The Bitcoin-Gold ratio has dropped to its lowest level in 12 weeks, signaling a shift in investor sentiment. Gold’s surge to record highs comes as fears of a U.S.-China trade war push traders toward the precious metal. Meanwhile, Bitcoin (BTC) struggles to gain upside traction despite inflows into U.S.-listed spot Bitcoin ETFs.

Bitcoin-Gold Ratio Falls to 34

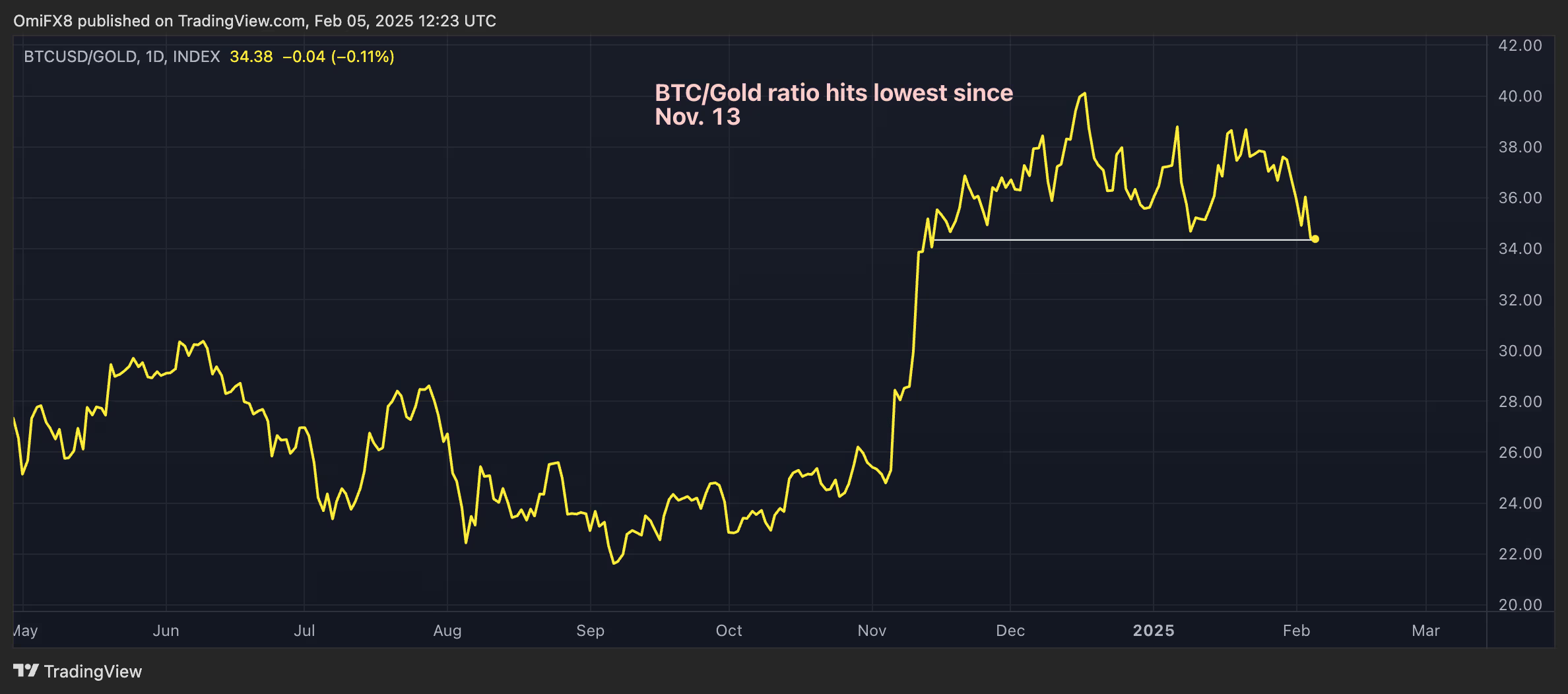

The Bitcoin-Gold ratio, which measures BTC’s price relative to gold per ounce, has fallen to 34—the lowest since mid-November 2024. The ratio has declined by 15.4% since peaking above 40 in December. This drop suggests that investors are prioritizing gold over Bitcoin as a hedge against economic uncertainty.

Gold Hits Record High Amid Safe-Haven Demand

Gold prices have surged nearly 10% year-to-date, reaching an all-time high of $2,877 per ounce. This rally is fueled by safe-haven demand, especially amid escalating tensions between the U.S. and China. Traders are even airlifting gold to the U.S. due to high Comex futures prices. Investment banking giant JPMorgan is set to deliver $4 billion worth of gold to New York this month.

Additionally, Chinese demand for gold has spiked due to the Spring Festival holidays, further driving up prices.

Bitcoin ETF Inflows Fail to Boost Prices

Despite $4 billion in inflows into U.S.-listed spot Bitcoin ETFs in the past three weeks, Bitcoin’s price remains under pressure. According to 10x Research, these inflows are primarily driven by non-directional arbitrage trades rather than genuine investor demand.

Markus Thielen, founder of 10x Research, noted that ETF purchases could be offset by simultaneous spot or futures selling, reducing any significant price impact.

Gold’s impressive rally highlights its strong safe-haven appeal amid global economic uncertainty. Meanwhile, Bitcoin’s price action remains lackluster despite ETF inflows, as arbitrage-driven trades limit upside potential. As geopolitical tensions continue to rise, investors will be watching closely to see if Bitcoin can reclaim its status as digital gold.