Bitcoin speculators are seizing the opportunity to lock in profits as BTC hits a three-month high, nearing $74,000. On-chain data shows that short-term holders (STHs) are leading the charge, sending large amounts of Bitcoin to exchanges for profit-taking.

Short-Term Holders Rush to Secure Gains

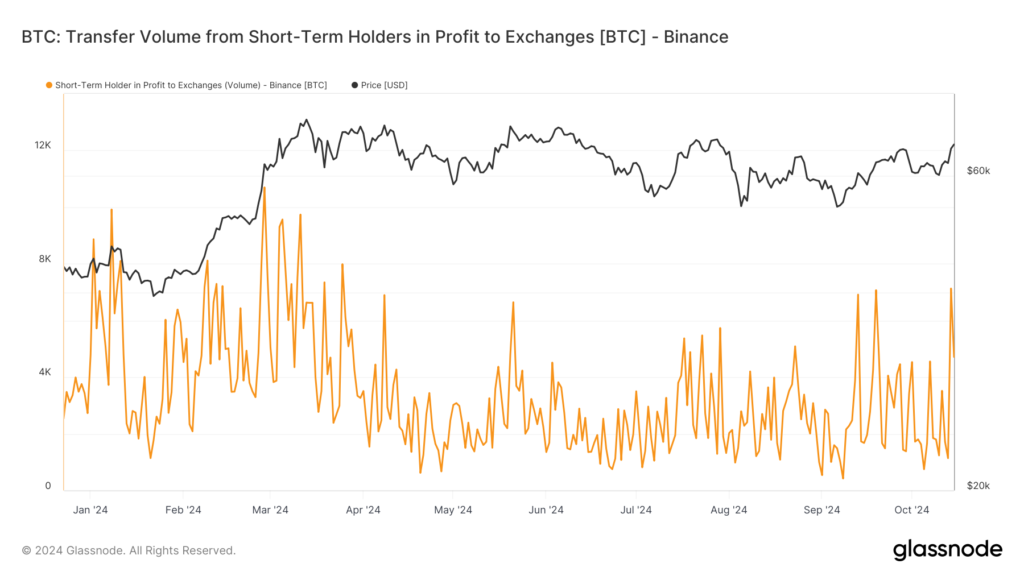

Data from analytics platform Glassnode reveals that Bitcoin holders who have owned BTC for 155 days or less are actively selling at current prices. As of October 14, 7,127 BTC, valued at roughly $480 million, was sent to Binance by STHs— the highest inflow since Bitcoin’s all-time high of $73,800 in March. This trend signals an aggressive profit-taking move as traders look to protect their gains.

Exchanges See Record Inflows

Binance isn’t the only exchange seeing significant inflows. According to Glassnode, the overall number of BTC being sent to major exchanges has surged, with daily totals this week among the highest since early June. These inflows suggest that STHs are capitalizing on the price increase after months of sideways market performance.

Positive Shift in Market Sentiment

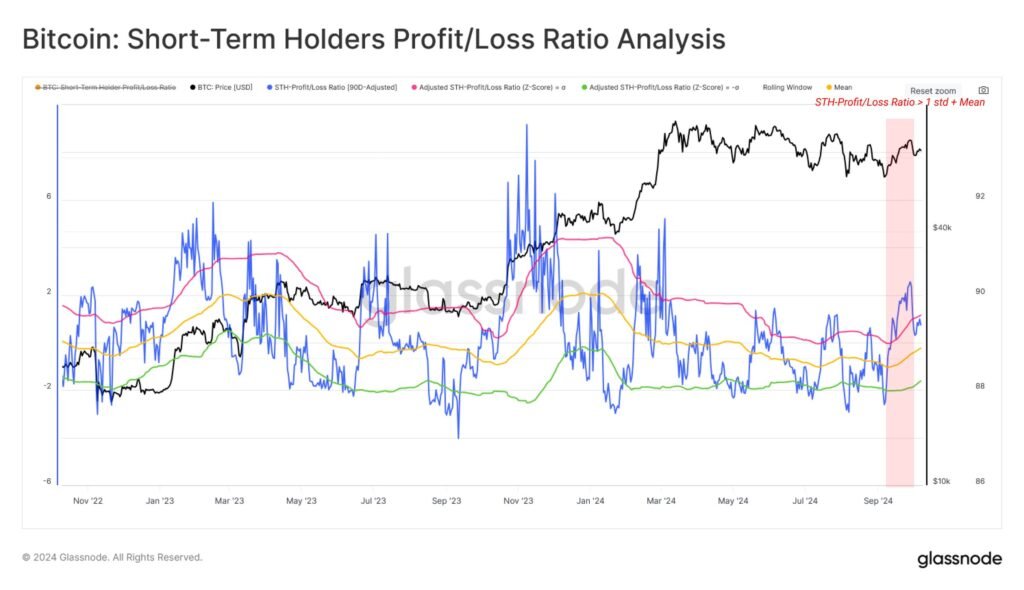

STHs’ profit-taking comes as their Profit/Loss Ratio hits 1.2, breaking one standard deviation above its 90-day mean. This metric, as highlighted by Glassnode, indicates a potential shift in investor sentiment, with many traders feeling satisfied after months of stagnation. The profit dominance suggests that STHs are still in the green, even as the market navigates heightened volatility.

Supply Squeeze Points to Future Volatility

While demand for Bitcoin has slowed since the all-time high in March, supply availability is also tightening. Glassnode noted a growing divergence between supply and demand forces, which historically precedes periods of significant market volatility. This compression of active supply, coupled with rising demand, could lead to further price fluctuations in the coming weeks.

With Bitcoin whales holding 1.5 million BTC and short-term holders cashing out, the market is poised for a potential shift in the weeks ahead.