The crypto market was hit by a sharp and unexpected downturn on Friday, causing Bitcoin to tumble below $116,000 and triggering widespread liquidations. In total, over $585 million worth of long positions were wiped out across major cryptocurrencies in just 24 hours. Despite the bloodbath, market sentiment remains cautiously bullish, with some analysts still eyeing higher price targets for the weeks ahead.

Bitcoin Drops Below $116K, Leads Liquidation Wave

According to data from CoinGlass, the price of Bitcoin dropped 2.63% to $115,356 in the past 24 hours, leading to $140.06 million in liquidated long positions. This sharp decline pulled the broader crypto market down with it, ending a short-lived bullish phase that had seen Bitcoin reach an all-time high of $123,100 just days earlier on July 14.

Crypto trader and analyst “Ash Crypto” described the drop as a “pure leverage flush” on X (formerly Twitter). He explained that many traders had gone long on altcoins following Ether’s recent price rally, only to be caught off guard when market makers reversed the trend, forcing mass liquidations of late positions.

Over 213,000 Traders Liquidated in One Day

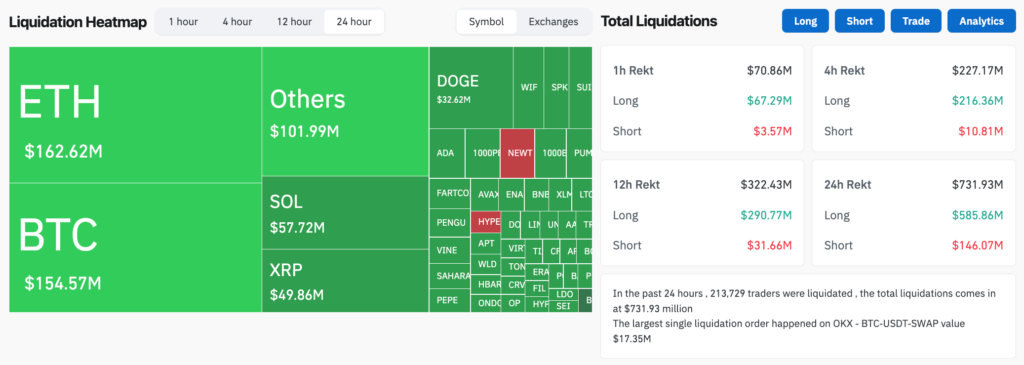

A total of 213,729 traders were liquidated in the span of 24 hours, losing a combined $585.86 million in long positions. When short positions are included, total liquidations for the day soared to $731.93 million.

Ether was the second-biggest contributor to long liquidations, with over $104.76 million wiped out as its price fell 1.33% to $3,598. Dogecoin was the hardest hit among the top 10 cryptocurrencies, dropping 7% to $0.22 and erasing $26 million in long positions, according to blockchain analytics firm Nansen.

The size and speed of the selloff caught many traders off guard, especially as recent price action had leaned heavily bullish across the board. The quick shift illustrates the risks associated with highly leveraged positions in crypto, where small price moves can trigger major margin calls.

Sentiment Still Bullish Despite Market Drop

Despite Friday’s brutal downturn, market sentiment remains positive overall. The Crypto Fear & Greed Index, a popular gauge of market mood, showed a score of 70 categorised as “Greed” in its Friday update. This suggests that many investors still believe the pullback is temporary and that the bull market has room to continue.

Some industry analysts continue to share optimistic price forecasts. Galaxy Digital CEO Michael Novogratz predicted that Ether would rise to at least $4,000, a nearly 10% increase from its current level. Meanwhile, analysts at Bitfinex noted that Bitcoin could target $136,000 if the uptrend resumes.

Risks Remain as Traders Brace for Reversal

Despite the optimistic outlook, many traders are hedging their positions in case Bitcoin reverses direction. A return to Thursday’s price level of $119,500 could trigger the liquidation of an estimated $3.07 billion worth of short positions, highlighting the high stakes currently in play for both bulls and bears.

For now, the market remains volatile, and the coming days may be critical in determining whether the dip was a temporary shakeout or a deeper correction. Traders are advised to be cautious, especially when using leverage, as market makers continue to exploit overcrowded positions for quick profit-taking.

The sudden drop in Bitcoin’s price below $116,000 has caused widespread losses, particularly among overleveraged traders. While the market shows signs of resilience, the road ahead remains uncertain. Volatility is expected to continue, and traders would do well to manage risk wisely in the days ahead.