France’s financial markets regulator, the Autorité des Marchés Financiers (AMF), has authorised cryptocurrency operations for Hexarq, a subsidiary of the French banking group BPCE. This makes Hexarq the second banking crypto outfit to secure AMF approval, following Société Générale’s Forge.

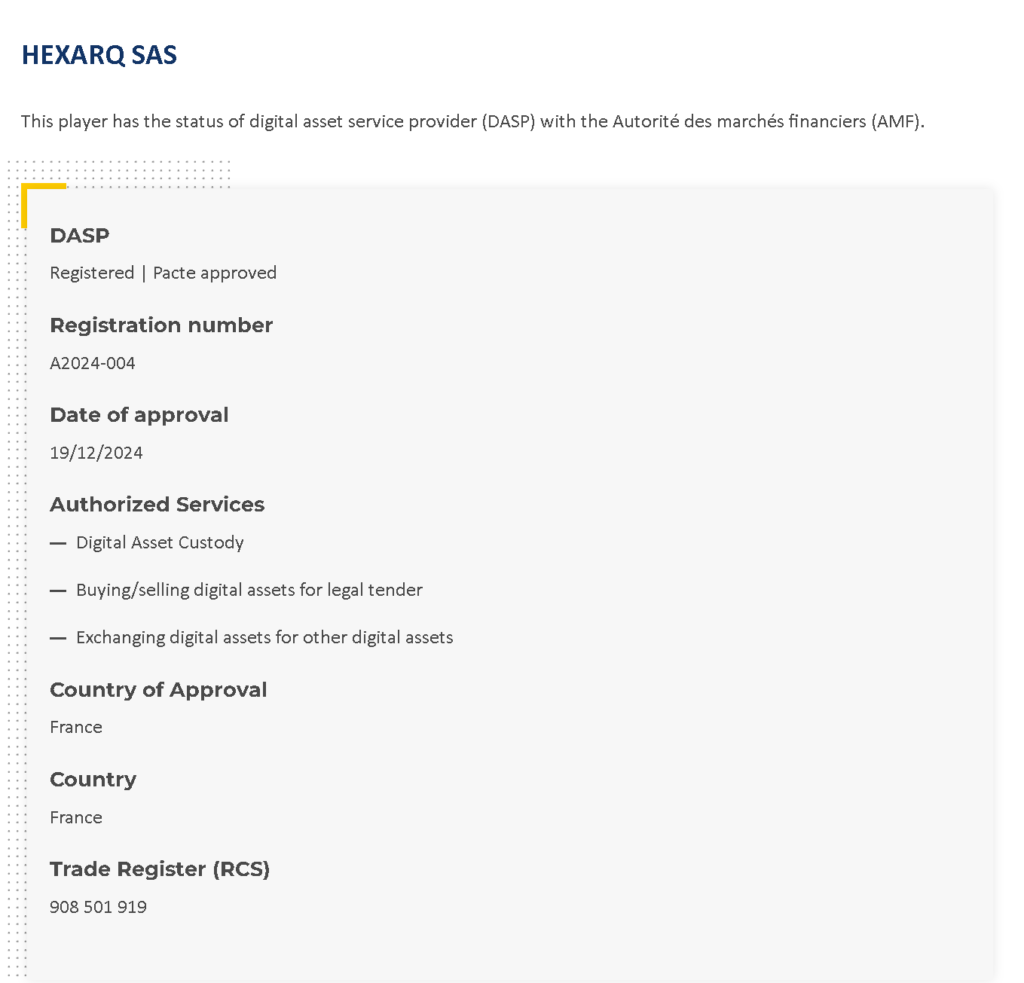

Hexarq, launched in January 2021, is a digital asset service platform specialising in cryptocurrencies and tokenised real-world assets (RWA). With its newly acquired Crypto Asset Service Provider (CASP) licence, the platform is now authorised to offer services such as cryptocurrency custody, as well as buying, selling, and trading crypto against the euro.

Integration into BPCE Networks by 2025

Hexarq is expected to roll out its cryptocurrency investment services within BPCE’s Banque Populaire and Caisse d’Épargne networks by 2025. This integration will potentially grant access to 35 million customers, cementing BPCE’s footprint in the crypto sector.

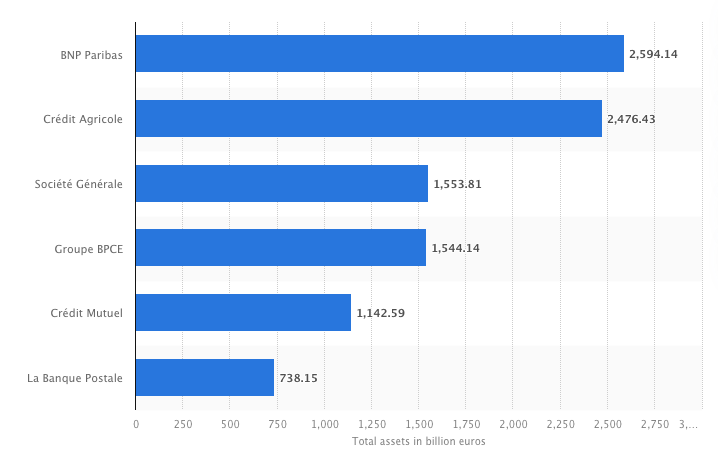

The banking group is among the top 10 in Europe, managing assets worth approximately €1.3 trillion ($1.3 trillion) as of September 2024. Despite the AMF approval, BPCE declined to provide further details regarding the specific launch plans for Hexarq’s crypto services.

Few CASP Authorisations Granted in France

Hexarq is one of only four businesses to have received CASP authorization from the AMF. Société Générale’s Forge obtained approval in 2023, while Deblock SAS and GOin SAS secured their licences in June 2023 and September 2022, respectively.

The AMF began accepting CASP applications in August 2024, ahead of the European Union’s Markets in Crypto-Assets (MiCA) regulations, which will come into full effect on 30 December 2024.

Hexarq’s approval signals a growing trend of regulatory acceptance for crypto operations within traditional banking institutions in France, potentially reshaping the financial landscape.