Bitcoin has surged towards the $77,000 mark, bolstered by a wave of investor optimism following Donald Trump’s victory in the US presidential election. The cryptocurrency saw a sharp rise in demand for Bitcoin-related products, with expectations of improved economic policies under a Republican administration fuelling the rally.

Bitcoin Nears $77K as ETF Inflows Hit Record High

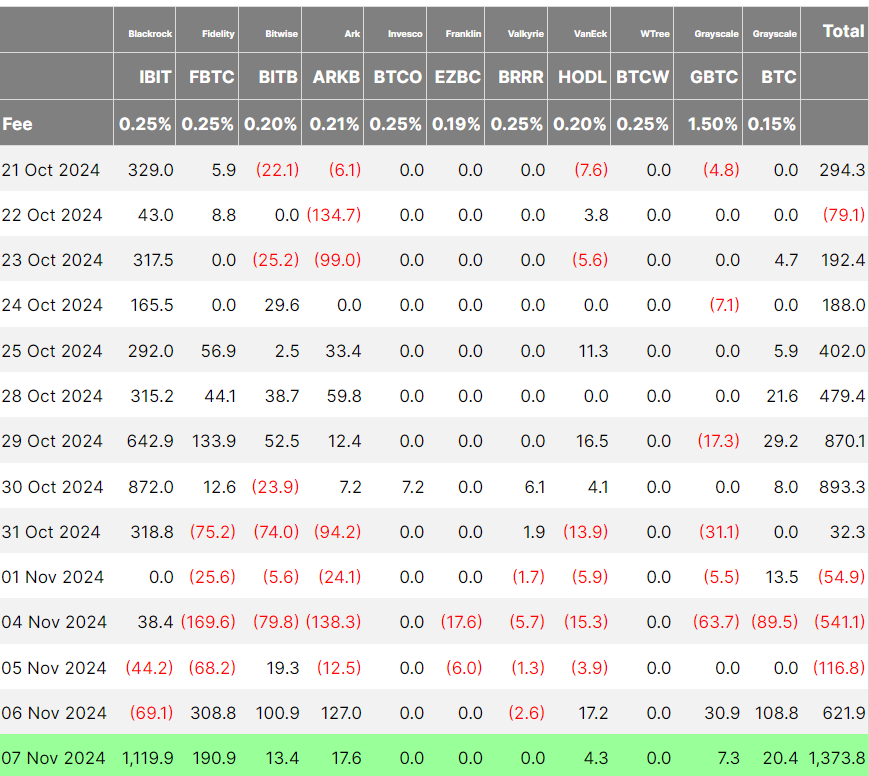

On November 8, Bitcoin traded at $76,027, just shy of $77,000. This rise follows an unprecedented $1.38 billion net inflow into Bitcoin spot ETFs on November 7, the day after Trump was declared the winner of the election. QCP Capital’s research note highlighted the correlation between Trump’s victory, the anticipated Federal Reserve rate cut, and the surge in investor appetite for risk assets like Bitcoin.

Optimism Surrounding Trump’s Economic Policies

QCP Capital suggests that the combination of Trump’s victory and the expected 25-basis-point Fed rate cut could push Bitcoin beyond $77,000. Investor confidence is also being driven by Trump’s proposals for major economic reforms, including a significant tariff hike on China, which analysts believe may reduce Bitcoin’s risk premium compared to traditional assets like stocks and gold.

Bitcoin ETF Inflows Could Fuel Future Growth

The new record of over $1.37 billion in Bitcoin ETF inflows on November 7 reflects growing investor interest in Bitcoin as a risk-on asset. With historical patterns indicating that Bitcoin’s price tends to rise following halving events, experts expect the current bullish momentum to extend well into 2025. Ryan Lee, chief analyst at Bitget Research, predicts that Bitcoin could surpass $100,000 before the end of 2024.

Positive Outlook for Ethereum and Other Cryptos

The rise in investor appetite for Bitcoin could also impact other cryptocurrencies. Ether, for example, is expected to break out above $3,200, fuelled by increasing demand for Ethereum-related ETFs and a positive outlook for risk assets in the broader market.