Bitcoin is set to reach a monumental valuation of $1.5 million per coin within the next decade, according to network economist Timothy Peterson. Known for his accurate predictions and bullish stance on Bitcoin, Peterson shared his forecast in a recent post on social media platform X, citing his model that prioritises network growth as a key driver of value.

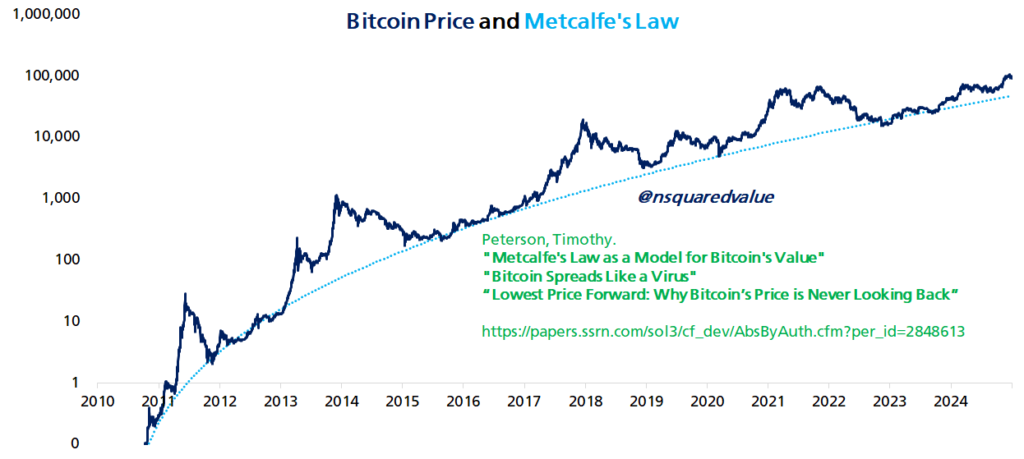

Bold Prediction Backed by Metcalfe’s Law

Peterson, author of the influential 2018 paper “Metcalfe’s Law as a Model for Bitcoin’s Value,” remains steadfast in his belief that Bitcoin’s value is tied to the expansion of its network. In his post, he confidently stated, “The year is 2035. Bitcoin is at – and you can hold me to this – $1.5 million.”

He humorously added that even in 2035, potential investors will still question whether it’s the right time to buy Bitcoin.

Peterson’s 2018 paper argued that traditional currency valuation models fall short when applied to Bitcoin. Instead, he pointed to mathematical laws explaining network connectivity, such as Metcalfe’s Law, as more reliable indicators of Bitcoin’s potential.

A Track Record of Accurate Predictions

Peterson has built a reputation for his precise Bitcoin forecasts. In 2020, his Lowest Price Forward indicator correctly predicted that BTC/USD would never trade below $10,000 again. More recently, he accurately pinpointed Bitcoin’s local price bottom in September 2023, missing the exact timing by just eight days.

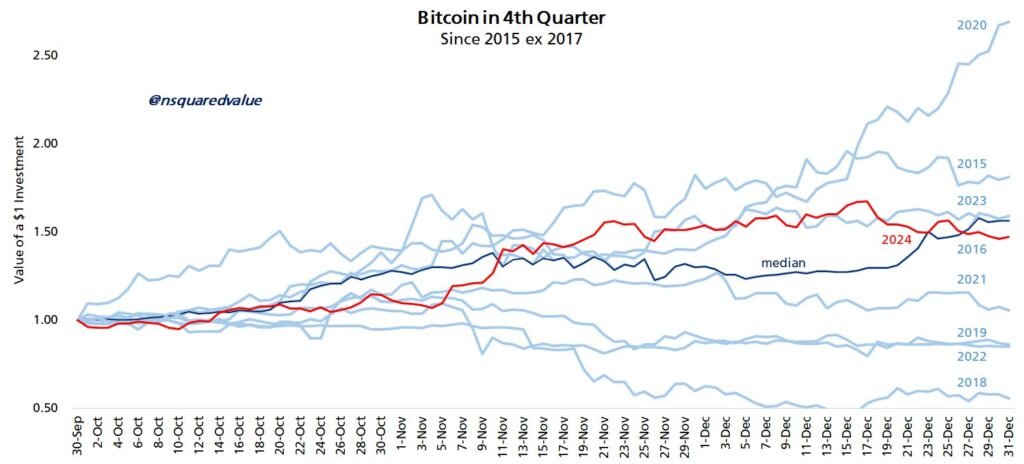

Despite his bullish long-term outlook, Peterson has described Bitcoin’s recent performance as lacklustre. Reflecting on Q4 2024, he noted, “It was the second-worst ‘Up’ quarter out of the past 10.”

Short-Term Concerns: Is the Dip Not Over?

While Peterson’s long-term forecast is optimistic, other analysts remain cautious about Bitcoin’s short-term trajectory. Some predict further price corrections in 2025, with targets dipping as low as $86,500—a 20% decrease from the current all-time high of $92,000.

Keith Alan, co-founder of trading resource Material Indicators, warned of continued price “suppression.” In a Jan. 9 post, Alan said, “This dip isn’t done dipping,” and speculated that Bitcoin could drop to $77,900 if key support levels fail to hold.

Alan’s analysis points to buyers waiting for lower entry points, which could delay any significant price recovery in the near term.

Mixed Sentiment in the Market

Bitcoin’s price predictions for the coming year remain divided, with some experts anticipating a further downturn while others expect renewed upward momentum. As Bitcoin navigates this uncertain period, the focus remains on its ability to hold key price levels and maintain investor confidence.

For now, Peterson’s $1.5 million prediction for 2035 stands as a bold vision for Bitcoin’s long-term potential, highlighting the continued influence of network economics in shaping the cryptocurrency’s future.