BlackRock has sought to reassure investors after its flagship spot Bitcoin ETF, IBIT, recorded significant withdrawals in November. The world’s largest asset manager said the activity reflects standard market behaviour rather than waning confidence in digital asset products.

IBIT Faces Pressure After Heavy Withdrawals

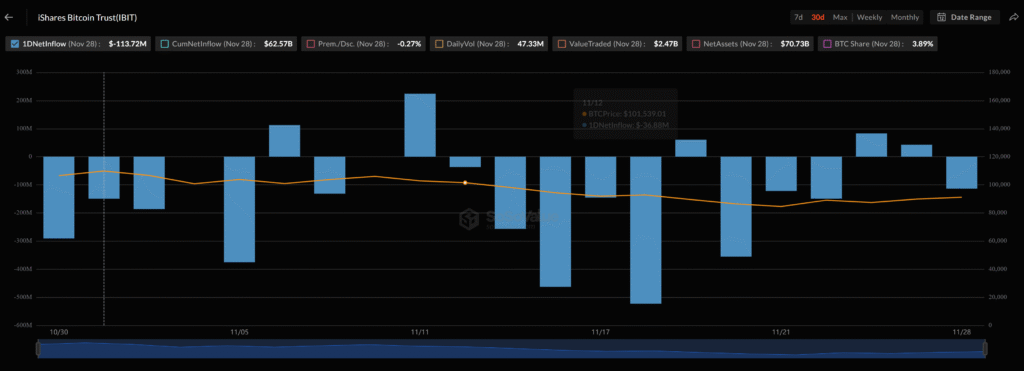

BlackRock’s United States listed IBIT ETF finished November under pressure following an estimated $2.34 billion in net outflows. The largest withdrawals occurred in the middle of the month, with around $523 million exiting on 18 November together with a further $463 million leaving on 14 November.

Despite the sharp outflows, BlackRock remains confident in the long term outlook for its cryptocurrency offerings. Speaking at the Blockchain Conference 2025 in São Paulo, BlackRock’s business development director Cristiano Castro described the withdrawals as routine and consistent with how investors use exchange traded funds.

BlackRock Says Outflows Reflect Normal Investor Behaviour

Castro highlighted the nature of ETFs as highly flexible financial instruments that allow rapid movement of capital. He noted that retail investors drive much of the trading in Bitcoin ETFs, which can lead to pronounced swings during periods of price compression.

He stated that such activity is “perfectly normal” in a market where participants adjust exposure according to sentiment together with cash flow needs. He added that the broader performance of BlackRock’s Bitcoin ETFs demonstrates continued strong interest despite the monthly volatility.

Bitcoin ETF Demand Surged Near $100 Billion at Peak

Castro pointed to previous demand as evidence of the product’s resilience. Combined United States and Brazil listings under the IBIT banner reached nearly $100 billion in assets at their peak earlier this year.

As Bitcoin rebounded above $90,000 on Thursday, holders of BlackRock’s spot Bitcoin ETF moved back into profit. Investors in IBIT now sit on a cumulative gain of approximately $3.2 billion, reversing losses from the recent downturn. At the height of the rally in early October, holders of BlackRock’s Bitcoin together with Ether ETFs were up almost $40 billion. That figure fell sharply to around $630 million last week before the latest recovery.

Bitcoin and Ether ETFs End Outflow Streak

The broader cryptocurrency ETF market also showed signs of stabilisation. Spot Bitcoin ETFs ended four consecutive weeks of heavy withdrawals with a weekly inflow of $70 million, offsetting part of the $4.35 billion that left the sector during November.

Spot Ether ETFs posted an even stronger rebound, bringing in $312.6 million after losing $1.74 billion across the previous three weeks. The renewed inflows suggest improving sentiment following a difficult month for both assets.

Market Outlook Remains Positive Despite Volatility

Although November brought sharp swings for digital asset products, BlackRock maintains that the underlying market fundamentals remain strong. The firm expects continued engagement from retail together with institutional investors as Bitcoin together with Ether prices stabilise.

Castro emphasised that short term outflows do not diminish the long term case for Bitcoin related investment vehicles. He described the rapid expansion of BlackRock’s ETF revenues as “a big surprise” and a signal of enduring demand within the sector.