Bitcoin climbed toward fresh weekly highs on Tuesday as global markets reacted positively to lower than expected US inflation numbers. The move came alongside a strong rally in equities, with the S&P 500 hitting a new record, while renewed political pressure on the Federal Reserve added another layer of uncertainty for investors.

The world’s largest cryptocurrency briefly pushed toward the $92,000 to $93,000 zone during the US market open, supported by optimism that easing inflation could eventually lead to looser monetary policy.

Cooler CPI Data Lifts Risk Appetite

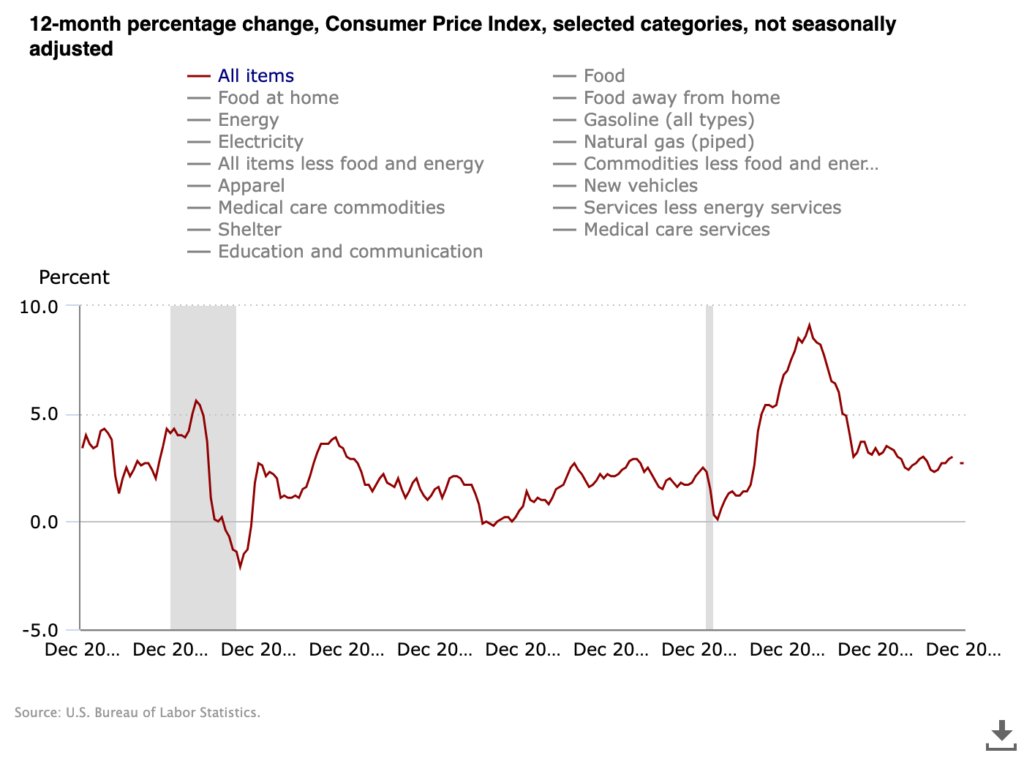

Market sentiment improved after the US Bureau of Labor Statistics released its Consumer Price Index data for December 2025. Headline inflation rose 2.7 percent year on year, matching forecasts, while core CPI came in at 2.6 percent, slightly below expectations.

In its statement, the BLS noted that the all-items index increased at the same pace as in November, reinforcing the view that inflation pressures remain contained. Traders quickly interpreted the data as supportive for risk assets, sparking gains across stocks and cryptocurrencies.

Bitcoin reacted swiftly, rising about 1.5 percent on the day, according to TradingView data. The move reflected broader confidence that the Federal Reserve may eventually have room to cut interest rates if inflation continues to cool.

Trading newsletter The Kobeissi Letter pointed out on social media that both headline and core CPI were flat on a monthly basis, a detail that further encouraged bullish sentiment across markets.

Stocks Hit Records Despite Fed Tensions

US equities extended their rally after the inflation report, with the S&P 500 climbing to a new all-time high. The gains came despite an increasingly public clash between President Donald Trump and Federal Reserve Chair Jerome Powell.

The Fed is widely expected to keep interest rates unchanged at its upcoming January 28 meeting. However, Trump has continued to call for lower rates, arguing that additional cuts would support growth and financial markets.

Tensions have escalated further following the announcement of a legal investigation involving Powell, which the Fed chair has suggested is linked to disagreements over monetary policy. Trump reiterated his demand for rate cuts after the CPI release, framing lower borrowing costs as a logical response to easing inflation.

Trump has also argued that US trade tariffs have helped bring inflation down, a claim that remains controversial. The Supreme Court is expected to rule on the legality of those tariffs later this week, adding another potential catalyst for market volatility.

Bitcoin Nears Heavy Resistance Zone

While Bitcoin’s upside move drew attention, traders cautioned that the price is approaching a technically significant resistance area. As BTC hovered near $92,000, analysts highlighted the challenge of breaking through levels where selling pressure has previously emerged.

Market commentator Exitpump pointed to two volume-weighted average price trendlines converging near current levels, describing the zone as a major resistance area. VWAP measures the average price over a set period, adjusted for trading volume, and is often used by traders to identify areas of strong supply and demand.

Another trader, Daan Crypto Trades, noted that recent sideways movement has built up liquidity on both sides of the market. According to his analysis, the $92,600 to $94,000 range represents a key upside area to watch, while support sits lower between $89,800 and $88,700.

This narrow trading range has persisted for nearly a week, suggesting that a decisive move may be approaching as traders position for the next breakout or breakdown.

Liquidations Rise as Traders Position for Volatility

As Bitcoin tested higher levels, leverage in the market began to unwind. Data from CoinGlass showed that total crypto liquidations over the past 24 hours reached nearly $170 million, reflecting increased activity as prices moved.

Liquidations often rise during periods of heightened volatility, when traders using borrowed funds are forced out of positions. The latest figures suggest that both long and short traders are actively repositioning as Bitcoin flirts with a potential trend change.

Daan Crypto Trades summed up the situation by suggesting that the current $90,000 to $92,000 range is unlikely to last much longer. Whether Bitcoin can gather enough momentum to clear resistance near $93,000 remains the key question for the days ahead.

For now, softer inflation data and strong equity markets have given bulls a boost, but the next move may depend on how macroeconomic policy and technical levels align in the near term.