Bitcoin’s breakout above the psychologically important $95,000 mark has energised some segments of the market—but not all. While miners are signalling renewed confidence by accumulating BTC, derivatives traders are expressing caution, betting on a potential short-term correction. This divergence has created an atmosphere of uncertainty around the coin’s next move.

Miners Accumulate as Reserves Rebound from Lows

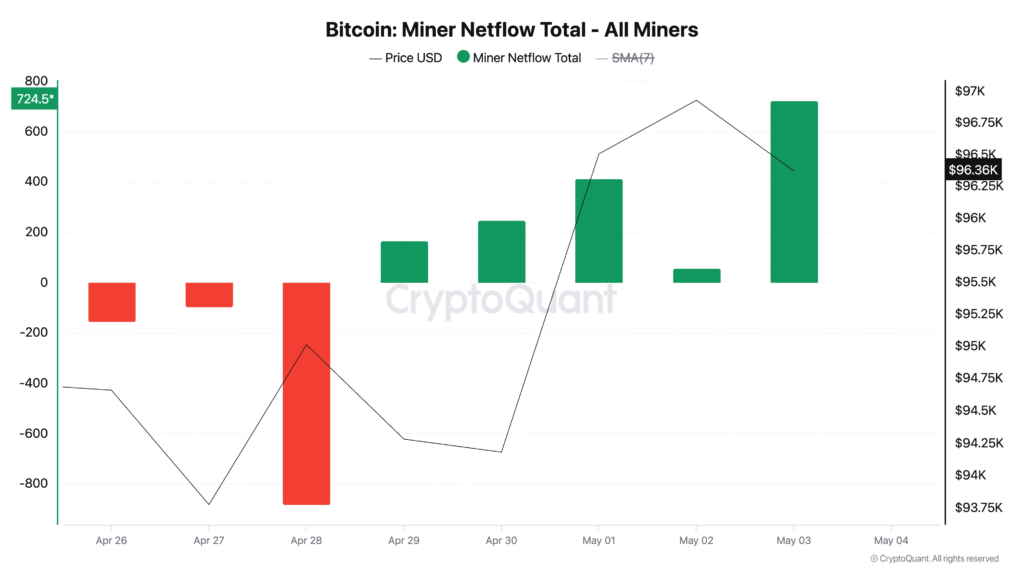

Data from CryptoQuant shows that miner reserves—which track the amount of BTC held in miners’ wallets—have started to climb after touching a year-to-date low of 1.80 million BTC on April 28. The reserve uptick began almost immediately after BTC crossed $95,000 on April 29.

Typically, a drop in miner reserves indicates selling pressure and bearish sentiment, while an increase suggests miners are holding their coins in anticipation of further price gains. The current accumulation trend signals that miners, who are often considered long-term holders, are turning bullish. This is further supported by positive miner netflows since the breakout, showing more coins entering miner wallets than leaving them.

Derivatives Traders Signal Bearish Bias

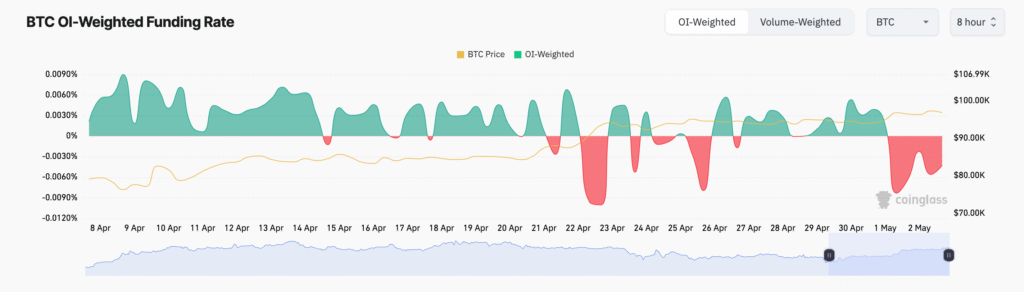

Despite the optimism from miners, activity in the derivatives market reveals a more cautious sentiment. Bitcoin’s funding rate in perpetual futures contracts has remained negative since the start of May, sitting at -0.0056% at the time of writing.

A negative funding rate means that traders holding short positions are receiving payments from those with long positions. In simple terms, more traders are betting on a price drop than a rise. This imbalance indicates that many in the market expect a near-term pullback, casting a shadow over the bullish miner narrative.

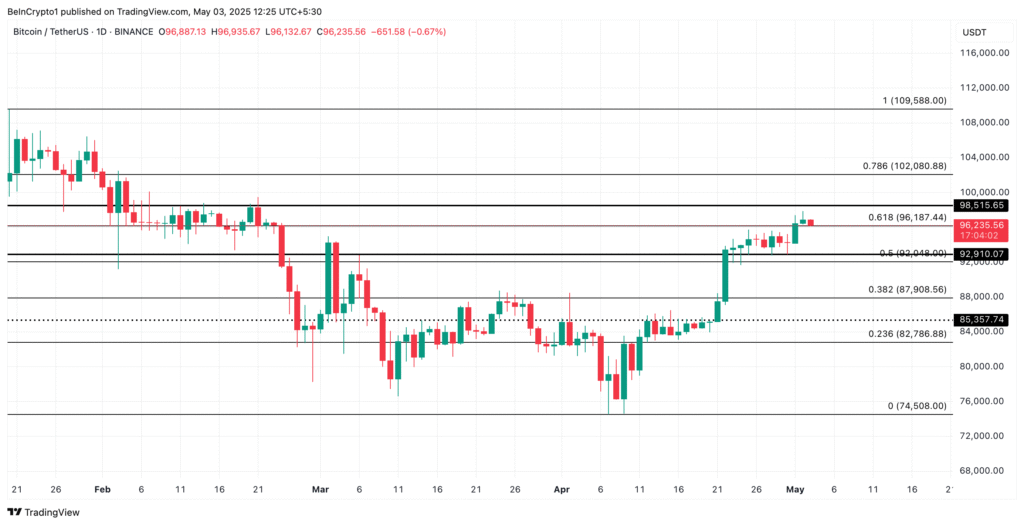

Price at Pivot: $98.5K Resistance, $92.9K Support

The next major test for Bitcoin lies ahead. If accumulation continues and buyer momentum strengthens, BTC could rally further, with immediate resistance at $98,515. A successful breakout above this level could open the door to retesting the $102,080 zone.

On the flip side, if the short bias in derivatives leads to selling pressure and weak demand, BTC may slip back below $95,000. The next key support lies at $92,910—a level that could be tested if bearish momentum builds.

Bitcoin’s move above $95,000 has triggered a clear divergence in sentiment. Miners are showing renewed faith in long-term upside by increasing their reserves, while traders in the futures market remain cautious, positioning for a possible decline.