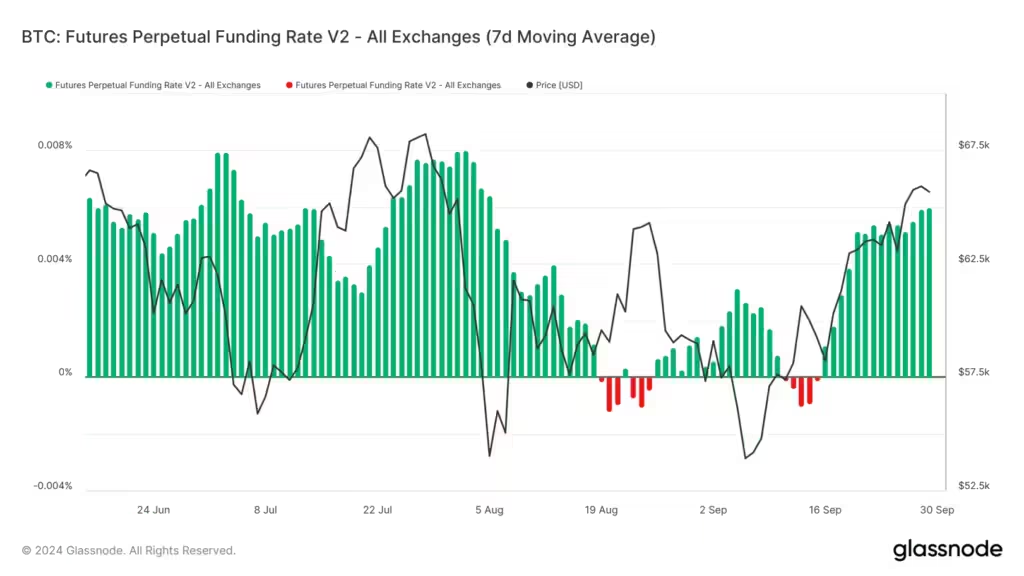

Bitcoin’s recent rally has come to an abrupt halt, with the cryptocurrency plunging below $64,000 following the surprise selection of Shigeru Ishiba as Japan’s next prime minister.

Ishiba’s appointment has renewed fears of a potential tightening of the Bank of Japan’s monetary policy, sending markets lower.

The decline in bitcoin can be attributed to several factors, including:

- Overbought conditions: Bitcoin had been experiencing a significant uptrend, leading to overbought conditions in the market. This made the cryptocurrency more susceptible to a correction, as investors sought to profit from the recent gains.

- BOJ tightening fears: Ishiba’s selection as prime minister has reignited concerns about the BOJ potentially adopting a more hawkish monetary policy. A tighter monetary policy could lead to a stronger yen, which could negatively impact global risk appetite and, in turn, the price of bitcoin.

- Economic uncertainty: The upcoming U.S. presidential election and a number of key economic reports scheduled for this week could introduce additional volatility into the market. Investors may be hesitant to maintain their positions in bitcoin as they await these important events.

Despite the recent decline, bitcoin’s long-term outlook remains positive. The cryptocurrency’s underlying fundamentals, such as its scarcity and growing adoption, continue to support its value. However, investors should be prepared for short-term fluctuations as the market navigates these uncertain times.

Key factors that could influence bitcoin’s price in the coming weeks include:

- The outcome of the U.S. presidential election: A change in the U.S. administration could lead to significant shifts in economic policy and global sentiment, which could impact bitcoin’s price.

- Economic data releases: The release of key economic indicators, such as the U.S. jobs report, could affect investor sentiment and market volatility.

- Central bank policy announcements: The actions of central banks, including the Federal Reserve and the Bank of Japan, could have a significant impact on global financial markets and the price of bitcoin.

As investors continue to monitor these developments, it is important to remain disciplined and avoid making impulsive trading decisions. By staying informed and maintaining a long-term perspective, investors can better navigate the challenges and opportunities presented by the cryptocurrency market.