US Federal Reserve’s monetary policy casts shadow over Bitcoin’s price performance in early 2025.

Bitcoin Breaches $100K, Corrects to $92.5K

Bitcoin (BTC) briefly surpassed the $100,000 psychological milestone on 7 January, marking the first time since 19 December, before a sharp correction pulled its value down to $92,500. Analysts have attributed this decline to growing concerns over the US Federal Reserve’s tightening monetary policy and rising bond rates.

Ryan Lee, Chief Analyst at Bitget Research, explained:

“Bitcoin’s dip stems primarily from strong US economic data pointing toward potential interest rate hikes. This development makes cryptocurrencies less attractive as investments, while the Federal Reserve’s signals of tighter monetary policy further intensify market corrections.”

Fed Policy and Economic Resilience in Focus

Recent signs of economic resilience in the US have delayed expectations of an interest rate cut, with markets now projecting the first reduction to occur on 18 June, according to the CME Group’s FedWatch tool. Meanwhile, the Federal Reserve’s next meeting on 29 January is expected to maintain interest rates, with a 95.2% probability of no change.

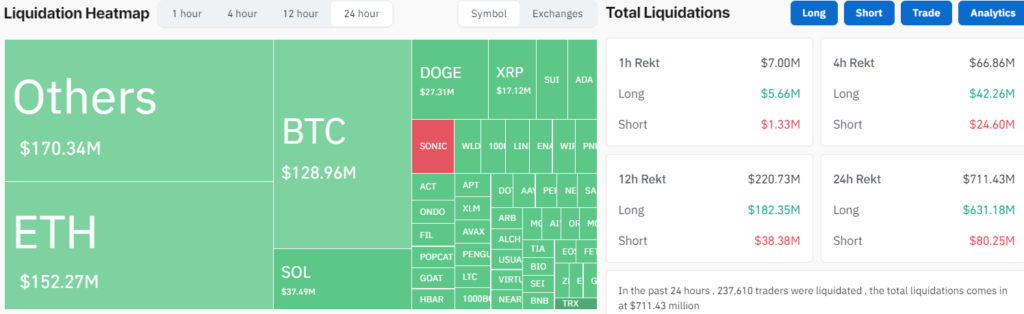

Bitcoin’s price correction also triggered significant market turbulence, liquidating over $631 million in leveraged long positions within 24 hours, according to CoinGlass data. This has led to predictions of a consolidation phase as traders unwind their leveraged positions.

Lee added:

“The interplay between macroeconomic indicators and crypto market dynamics will remain a critical factor influencing investor behaviour and overall market performance in the coming weeks.”

$90K Retest Possible Before Rally to $126K

Despite the recent correction, analysts remain optimistic about Bitcoin’s long-term trajectory. Some believe the cryptocurrency may drop below $90,000 before embarking on a significant rally above $126,000.

John Glover, Chief Investment Officer at Ledn and former Barclays Managing Director, noted:

“This could lead us to test the $90,000 level again before the next significant move higher. Using wave analysis, we appear to be completing the fourth wave, suggesting a rally toward the $126,000–$128,000 range following this consolidation phase.”

Popular crypto analyst Rekt Capital also highlighted the importance of holding the $91,000 support level. In a post on X (formerly Twitter) on 8 January, they wrote:

“Bitcoin has failed its Daily retest, losing $101,165 as support. As a result, Bitcoin has reverted back into its $91,000–$101,165 range once again.”

Long-Term Optimism for Bitcoin’s Price

While short-term corrections continue, the broader outlook for Bitcoin remains positive. Analysts predict a cycle peak above $150,000 in late 2025, driven by a forecasted $20-trillion increase in the global money supply, which could attract $2 trillion in investment into the cryptocurrency market.

As the market navigates this period of uncertainty, all eyes are on Bitcoin’s ability to hold key support levels and recover momentum for its next upward trajectory.