Bitcoin slipped below the $90,000 mark on Thursday, triggering fresh debate over whether the market is setting up a short term bottom or laying the groundwork for a deeper pullback. Traders are closely watching technical signals, particularly an unfilled gap in CME futures, that could pull the price toward the $88,000 region.

Bitcoin loses grip on $90,000 level

Market data from TradingView showed Bitcoin hitting an intraday low of $89,530 on Bitstamp during the Asian trading session. The move marked a clear break below $90,000 after several days of sideways trading.

The decline followed a cooling of the early year rally seen across risk assets. Bitcoin mirrored gold’s price action as both assets eased after gains that were partly driven by geopolitical tensions surrounding Venezuela. As momentum faded, short term technical levels came back into focus for traders.

Test of the 21 day moving average

One of the key technical developments was Bitcoin’s interaction with the 21 day moving average, which sat near $88,900 at the time of the drop. This level has acted as a trend indicator during recent price advances.

Crypto trader and analyst Michaël van de Poppe noted that Bitcoin briefly dipped below the 21 day moving average before recovering slightly. According to him, such moves are not unusual during strong trends, as the market often seeks liquidity below well watched levels.

Van de Poppe suggested that holding this zone would be constructive for the broader uptrend, even if short term volatility remains elevated.

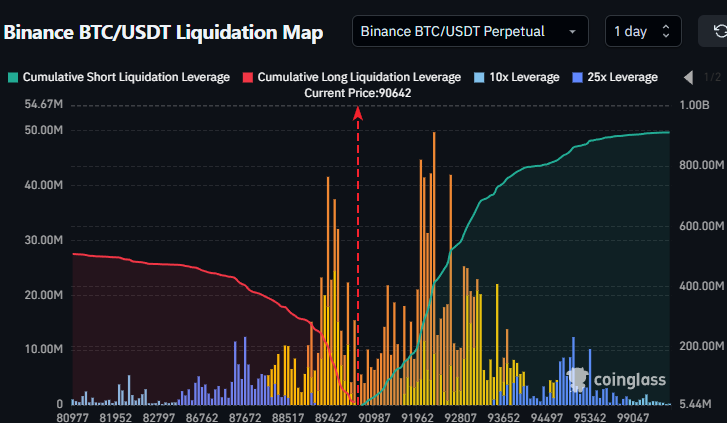

Traders mark key liquidity zones

Order book data from major exchanges highlighted $89,000 and $92,000 as important price levels. Trader Daan Crypto Trades described these zones as critical areas where buyers and sellers are actively positioned.

With Bitcoin trading near the middle of its broader range, Daan said choppy price action could persist through the end of the week. This type of consolidation often reflects uncertainty, as traders wait for a clearer directional signal.

CME futures gap remains in focus

Much of the current discussion centers on Bitcoin futures traded on the CME Group. During the New Year period, price gaps formed on the CME chart as spot markets moved while futures trading was paused. Historically, Bitcoin has shown a tendency to revisit and fill these gaps.

The latest drop below $90,000 filled one of the two open gaps. However, another gap remains unfilled around the $88,000 to $88,200 area. This has become a near term target for many technical traders.

Crypto education platform Coin Bureau questioned whether Bitcoin is now headed lower to close this remaining gap. Several analysts agree that such a move would be technically clean, removing a potential source of downside risk.

Could $88,000 mark a cycle bottom

Pseudonymous analyst CW, who contributes to onchain analytics platform CryptoQuant, described the remaining CME gap as a potential risk for the market. He argued that filling it could help stabilize price action and allow a more sustainable rally to begin.

At the same time, CW noted an alternative scenario. If Bitcoin reverses higher without filling the gap, the $88,000 area could later be viewed as the bottom of the next market cycle. This idea is based on historical chart behavior rather than broader economic or macro factors.

For now, Bitcoin remains caught between competing technical signals. Whether the market dips further to close the final CME gap or finds support above it may shape price action in the days ahead.