Blockchain transaction data linked to cryptocurrency payments on darknet markets may offer an early warning of emerging drug overdose crises, months before official public health data catches up. That is the key finding of a new report released by blockchain analytics firm Chainalysis, which examined illicit activity across online drug and fraud marketplaces.

The report suggests that shifts in crypto payment patterns, especially large transfers connected to drug suppliers, often appear well ahead of spikes in hospitalizations and overdose deaths. Researchers argue that this time gap could help authorities and health agencies respond faster to looming public health emergencies.

Darknet drug markets remain resilient despite crackdowns

According to the analysis, cryptocurrency flows linked to darknet drug and fraud markets reached nearly $2.6 billion in 2025. This highlights the continued scale and resilience of online illicit markets, even as law enforcement agencies repeatedly shut down major platforms.

Most vendors, the report noted, receive funds through personal crypto wallets or centralized exchanges, making blockchain transactions a key data source for tracking how these markets operate. While individual marketplaces are often dismantled, vendors typically move quickly to alternative platforms, keeping the overall ecosystem alive.

Chainalysis pointed out that the persistence of these markets makes long term monitoring more valuable than focusing only on individual takedowns.

Crypto payments mirror real world overdose trends

Beyond mapping criminal activity, the report linked blockchain data to real world health outcomes. One of the most striking findings involved suppliers of fentanyl precursor chemicals. Crypto payments to wallets associated with these suppliers fell sharply starting in mid 2023.

Several months later, overdose deaths in the United States and Canada also declined, after reaching a peak earlier in 2023. The timing suggests a lag between changes in drug supply activity and visible impacts on public health statistics.

Chainalysis estimated that monitoring transactions tied to precursor suppliers could provide a three to six month advance signal before overdose trends become visible in official data.

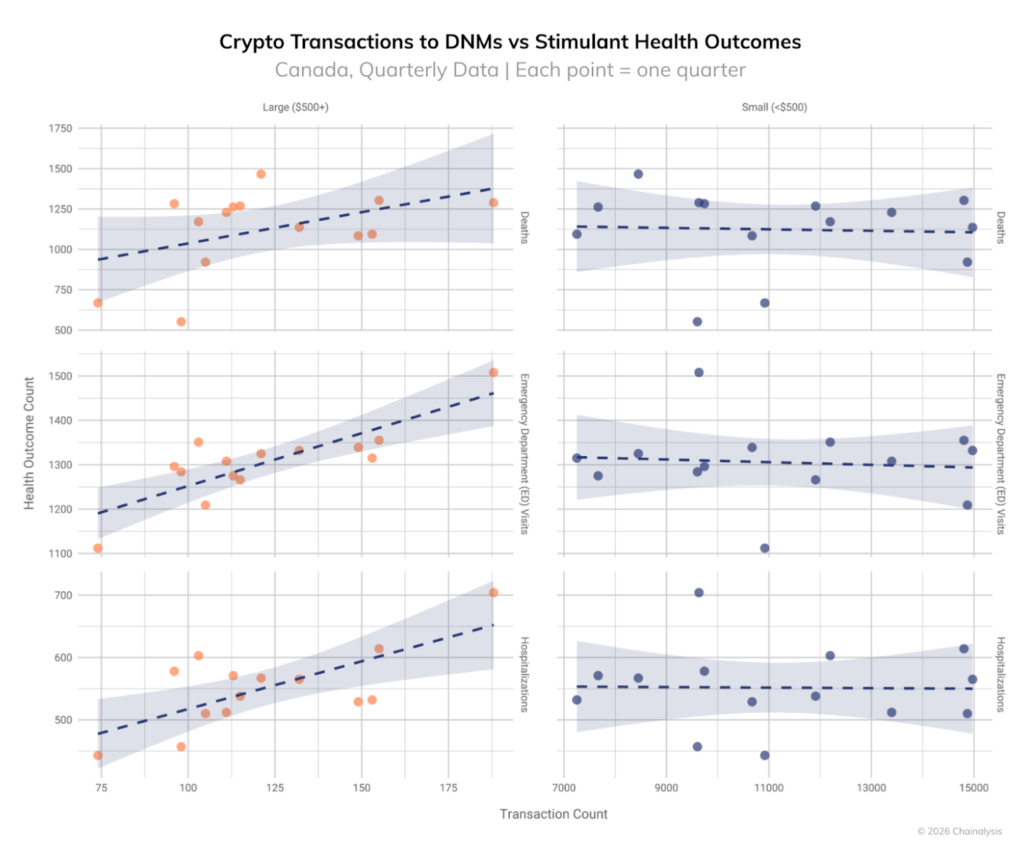

Larger transactions linked to hospitalizations and deaths

To test the link between crypto payments and health outcomes, the report compared blockchain data with Canadian hospital records. The results showed a clear distinction based on transaction size.

Smaller payments, typically under $500, showed no consistent relationship with emergency room visits or overdose deaths. In contrast, larger transfers were closely associated with rising stimulant related hospitalizations and fatalities.

The researchers believe these bigger payments likely represent bulk purchases or redistribution, rather than personal use. As drugs move from suppliers to distributors and then to users, the health impacts emerge later, often months after the initial transactions take place.

As the report explained, money moves before the crisis hits. Drugs are bought and distributed well before users suffer overdoses that require medical care. Because blockchain records update almost instantly, they offer a faster and more detailed signal than traditional reporting systems.

Market shutdowns trigger rapid migration

The report also highlighted how quickly darknet activity adapts to disruption. When Abacus Market was shut down in July 2025, transaction activity did not disappear. Instead, it shifted rapidly to successor platforms such as TorZon.

Chainalysis found that many vendors routinely resupply across multiple platforms and relocate within days of a shutdown. This pattern reinforces the idea that monitoring overall transaction flows is more effective than tracking individual marketplaces in isolation.

Fraud markets shrink but evolve

Fraud focused marketplaces showed a different trajectory. Onchain volumes tied to fraud shops dropped sharply year over year, falling from about $205 million to $87.5 million after infrastructure takedowns.

However, the decline did not mean fraud activity vanished. Instead, it shifted toward wholesale models. The report pointed to Chinese language networks operating on Telegram, where large scale bulk sales of stolen payment data have become more common.

These operations tend to involve fewer transactions, but at much higher values, making them harder to spot through traditional methods alone.

Rise in trafficking linked transactions

In a separate but related finding, Chainalysis reported a sharp increase in crypto transactions tied to suspected human trafficking networks. In 2025, such activity rose by 85 percent, reaching hundreds of millions of dollars.

The report said much of this activity was linked to Southeast Asia and closely connected to scam compounds, online gambling operations and Chinese language money laundering groups. The overlap between scams, trafficking and illicit financial networks underscores how blockchain analysis can expose connections across different types of crime.

A potential tool for public health response

While the report does not suggest blockchain data as a replacement for traditional public health surveillance, it argues that crypto transaction monitoring could act as a powerful complement. By identifying shifts in drug supply and distribution earlier, authorities may gain valuable time to deploy prevention, treatment and harm reduction measures.

Chainalysis emphasized that the goal is not just enforcement, but early intervention. In an environment where official statistics often lag by months, blockchain data could help close the gap between emerging risks and real world response.