part of a broader resurgence in crypto IPO activity, particularly in the U.S. Several prominent crypto firms are preparing to enter public markets, signalling increased investor confidence and improved regulatory clarity.

In July, BitGo, a major digital asset custodian, also filed for a U.S. public offering, although it has yet to disclose valuation or share details. Meanwhile, crypto exchange Kraken is reportedly aiming to raise $500 million through an IPO that could push its valuation to $15 billion, up from a previous $11 billion.

Reports also suggest that OKX, one of the world’s top crypto exchanges, is working toward a U.S. listing after recently reactivating its operations in the country.

Regulatory Tailwinds Boost Investor Confidence

The uptick in crypto IPOs comes amid a favourable shift in the regulatory landscape. In July, U.S. President Donald Trump signed the GENIUS Act into law, establishing the first formal stablecoin regulatory framework in the country. Shortly after, the House of Representatives passed two additional bills addressing market structure and anti–central bank digital currency (CBDC) provisions before going on recess.

The legislative clarity has encouraged institutional capital to re-enter the space with conviction. Notably, Circle, the issuer of the USDC stablecoin, recently executed one of the most successful crypto IPOs this year. Before going public, it increased its IPO raise target to $900 million amid strong investor demand.

Bullish’s IPO represents a significant moment for the crypto industry as it attempts to bridge the gap between traditional finance and decentralised infrastructure. With heavyweight backers like BlackRock and ARK, a diversified business model, and a favourable market environment, Bullish is well-positioned to become a key player in the new wave of crypto-related public companies. As the IPO market heats up, all eyes will be on August 12, when Bullish is expected to make its public market debut.