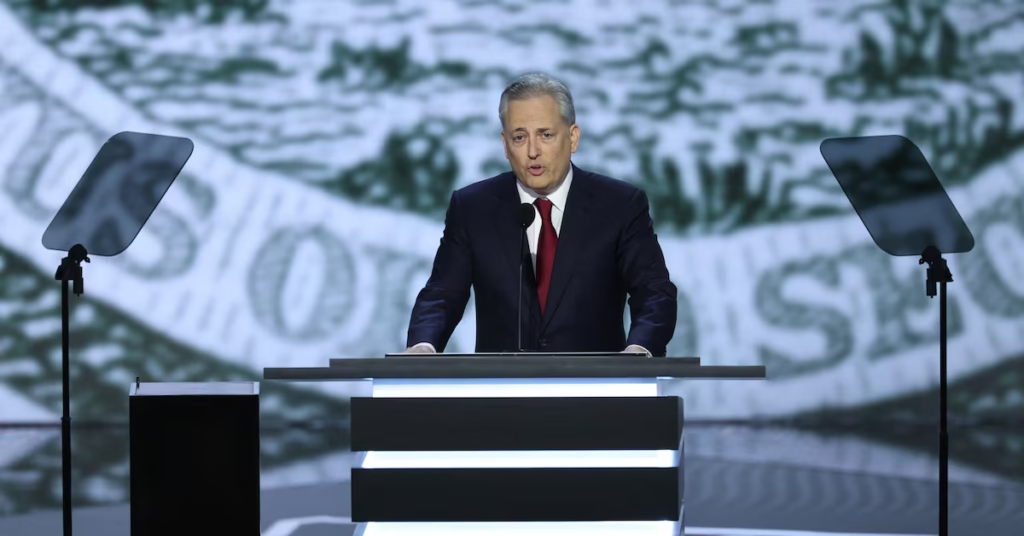

Patrick Witt, the newly appointed executive director of the President’s Council of Advisers on Digital Assets, has stepped into his role with urgency, declaring that the White House will push hard for comprehensive crypto legislation. His comments come at a pivotal moment, as the U.S. government seeks to finalise market structure rules, roll out stablecoin regulation and even establish a federal bitcoin reserve.

Pedal to the Metal on Crypto Legislation

Witt, who succeeded Bo Hines last month, wasted no time setting out his priorities. In his first interview since assuming the role, he told CoinDesk that his focus would centre on three critical areas:

- The Senate’s market structure legislation.

- The implementation of the recently enacted Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act.

- The establishment of a federal bitcoin reserve.

“There’s no drop off here,” Witt insisted. “We’re keeping the pedal to the metal with all of the different initiatives on the legislative front and the interagency actions recommended in the report.”

His comments underline the administration’s determination to transform the U.S. into a global leader in digital asset regulation, an effort that began under Hines but now falls squarely on Witt’s shoulders.

A Push for Market Structure Reform

At the top of Witt’s agenda is the Senate’s draft market structure bill, which has emerged from the Banking Committee with what he described as “significant improvements.” While the House of Representatives already passed its version, the Digital Asset Market Clarity Act, Witt stressed the importance of ensuring the Senate’s draft can also win broad bipartisan support.

“Our interest here is to make sure that we’re listening to all parties in the space, that we’re working to get something that moves the ball forward,” said Witt, who is no stranger to high-pressure situations, having once played quarterback for Yale.

He emphasised that the administration is in “regular touch” with both the Senate Banking and Agriculture Committees, which must complete their drafts and advance them to the Senate floor. From there, the bill will require at least 60 votes, meaning input from Democrats is essential.

The White House hopes the Senate’s version will mirror the GENIUS Act’s trajectory, a bipartisan bill that cleared both chambers with overwhelming support. “We’re confident that what comes out in the Senate is ultimately going to be a product that the House can also support,” Witt said.

Implementing the Stablecoin Law

Another immediate task for Witt is shepherding the implementation of the GENIUS Act. Signed into law earlier this year, the Act provides the first clear federal framework for stablecoins in the United States. While Hines helped usher the legislation through Congress, Witt must now coordinate regulators to ensure it is enforced effectively.

With his background in government, including stints at the Department of Defense and the Office of Personnel Management during Trump’s first term, Witt said he brings practical experience in navigating the federal bureaucracy.

“I know what that’s like from the agencies,” he explained. “So hopefully I can bring a good perspective to what’s achievable there and how to approach it in the right way.”

The Act, while hailed as a landmark, covers only a slice of the crypto landscape. Witt echoed administration crypto czar David Sacks, noting: “GENIUS was a huge win, but it addresses a relatively small portion of the overall crypto market. This bill addresses the remaining, call it 80% of it. So this one’s huge and we want to make sure we don’t drop the ball.”

Building a Bitcoin Strategic Reserve

Perhaps the most headline-grabbing initiative is the White House’s proposed Bitcoin Strategic Reserve. Under the plan, the U.S. Treasury would hold bitcoin seized by the government as a long-term investment asset. Witt described this as “a top priority for me, personally, for this office, for the administration.”

However, he admitted that legal and legislative challenges remain. “It’s not there yet, because the work presents some novel legal questions that we just need to get resolved,” Witt said.

The White House aims to secure Congressional approval to anchor the reserve in law, though Witt stopped short of revealing how the reserve might grow beyond government seizures. “The administration is contemplating some creative ways that we can get at accumulation with existing authorities,” he hinted.

The initiative reflects President Trump’s high-profile embrace of digital assets, a stance that has drawn criticism from some lawmakers who point to his personal financial interests in the sector.

Addressing Conflict-of-Interest Concerns

Democrats in Congress have repeatedly raised objections over Trump’s reported billions in crypto-related investments and equity stakes, arguing that his policies may present conflicts of interest. Witt, much like his predecessor, dismissed these concerns as unfounded.

“It’s like saying any private citizen has a conflict when we strengthen America’s economy,” he argued. “This is a win for America. It’s not a win for any particular group of individuals.”

This line of defence echoes the administration’s broader messaging: that its crypto agenda is focused on economic growth and technological leadership, rather than personal enrichment.

An Experienced Hand at the Helm

Unlike Bo Hines, whose brief tenure ended with a move to stablecoin issuer Tether, Witt arrives with a deeper bench of policy and executive-branch experience. His three years at McKinsey & Co. and service at the Pentagon and OPM provide him with insider knowledge of how to move legislation and regulations through Washington’s complex machinery.

That expertise could prove vital as he works to translate sweeping policy goals into tangible outcomes. Whether it’s coordinating multiple federal agencies on stablecoin oversight or negotiating with lawmakers across the aisle, Witt will need to draw on his political and strategic background to deliver results.

The Road Ahead

The coming months will be decisive for the U.S. digital asset landscape. With the GENIUS Act now law, attention is firmly fixed on whether the Senate can finalise its market structure bill in a form that commands bipartisan support and aligns with the House’s vision. Meanwhile, the creation of a Bitcoin Strategic Reserve could mark a historic step, signalling America’s intent to institutionalise digital assets at the highest level.

For Patrick Witt, the task is daunting, but his message is clear: the administration is not slowing down. “We’re keeping the pressure up from this side,” he said, underscoring the White House’s determination to deliver a comprehensive crypto framework.

If successful, these initiatives could not only shape the trajectory of the U.S. crypto industry but also set global standards for how governments manage digital assets in the years ahead.