Bitcoin is witnessing a gradual resurgence in buyer interest, with large-volume investors leading the way while smaller traders remain hesitant following recent market declines.

Whale Activity Suggests Changing Market Dynamics

Bitcoin (BTC) is proving to be an attractive investment for major players at the $80,000 level, while those looking to exit the market appear to be reconsidering their strategy.

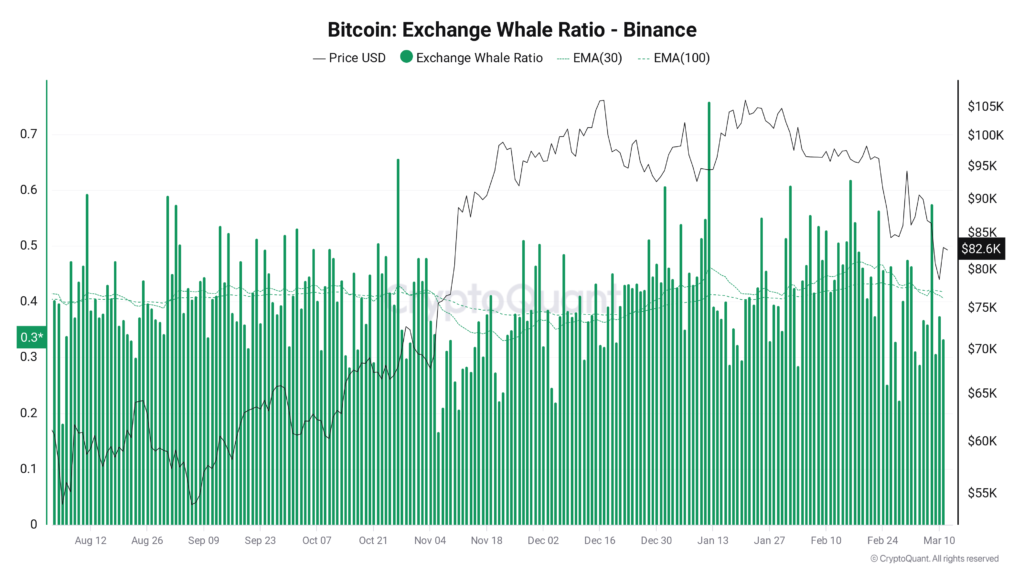

According to on-chain data from CryptoQuant, the influence of large investors on Binance—the world’s largest cryptocurrency exchange—has been declining. In a recent blog post, CryptoQuant contributor Darkfost highlighted that the proportion of the top 10 largest inflows to Binance attributed to whales has decreased.

“Monitoring whale behaviour has consistently provided valuable insights into potential market movements,” Darkfost wrote. “Given that Binance handles the highest volumes, analysing the Bitcoin exchange whale ratio on Binance provides a good insight into broader whale activity.”

Since mid-January, when Bitcoin reached its most recent all-time highs, Binance’s whale ratio has been on a downward trend. This suggests that whales are now reducing their selling pressure.

“Historically, an increasing ratio has been associated with short-term price corrections or consolidation phases, while a decreasing ratio has often preceded bullish trends,” the post added. “If this trend of diminishing selling pressure continues, it could help end the current correction and potentially signal a market rebound.”

Smaller Investors Remain Cautious

Despite whale accumulation, overall interest in Bitcoin remains subdued. Many smaller investors appear hesitant to enter the market at current price levels, with demand for BTC exposure showing signs of weakness.

Blockchain analytics firm Glassnode, in its latest edition of The Week Onchain newsletter, noted that capital inflows from short-term holders (STHs) have been disappointing. These investors, who typically hold Bitcoin for up to six months, have shown reluctance to buy at current levels.

An analysis of capital flows revealed that investors who purchased BTC within the past week to one month now have a lower cost basis than those holding for one to three months. This shift indicates a lack of confidence among new buyers.

“With Bitcoin prices dropping below $95,000, this model also confirmed a transition into net capital outflows, as the one-week to one-month cost basis fell below the one-month to three-month cost basis,” Glassnode reported.

“This reversal indicates that macro uncertainty has spooked demand, reducing new inflows and arguably increasing the probability of further sell pressure and a prolonged correction. This transition suggests that new buyers are now hesitant to absorb sell-side pressure, reinforcing the shift from post-ATH euphoria into a more cautious market environment.”

Market Outlook: A Turning Point?

While Bitcoin’s price remains in a consolidation phase, the behaviour of large investors offers a potential sign of recovery. The cooling of whale-driven sell pressure on Binance suggests that the worst of the recent market correction could be nearing its end.

However, uncertainty remains among smaller investors, who have been reluctant to engage at current price levels. A clear resurgence in demand will likely be needed before a strong bullish trend can resume.

For now, Bitcoin’s trajectory hinges on whether the cautious sentiment among retail traders persists or if the influence of large investors is enough to drive a more sustained rebound.