Bitcoin’s price is under pressure once again as financial markets reel from renewed fears of a US-China tariff war and heightened stock market volatility. Analysts are warning that Bitcoin could test the $71,000 level — a five-month low — if the current market turbulence continues.

Bitcoin Mirrors Equities in Chaotic Trading

At the opening of Wall Street on 9 April, Bitcoin (BTC) made a swift rebound to $78,300, following a dip under $75,000 earlier in the day. This movement mirrored the dramatic swings in the US stock market, particularly the S&P 500, which saw one of its most volatile intraday reversals in history.

According to data from Markets Pro and TradingView, the sudden shift in equities was triggered by escalating tensions between the US and China, with both countries announcing fresh tariffs. The resulting uncertainty spilled into the crypto market, wiping out Bitcoin’s recent attempt to maintain levels above $80,000.

Markets Rattled by Political Uncertainty

The Kobeissi Letter, a prominent market commentary source, noted the historic nature of the S&P 500’s intraday reversal, stating it surpassed those seen during the financial crises of 2008 and 2020. It pointed out the unusual sensitivity of the markets to even minor political developments — especially statements from former US President Donald Trump.

“The problem with markets right now is that both bulls and bears feel uncomfortable,” Kobeissi wrote. “Stocks can swing over $5 trillion in market cap from just one post by Trump. That’s why we’re seeing this herd-like price action.”

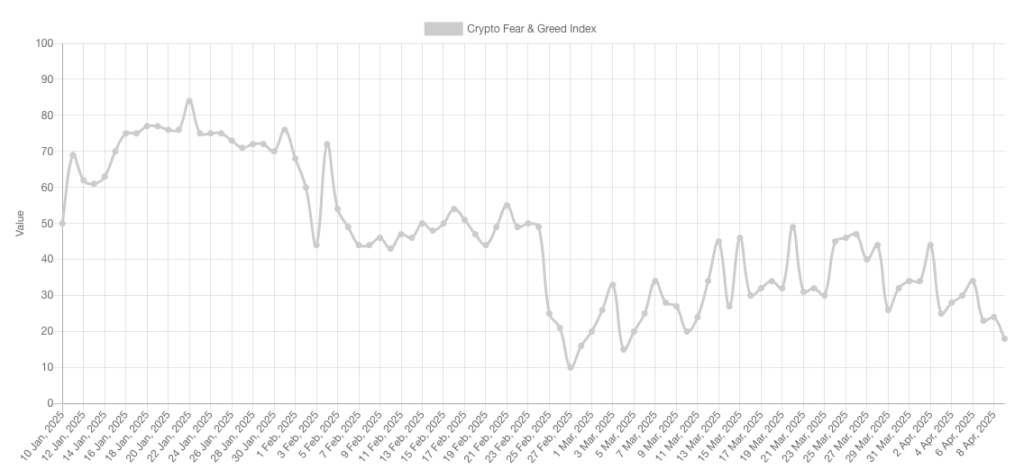

Bitcoin and other cryptocurrencies have not been immune to this dynamic. The Crypto Fear & Greed Index dropped to its lowest point since early March, highlighting a growing sense of anxiety among traders.

Analysts Cautious Despite Lower Prices

Keith Alan, co-founder of Material Indicators, expressed caution amid the current uncertainty. While some digital assets appear attractively priced, Alan admitted he was hesitant to make any major moves. “Part of me wants to sit on my hands and wait for this shit storm to pass,” he wrote on social media platform X. “I’m not too eager to buy, even though some of these assets are on sale at great prices.”

Resistance Forms at $82,000 as Price Gap Looms

Popular crypto analyst Rekt Capital pointed to a resistance zone for Bitcoin between $82,000 and $85,000, created by a recent gap on the CME Group’s Bitcoin futures chart. He noted that BTC had broken down from a sideways trading range and had filled the CME gap, which now acts as a price ceiling.

“Bitcoin is experiencing downside continuation after upside wicking into the early March Weekly lows,” Rekt Capital explained. “Having confirmed this red level as new resistance, BTC is now dropping into the $71,000–$83,000 Volume Gap to fill this market inefficiency.”

According to Rekt Capital, the lower end of this range — around $71,000 — could serve as the next significant support level. He remains among the analysts who believe a long-term reversal could occur around $70,000, should current trends persist.