BlackRock’s spot Bitcoin exchange-traded fund (ETF) is rapidly approaching $70 billion in assets under management (AUM), solidifying its role as a key institutional player in the crypto market. While retail investor interest appears to be waning, the asset management giant is scooping up a growing share of Bitcoin, with its iShares Bitcoin Trust (IBIT) now holding more than 3.25% of the total BTC supply.

The development marks a critical moment in the evolution of institutional adoption in the digital asset space and reflects a broader shift in Bitcoin’s investor base.

BlackRock Leads the Spot Bitcoin ETF Market

BlackRock, the world’s largest asset manager, has amassed over $69.7 billion worth of Bitcoin through its IBIT fund, according to recent data. Launched in January 2024, the ETF has quickly risen to dominate the US spot Bitcoin ETF market, accounting for over 54.7% of the total market share. Altogether, US-based spot Bitcoin ETFs hold 6.12% of the current BTC supply, data from Dune Analytics reveals.

This milestone comes amid a wave of inflows into Bitcoin ETFs, with US products registering eight consecutive days of net positive flows. On Wednesday alone, $388 million in Bitcoin entered the ETF market, according to figures from Farside Investors.

As a result, IBIT has broken into the top 25 largest ETFs globally, ranking 23rd among both crypto-specific and traditional finance ETFs, according to data provider VettaFi.

Institutional Interest Outpaces Retail Inflows

Enmanuel Cardozo, a market analyst at digital asset platform Brickken, believes the rapid accumulation by BlackRock signals long-term commitment from institutional players. “Large institutions like BlackRock are a big part of the price action, and supply scarcity is an important driver right now,” Cardozo commented.

He also noted that Bitcoin historically performs well in the aftermath of major geopolitical events, suggesting that institutional demand could remain strong regardless of short-term retail sentiment.

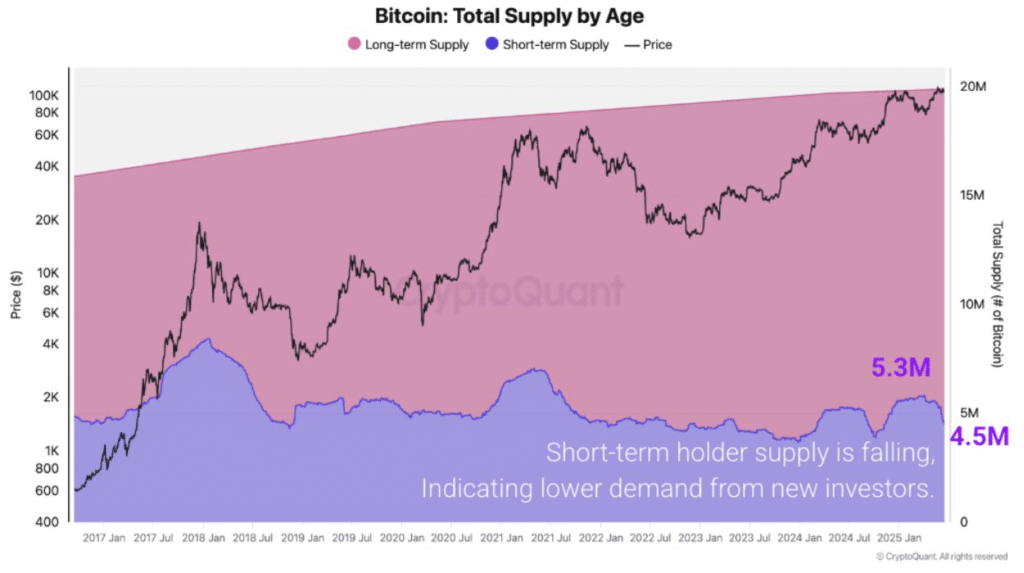

However, other analysts have raised concerns about weakening demand from individual investors. CryptoQuant, a blockchain analytics platform, recently reported a significant decline in short-term Bitcoin holders, down 800,000 BTC since late May, from 5.3 million to 4.5 million BTC. This drop highlights a cooling in new retail investor interest, raising questions about the sustainability of Bitcoin’s current momentum without fresh capital inflows.

Large Transactions Dominate Bitcoin Network

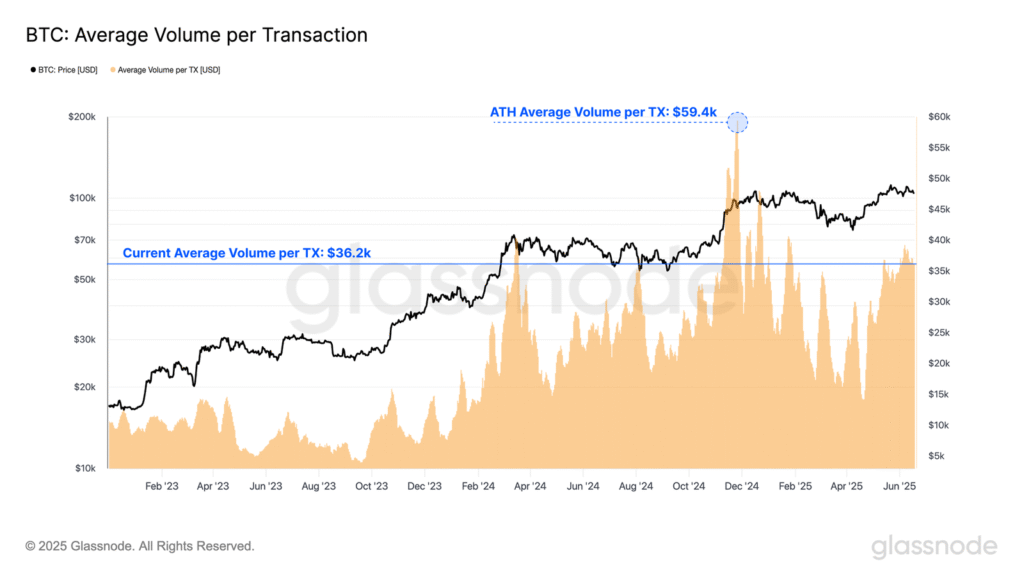

Blockchain data from Glassnode supports the notion that institutional or high-net-worth investors are driving recent activity. While the total number of Bitcoin transactions has declined, the average transaction size has surged to $36,200. Transactions exceeding $100,000 now account for more than 89% of total network activity.

“This trend implies that larger entities continue to utilise the Bitcoin network, with the throughput per transaction rising even as overall activity by count declines,” said Glassnode in its Thursday report.

The dominance of large-value transactions further reinforces the shift in Bitcoin’s investor base away from retail participants and toward institutions and corporate treasuries.

Market Awaits Next Catalyst Amid Mixed Signals

Despite IBIT’s rapid ascent, some analysts suggest that Bitcoin may be entering a consolidation phase. Iliya Kalchev, analyst at crypto lender Nexo, cautioned that recent ETF demand might be offset by selling pressure from miners and profit-taking investors.

Kalchev also pointed out that long-dormant Bitcoin wallets are currently absorbing more BTC than miners are producing, which may help maintain upward pressure on the price. “A breakout may need a new catalyst or sentiment shift,” he said.

Should investor enthusiasm continue to fade, Bitcoin may find its next significant support at around $92,000, a level identified by CryptoQuant as the onchain realised price typically acting as strong support during bull cycles.

Conclusion

As BlackRock’s IBIT ETF closes in on $70 billion in AUM and secures a significant share of Bitcoin’s total supply, the balance of power in the market is shifting further toward institutional investors. With retail demand weakening and high-value transactions now dominating network activity, the next phase of Bitcoin’s journey may hinge on fresh narratives or macroeconomic developments to sustain momentum.

Nonetheless, the long-term implications of BlackRock’s aggressive Bitcoin accumulation suggest that institutional conviction remains strong, even as “new money” from retail traders appears to be drying up.