As Bitcoin continues its upward momentum, US crypto-linked stocks followed suit on Monday, buoyed by a growing trend of public companies adding the leading cryptocurrency to their balance sheets. While most crypto-related firms posted gains, not all companies rode the rally, with notable exceptions like Robinhood lagging behind.

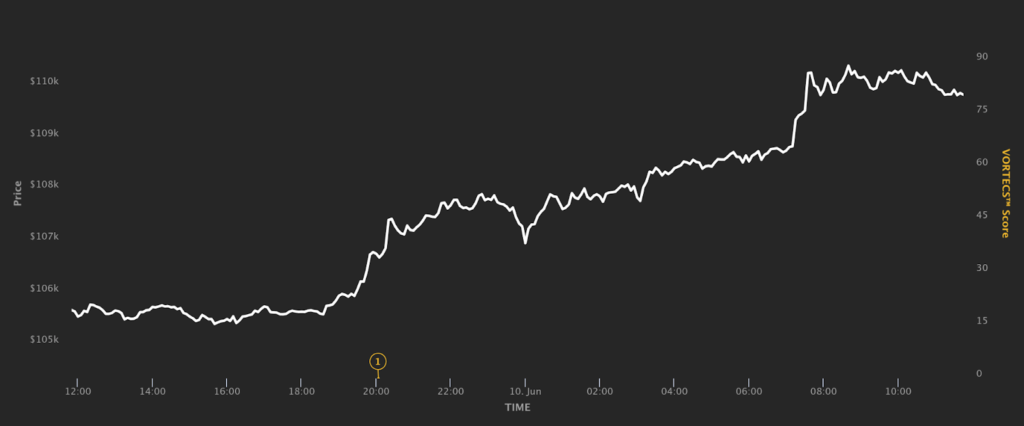

Bitcoin Climbs Past $110K as Market Optimism Grows

Bitcoin gained 4% on Monday to reach $110,150, inching closer to its May 22 high of $112,000. The rally was supported by a calming of macroeconomic jitters, as trade talks between the US and China resumed in the UK. The positive sentiment in the crypto market spilled over to related equities, with multiple US-listed crypto firms closing the day in the green and further strengthening their positions in after-hours trading.

The recent upward trajectory in Bitcoin’s price has reignited interest from publicly traded firms looking to leverage the asset’s performance to enhance shareholder value and diversify reserves.

Crypto-Linked Stocks Ride the Bitcoin Wave

Major US crypto stocks saw gains aligned with Bitcoin’s price jump. Shares in Circle Internet Group (CRCL), a stablecoin issuer that recently went public via Nasdaq, soared 7% during the trading session and gained an additional 2.2% after-hours, closing at $117.79.

Crypto mining companies also posted strong performances:

- Core Scientific Inc. (CORZ) rose 4.27%, followed by a 0.87% gain post-market.

- CleanSpark Inc. (CLSK) and MARA Holdings Inc. (MARA) both advanced over 3% in regular trading and added another 1% after-hours.

- Riot Platforms Inc. (RIOT) ended the day up 2.74%, with a 1.2% after-hours boost.

Meanwhile, MicroStrategy Inc. (MSTR) the software firm known for its aggressive Bitcoin acquisition strategy continued its upward trajectory, closing the session up 4.71% and gaining another 1% after hours to reach $396.61.

Robinhood Slides Amid S&P 500 Disappointment

While most crypto-tied firms were celebrating gains, Robinhood Markets Inc. (HOOD) was a notable outlier. Its shares dropped nearly 2% to $73.40 following disappointment over its exclusion from the S&P 500 index during the latest quarterly rebalancing by S&P Dow Jones Indices.

Analysts and investors had speculated that Robinhood, given its rising market cap and volume, might be added to the prestigious index. Inclusion typically boosts visibility and share price due to passive fund tracking. However, the absence of any changes left HOOD trailing behind.

In contrast, eToro Group Ltd. (ETOR), which debuted on the market less than a month ago, surged over 10.5% during the day and extended gains by 2.4% after hours to settle at $77.79. Similarly, Coinbase Global Inc. (COIN) posted a solid 2% gain to close at $256.63, benefiting from the bullish sentiment.

Firms Continue Adding Bitcoin to Balance Sheets

A growing list of public companies are acquiring Bitcoin as part of their treasury strategy, hoping to capitalise on the crypto’s perceived long-term value and bullish momentum.

On Monday, BitMine Immersion Technologies Inc. (BMNR) revealed it had purchased 100 BTC following a share offering that aimed to raise $18 million. Despite the announcement, BMNR shares ended down 8.7%, though they rebounded 5.2% after hours to $7.25, indicating investor hesitancy over the short-term impact.

KULR Technology Group Inc. (KULR), an energy management company, also joined the Bitcoin accumulation trend. The firm disclosed it had purchased another $13 million in Bitcoin, bringing its total holdings to 920 BTC at an average cost of $98,760 per coin. The news helped lift KULR shares by 4.2% during Monday’s session.

Corporate Bitcoin FOMO Fuels Market Optimism

Bitcoin’s recent price rally is rekindling institutional enthusiasm, especially among publicly traded companies eager to align with crypto’s upside potential. As firms from across sectors, from mining to fintech to energy diversify into Bitcoin, the asset is becoming increasingly embedded in the financial strategies of traditional markets.

While not all stock performances matched the bullish mood such as Robinhood’s stumble, the overall trend signals increasing confidence in crypto as a treasury asset. With Bitcoin inching toward record highs again and corporate adoption rising, the synergy between Wall Street and crypto markets appears stronger than ever.