Bitcoin remains resilient as the year ends, defying a major options expiry event that could have triggered a significant market correction.

Bitcoin (BTC) showcased impressive resilience following the year’s final options expiry on 27 December, avoiding a feared price drop below $85,000. Over $14.2 billion worth of Bitcoin options expired at 8:00 a.m. UTC, with a ‘max pain’ point of $85,000 — the price at which the majority of options contracts would have expired worthless.

Contrary to expectations of a correction, Bitcoin soared, peaking at $97,330 by 9:06 a.m. UTC, just one hour after the expiry, according to TradingView data. The total options expiry for Bitcoin and Ether (ETH) on 27 December stood at $18 billion, as per a post from Deribit Exchange.

“With the market heavily leveraged to the upside, any significant downside move could have triggered a rapid snowball effect. All eyes were on this expiry to set the narrative heading into 2025,” Deribit noted.

January Outlook: Bitcoin Poised to Hit $110,000 Before Correction

Analysts suggest Bitcoin could continue its bullish momentum into January, potentially peaking at a ‘local top’ above $110,000. This projection is based on Bitcoin’s correlation with the global liquidity index, which reflects the availability of market capital. However, a correction may follow the anticipated high, marking a potential shift in market trends.

Bitcoin ETFs Bounce Back with $475 Million Inflows

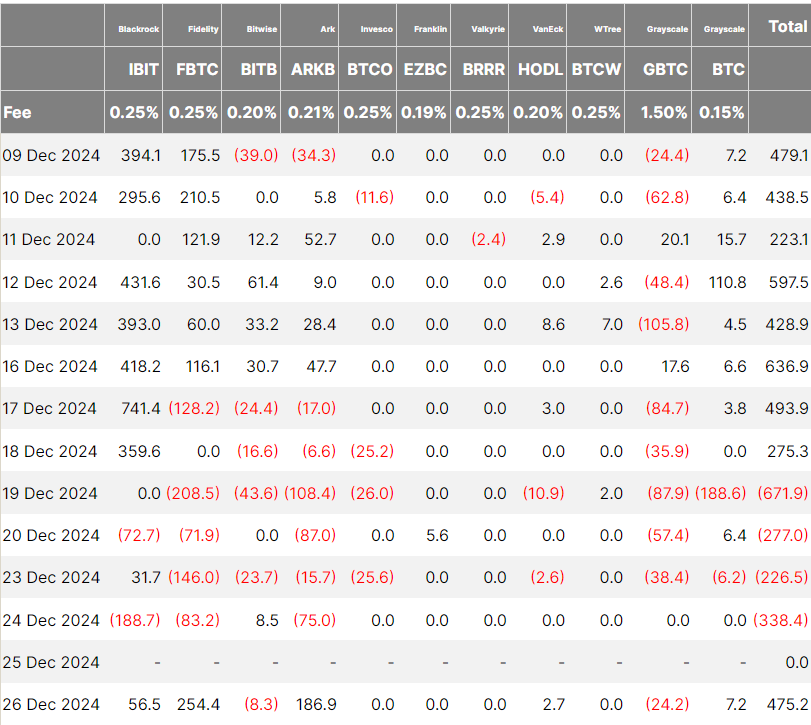

Adding to Bitcoin’s positive performance, the United States spot Bitcoin exchange-traded funds (ETFs) ended a four-day losing streak on 26 December, receiving net inflows worth $475 million, according to Farside Investors data. These ETFs have been a driving force behind Bitcoin’s 2024 rally, contributing approximately 75% of new investments in the cryptocurrency.

The surge in ETF inflows has helped push Bitcoin’s price past $50,000 earlier this year and remains a significant factor as the market approaches the new year. Analysts believe that the end of the Christmas holidays could see a return of institutional liquidity, bolstering the crypto market further.

Key Resistance and Liquidation Risks

Despite the optimism, Bitcoin faces substantial resistance around the $98,000 mark. A successful rally beyond this level could lead to the liquidation of over $885 million worth of leveraged short positions across exchanges, according to Coinglass data.

Ryan Lee, Chief Analyst at Bitget Research, shared his outlook: “Post-Christmas, market activity typically picks up again, with funds expected to actively position for sectors that might benefit from Trump’s upcoming inauguration. This could help push Bitcoin above $105,000.”

Optimistic Projections for 2025

Looking ahead, analysts remain optimistic about Bitcoin’s trajectory in 2025, citing improving macroeconomic conditions and evolving financial policies in the United States. Some forecasts suggest Bitcoin could rally as high as $160,000, driven by increased institutional adoption and market liquidity.

As Bitcoin closes the year on a high note, the coming weeks will likely define its momentum heading into the new year, with traders and investors closely monitoring its performance around key resistance levels.