Former BitMEX chief executive Arthur Hayes believes Bitcoin has already found its latest market floor after last week’s sharp drop to nearly $80,000. His optimism is rooted in expectations of improving United States liquidity conditions as the Federal Reserve prepares to end its current phase of quantitative tightening.

Hayes Predicts $80,000 Will Hold as Key Support

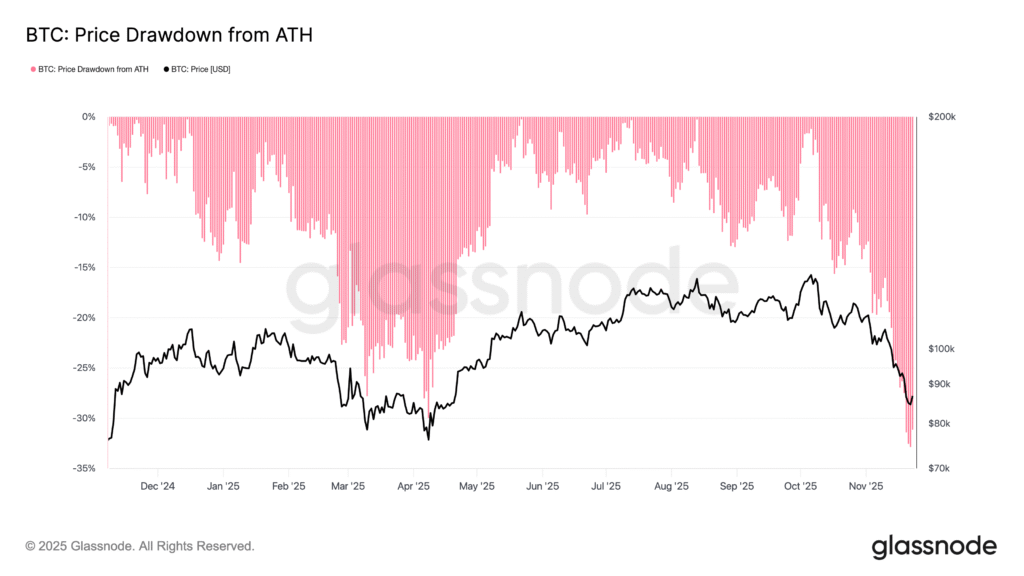

Bitcoin recently fell more than thirty five percent from its all time high, touching a low of around $80,500. Hayes told his X followers that he considers this level a firm support zone and expects the market to recover from here. According to him, there may be brief dips into the low $80,000 range although he does not expect a deeper breakdown. He wrote that he thinks “$80,000 holds,” signalling confidence that the worst of the correction has passed.

Liquidity Shifts Could Boost Crypto Markets

Hayes bases his bullish outlook on upcoming changes in United States liquidity. The Federal Reserve is expected to stop reducing its balance sheet next month which effectively ends the current quantitative tightening cycle. A halt in balance sheet contraction often leads to marginal improvements in liquidity across financial markets. He added that bank lending rose in November which supports his broader view that money conditions are slowly turning favourable for risk assets such as cryptocurrencies.

Link Between Fed Policy and Crypto Recovery

The former BitMEX executive has repeatedly argued that Bitcoin requires a return to quantitative easing to regain strong upward momentum. Last week, he pointed out that United States equities may need to undergo a similar correction before a full recovery begins in both markets. In his view, a substantial downturn in major technology stocks would likely encourage policymakers to inject more liquidity which would then spill over into digital assets.

Market Expectations Remain Volatile Ahead of Fed Decision

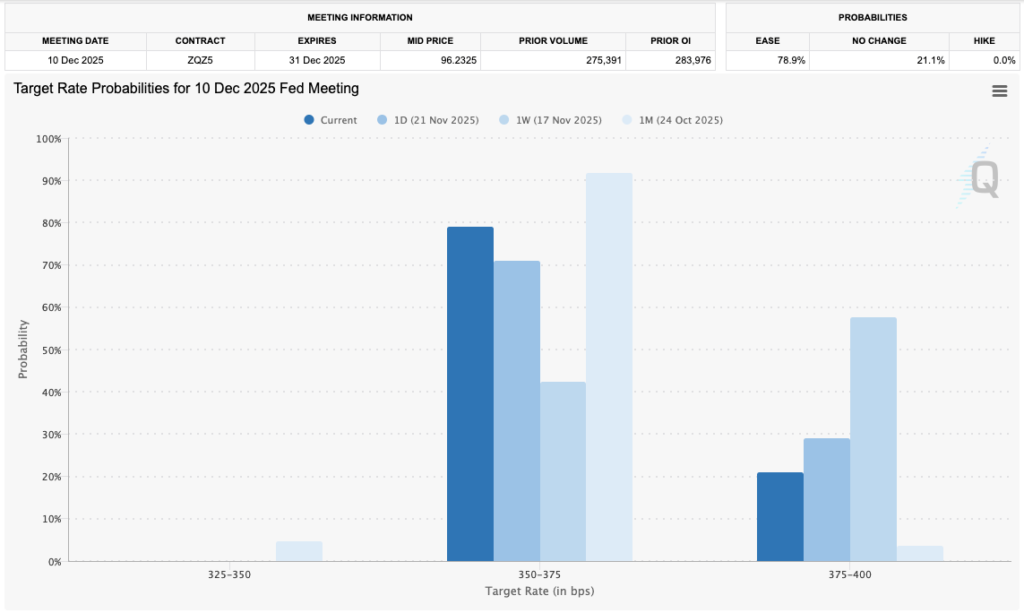

Expectations for the Federal Reserve’s December interest rate decision have shifted dramatically during the recent United States government shutdown. With limited macroeconomic data available, traders struggled to form clear predictions. CME Group’s FedWatch Tool now shows a roughly seventy nine percent chance of a quarter point rate cut which is a sharp increase from forty two percent only a week earlier.

Prominent economist Mohamed El Erian highlighted the unusual level of volatility in rate expectations. Posting on X, he described the rapid swings as “stunning” and warned that this kind of instability contrasts sharply with the predictability the central bank usually aims to maintain. He attributed the uncertainty to disrupted data flows, pressure from the Fed’s dual mandate, a transitional period for the Chair and the absence of a clear long term strategy.

Outlook for Bitcoin

With Bitcoin trading above $86,000 and global markets watching the Fed’s next move, Hayes maintains that liquidity will dictate the next major shift. If the central bank signals a softer stance and conditions ease as expected, he believes crypto markets could experience a renewed period of growth.