Bitcoin has managed to remain above the critical $95,000 support level despite experiencing the heaviest selling pressure since 2022. Analysts warn that a drop below $93,000 could trigger $1.7 billion in liquidations amid mounting concerns over global trade tensions.

Bitcoin Resilient Despite Heavy Selling

The price of Bitcoin saw a sharp decline on 9 February, briefly hitting a one-week low of $94,726 before rebounding, according to Markets Pro data. Despite the turbulence, Bitcoin has demonstrated remarkable resilience, recovering to trade close to $100,000.

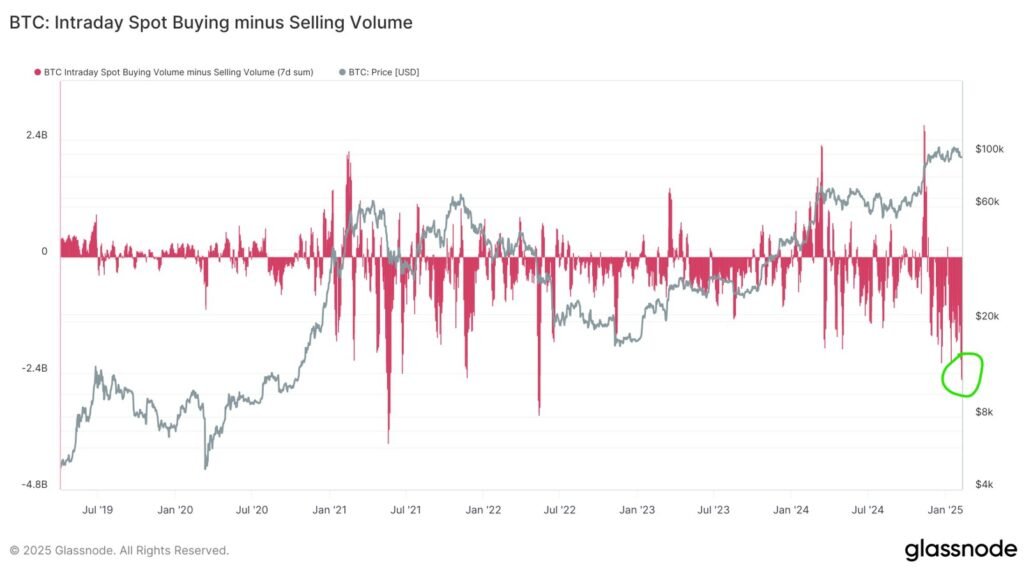

According to André Dragosch, head of research at Bitwise Europe, this marks the highest level of selling pressure on Bitcoin spot exchanges since the collapse of Three Arrows Capital (3AC) in June 2022. However, the fact that Bitcoin is holding steady suggests a potential “seller exhaustion,” he noted in a post on X (formerly Twitter) on 10 February.

Market Comparisons to Three Arrows Capital Collapse

The collapse of 3AC, a Singapore-based crypto hedge fund that once managed over $10 billion in assets, had a significant impact on the cryptocurrency sector. The fund reportedly exchanged $500 million worth of Bitcoin with the Luna Foundation Guard before Terra’s implosion, leading to a domino effect across crypto lending firms.

As a result, several major crypto lenders, including BlockFi, Voyager, and Celsius, suffered substantial losses and were eventually forced into bankruptcy due to their exposure to 3AC.

$93K Support Level Crucial for Market Stability

Bitcoin’s near-term momentum is heavily dependent on its ability to hold above the $93,000 support level, with analysts warning that a breach could trigger a sharp decline.

According to data from CoinGlass, a move below $93,000 could result in over $1.7 billion in leveraged long positions being liquidated across exchanges, potentially intensifying the market downturn.

Ryan Lee, chief analyst at Bitget Research, told that if Bitcoin slips below this threshold, further downside movement could see it test $91,500.

Trade War Concerns Weigh on Investor Sentiment

Bitcoin’s price action is being influenced by broader macroeconomic factors, particularly rising trade tensions between the United States and China. Recent announcements of new import tariffs by both nations have created uncertainty, dampening investor confidence.

Should these tensions escalate, economic instability could push Bitcoin below $90,000 in the short term, despite its reputation as a hedge against traditional financial volatility.

Markets Await Key Trump-Xi Meeting

Market participants are closely watching upcoming discussions between former US President Donald Trump and Chinese President Xi Jinping, which aim to ease trade tensions and prevent a full-scale trade war.

Trump was originally scheduled to meet Xi on 11 February, but reports from The Wall Street Journal, citing unnamed US officials, suggest the meeting may be delayed. The outcome of these talks could play a crucial role in shaping global market sentiment, including Bitcoin’s price trajectory.