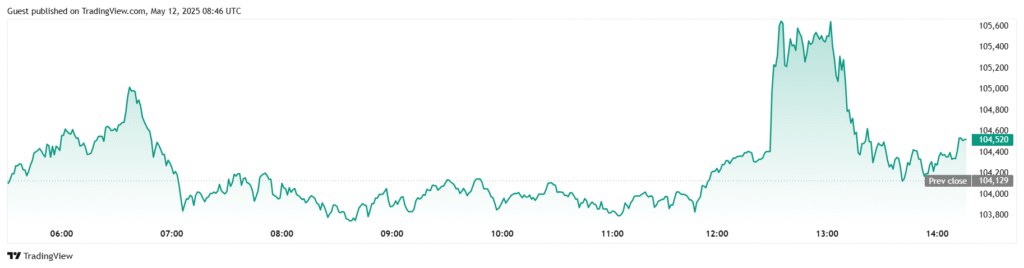

In a surprising turn of events, the United States and China have agreed to a 90-day mutual reduction of tariffs, a significant de-escalation in their long standing trade war. This development has not only boosted investor confidence in traditional markets but also sent ripples through the crypto world. Bitcoin, the world’s leading cryptocurrency by market capitalisation, surged 1.3% on the news, crossing $105,000 and coming within reach of its all time high.

The agreement, announced on 12 May following two days of high-level negotiations in Geneva, will see the US lower its tariffs on Chinese imports from a punishing 145% to a more moderate 30%. In return, China will reduce tariffs on American goods from 125% to 10%. Both reductions will be in effect for a 90-day period.

US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer described the deal as a “critical step” toward stabilising global trade. Chinese officials confirmed that a joint statement outlining the details will be released soon.

Bitcoin Rebounds From April Slump

The trade war had previously sent shockwaves through the crypto market. In early April, following former President Trump’s tariff hike announcement, Bitcoin tumbled below $80,000. The sharp increase in trade barriers threatened to inject inflation into global markets, and digital assets were not spared.

However, Bitcoin staged a remarkable V-shaped recovery from its April lows, supported by strong inflows into spot Bitcoin exchange-traded funds (ETFs) and renewed investor interest. At press time, Bitcoin is trading at approximately $104,520, around 4.4% short of its previous record high of $109,350.

Market analysts suggest the easing of tariffs could provide the momentum needed for Bitcoin to breach new highs. According to Markus Thielen, founder of 10x Research, “The CPI report due this week could be the bullish trigger BTC needs if inflation continues to cool, we could see new all-time highs.”

CPI Expectations Add to Bullish Outlook

Investors are now closely watching the upcoming US Consumer Price Index (CPI) report, expected on Tuesday. Analysts at RBC forecast that headline CPI eased to 2.3% year-on-year in April, down from March’s 2.4%. Core CPI, which strips out volatile food and energy prices, is expected to remain steady at 2.8%.

A softer CPI could reinforce expectations of a Federal Reserve rate cut, a traditionally bullish signal for risk assets like Bitcoin. “If inflation remains on a downward path and tariffs don’t spike again, we’re in a sweet spot for crypto,” said Thielen.

Even a slightly hot inflation reading might be discounted by investors, as it would reflect economic conditions during the height of the April trade tensions not the recent policy shift. Federal Reserve Chair Jerome Powell echoed this sentiment last week, saying, “The underlying inflation picture is good,” while downplaying the long-term inflationary impact of tariffs.

Altcoins Ride the Momentum

The bullish sentiment has not been confined to Bitcoin. Ether (ETH), the second-largest cryptocurrency, posted its strongest weekly gain since December 2020, rising 39% to $2,500. Other major altcoins have also experienced significant surges, Dogecoin (DOGE) soared 56%, Cardano (ADA) climbed 19%, Solana (SOL) gained 20%, and Ripple (XRP) rose 9.7%, according to data from TradingView.

Despite the rally, analysts at HTX Research point out that speculative excess has not yet taken hold. “Implied volatility in Bitcoin options remains steady between 50%–55%, well below the frenzied 80%+ levels seen during previous bull runs,” HTX stated. The relatively moderate volatility suggests that the current rally is more sustainable and less driven by short-term hype.

Open interest in CME Bitcoin futures currently sits at $14.8 billion also below the $20 billion peak reached during the 2020 US election cycle. This indicates that leveraged bets are still in check, reducing the risk of a sudden market correction.

ETFs, Yields, and What’s Next

Another major tailwind for Bitcoin has been the continued capital inflow into spot ETFs. BlackRock’s IBIT ETF, in particular, has recorded net inflows for 20 consecutive trading days, surpassing $5 billion in assets under management. This trend underscores institutional confidence in Bitcoin as a maturing asset class.

Meanwhile, the Federal Reserve’s decision last week to keep interest rates steady at 4.25%–4.5% has helped maintain a favourable environment for crypto investments. As long as bond yields remain below 4.8% and ETF inflows remain consistent, analysts expect Bitcoin to consolidate within the $105,000–$115,000 range before making its next breakout attempt.

“Without excessive leverage in the market and with growing institutional support, Bitcoin is well-positioned to test new highs, especially if macroeconomic indicators continue to support risk-on sentiment,” said HTX.