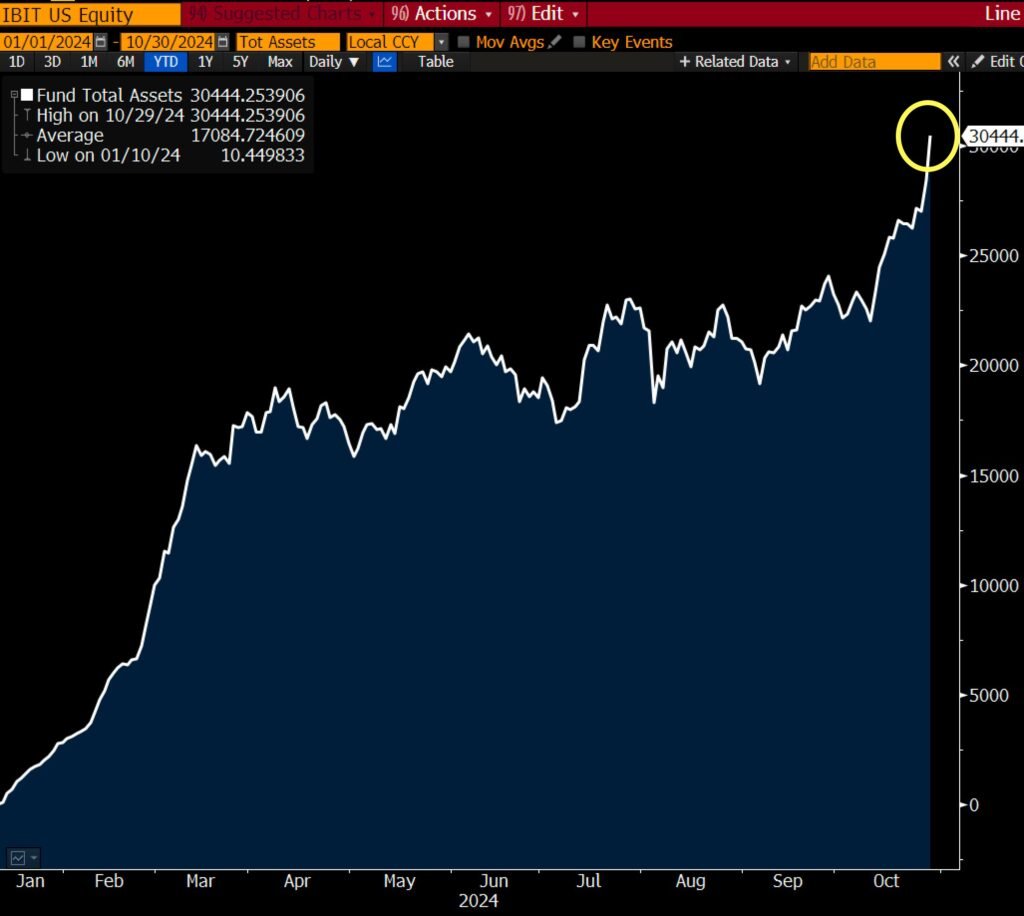

BlackRock’s spot Bitcoin exchange-traded fund (ETF) has achieved a significant milestone, surpassing $30 billion in Bitcoin holdings in less than 10 months since launching in January 2024. This milestone, highlighted by Bloomberg ETF analyst Eric Balchunas, represents an all-time record for ETFs. “It hit this milestone in just 293 days,” Balchunas noted on X (formerly Twitter), surpassing the previous record set by JEPI in 1,272 days and GLD in 1,790 days.

Currently, BlackRock holds over 417,000 Bitcoins, valued at approximately $71,915 each, indicating a strong demand for institutional exposure to cryptocurrency.

Bitcoin ETFs Approach 1 Million BTC in Holdings

Bitcoin ETFs across the US are also on the verge of reaching a notable benchmark: a combined 1 million BTC, valued at over $71.7 billion. As of October 30, ETFs collectively hold about 996,000 BTC, with Balchunas noting there is “a good chance to pass 1 million today.” Achieving this would position Bitcoin ETFs as the largest collective Bitcoin holder globally, second only to the anonymous founder Satoshi Nakamoto’s wallet, which contains approximately 1.1 million BTC.

Record Inflows Fuel BTC Rally Speculations

With the US presidential election around the corner, Bitcoin ETF inflows have surged, with ETFs pulling in $870 million on October 29 alone, marking the second-highest single-day inflow since March. The increasing investment into these ETFs, which accounted for 75% of new Bitcoin investment by mid-February, has reignited expectations for Bitcoin to reach new record highs. Some analysts, including those from Bitfinex, anticipate a Bitcoin rally to $80,000 by year-end, driven by options market conditions and a potential Republican victory.

Analysts Cautiously Optimistic Amid “Trump Hedge” Concerns

While optimism abounds, some analysts caution that the recent inflows may be a “Trump hedge” against economic uncertainty, rather than a sign of sustainable growth. Without stronger macroeconomic conditions, they warn, Bitcoin may struggle to reach a new all-time high.