Bitcoin surged close to $113,000 after disappointing US employment data rattled markets and renewed expectations of interest rate cuts from the Federal Reserve. The August jobs report, the weakest since 2021, has reinforced Bitcoin’s appeal as a macro hedge amid growing economic uncertainty.

Weakest Payroll Gains in Three Years

The US Bureau of Labor Statistics reported that the economy added just 22,000 jobs in August, far below the forecast of 75,000. This marked the weakest payroll gains since 2021, raising concerns about the resilience of the US labour market.

The unemployment rate also rose to 4.3%, its highest level since October 2021, while revisions to June and July payroll figures erased a combined 285,000 jobs. Analysts have warned that such deep downward revisions signal a more severe slowdown than initially recognised.

“That’s a total of -285,000 jobs in two months. What is happening here?” asked several market commentators, highlighting the extent of the deterioration.

Layoffs Rise as Job Creation Stalls

Further evidence of weakening employment came from corporate hiring and layoff data. According to Bloomberg, American companies announced just 1,494 new jobs in August, the lowest for that month since 2009. At the same time, layoffs surged by 39% to 85,979, signalling growing corporate caution.

For the first time since April 2021, the number of unemployed Americans has outpaced available job openings. July data showed 7.24 million unemployed people versus 7.18 million job openings, reversing a trend of labour market tightness that had characterised much of the post-pandemic recovery.

Despite some wage resilience with pay growing 3.7% year-on-year, outpacing inflation at 2.7%, the broader slowdown has alarmed investors. While higher wages usually support consumer spending, the slowdown in hiring suggests corporate America is preparing for tougher conditions ahead.

Bitcoin Rallies on Macro Hedge Appeal

As labour market cracks deepen, Bitcoin has emerged as a favoured safe-haven alternative. The cryptocurrency surged towards $113,000, with intraday gains of more than 2%, as traders positioned for a more dovish Fed policy stance.

Bitcoin’s rally underscores its evolving role as a macro hedge. With traditional assets increasingly sensitive to economic shocks, investors are diversifying into digital alternatives. Analysts argue that in times of weakening fundamentals, Bitcoin’s scarcity and decentralisation make it a viable hedge against policy missteps and systemic risks.

The timing is also significant. Bitcoin has often rallied during periods of heightened uncertainty around US economic performance with Federal Reserve decisions and this labour market shock has only amplified that trend.

Fed Faces a Balancing Act

The August jobs report complicates the Federal Reserve’s path ahead. On one hand, wages are still rising above inflation, but on the other, employment growth is faltering. This divergence makes the Fed’s September policy meeting more critical than ever.

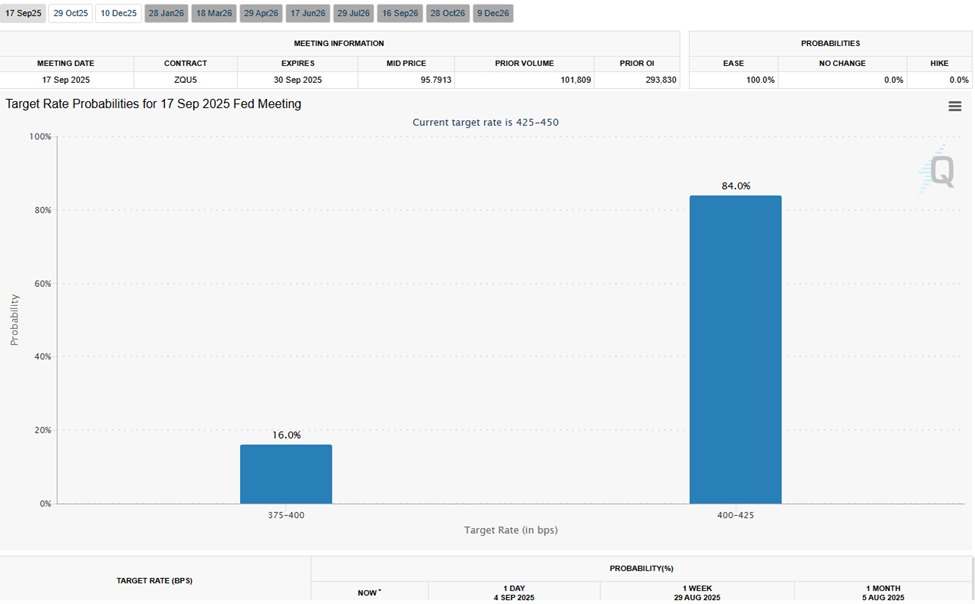

Markets are now betting on multiple rate cuts in 2025. In a notable revision, Bank of America now projects two rate cuts this year, compared to its earlier forecast of none.

With unemployment rising, layoffs accelerating and hiring slowing, the Fed faces pressure to act before economic weakness spirals further. However, cutting rates too aggressively risks fuelling inflationary pressures again, leaving policymakers in a tight spot.

Bitcoin as a Global Barometer of Fear and Resilience

The sharp response of Bitcoin to the US jobs data reinforces its dual role as both a risk asset and a fear barometer. For many investors, it is no longer just a speculative instrument but a global signal of resilience amid macroeconomic cracks.

As economic momentum falters, crypto markets are gaining traction as a parallel financial ecosystem where capital seeks refuge during times of instability. The August jobs report could therefore prove to be more than a labour market data point, it may mark the beginning of a new chapter for Bitcoin’s institutional narrative.

With its climb towards $113,000, Bitcoin is once again testing its position not only as the world’s largest cryptocurrency but as a gauge of shifting global risk appetite.