Bitcoin continues its impressive rally as strong capital inflows and bullish technical patterns suggest the top cryptocurrency could breach a new all-time high in the coming week. With prices currently consolidating above the crucial $100,000 level, investors are closely watching for a breakout that could send Bitcoin soaring past $110,000 by the end of May.

Realised Cap Growth Signals Strong Market Foundation

According to on-chain analytics firm Glassnode, Bitcoin’s Realised Cap – which reflects the total value of all coins based on their last moved price – has increased by $30 billion since April 20. Now standing at $900 billion, the realised cap is growing at a steady 3% monthly rate in May. While this pace is slower than the sharp 8% surge seen in late 2024, when Bitcoin reached $93,000, it reflects consistent investor confidence and fresh capital entering the market.

The sustained rise in realised cap shows long-term holders are continuing to accumulate, while new investors are entering at higher price levels. This steady inflow is creating a solid foundation for potential price expansion.

Spot Market Volume Shows Bullish Conviction

One of the strongest indicators of this bullish momentum is the recent surge in Bitcoin’s spot volume delta. Glassnode reported that the 7-day simple moving average (SMA) of the Spot Volume Delta turned sharply positive, reaching nearly $5 billion on May 13. This metric measures net buying pressure in spot markets and, when positive, signals strong demand from actual buyers rather than speculative leveraged positions.

Such aggressive spot buying activity has only been recorded a handful of times in 2025 and is typically associated with meaningful price rallies. It also confirms that the recent move above $100,000 is supported by real capital rather than excessive leverage or short-term speculation.

Technical Patterns Point to Higher Highs

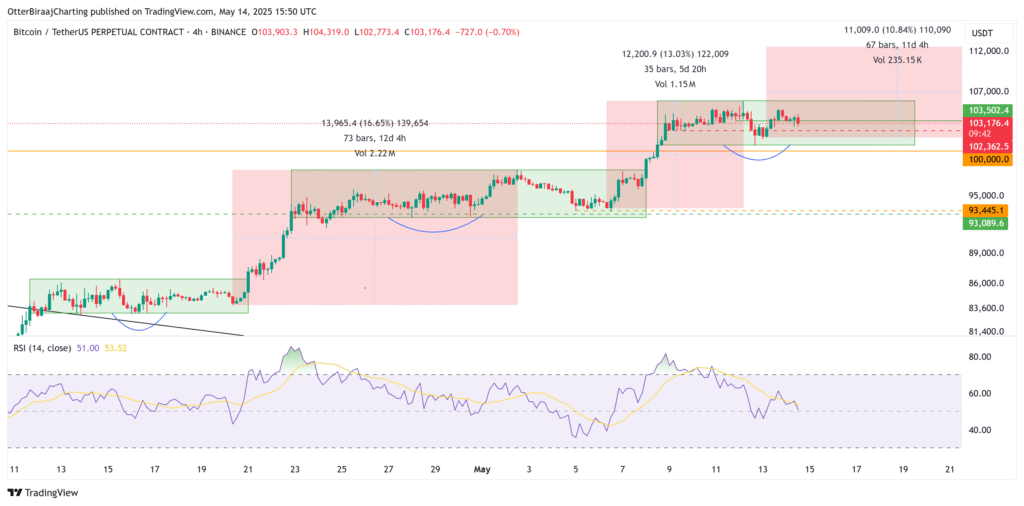

Bitcoin’s recent price action follows a clear consolidation-and-breakout pattern. Since forming a bottom around $74,500 in early April, Bitcoin has moved in a stair-step fashion—forming higher highs and higher lows through repeated consolidation phases.

Currently, the price is ranging between $100,678 and $105,700. This third consolidation phase mirrors the structure of previous ones, where the price briefly moves sideways before surging to a new range. If the pattern continues, Bitcoin could retest the lower end of this range—between $100,000 and $102,000—before launching toward $110,000 and beyond.

The Relative Strength Index (RSI) has also mirrored this structure, showing overbought signals during breakouts and resetting to around 50 during consolidation, suggesting continued bullish health without overheating.

Key Levels to Watch in the Coming Week

For bullish momentum to remain intact, Bitcoin must hold above the $100,000 support zone. A retest and successful rebound from the $100,000–$102,000 range would strengthen the case for a breakout above $110,000. However, a failure to maintain this level could invalidate the bullish setup, especially if price dips below $102,000 and fails to recover quickly.

Market sentiment, capital inflows, and institutional buying suggest that the path of least resistance remains upward, but traders should remain cautious of short-term volatility as Bitcoin navigates a critical technical zone.

With bullish fundamentals, strong spot demand, and favourable technical setups, Bitcoin is well-positioned to attempt new all-time highs in the coming days. While a 10% rally from current levels remains possible, traders should watch for support resilience at $100,000 and be ready for volatility during this pivotal phase of the market.