Spot Bitcoin exchange-traded funds (ETFs) recorded their second-largest single-day outflow on Friday, shedding over $812 million. Meanwhile, Ether ETFs marked the end of a historic 20-day inflow streak, losing more than $152 million in a single session. The developments come amid heightened volatility in the cryptocurrency markets and shifting investor sentiment.

Bitcoin ETFs Lose $812 Million in a Day

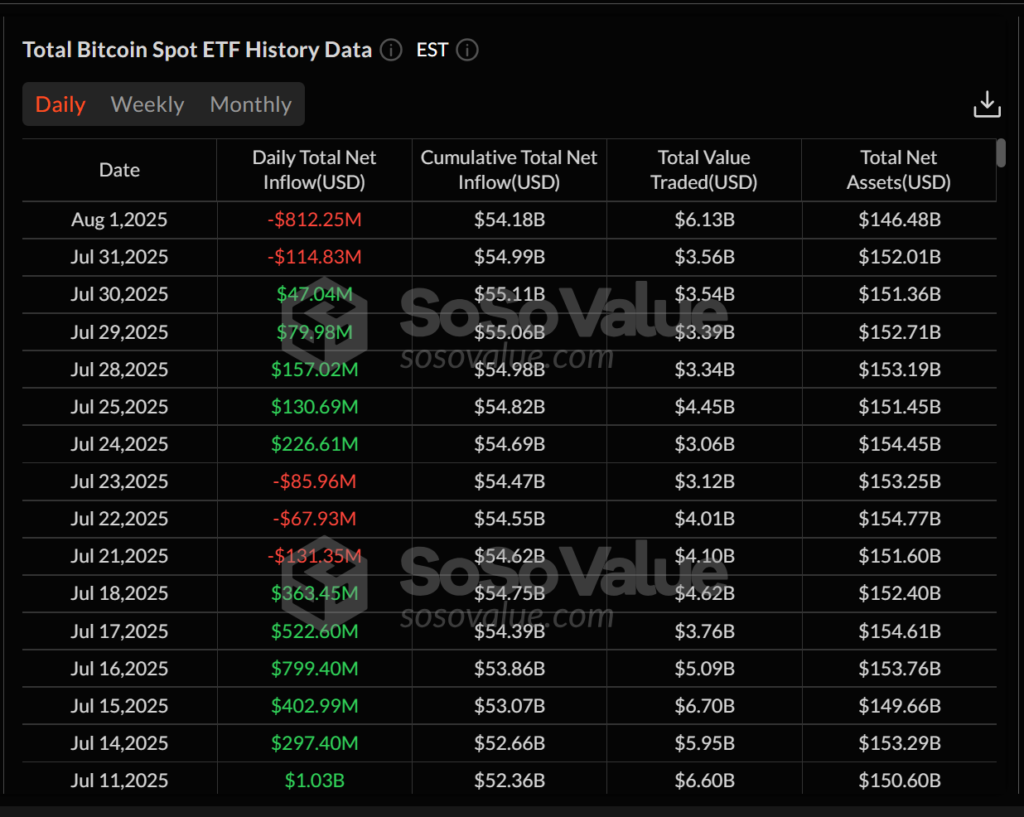

Spot Bitcoin ETFs experienced a significant setback with net outflows totalling $812.25 million on Friday. The drawdown wiped out a week’s worth of gains and pulled cumulative net inflows down to $54.18 billion. Total assets under management (AUM) fell to $146.48 billion, which now accounts for 6.46 per cent of Bitcoin’s market capitalisation, according to SoSoValue.

Fidelity’s FBTC led the outflows, recording $331.42 million in redemptions. ARK Invest’s ARKB closely followed, with investors pulling out $327.93 million. Grayscale’s GBTC registered a $66.79 million loss, while BlackRock’s IBIT saw a relatively modest outflow of $2.58 million.

Despite the downturn, trading activity remained strong. Spot Bitcoin ETFs registered a total trading volume of $6.13 billion, with IBIT alone contributing $4.54 billion. This suggests that while investors are withdrawing funds, market engagement continues.

Ether ETFs End Record Inflow Run

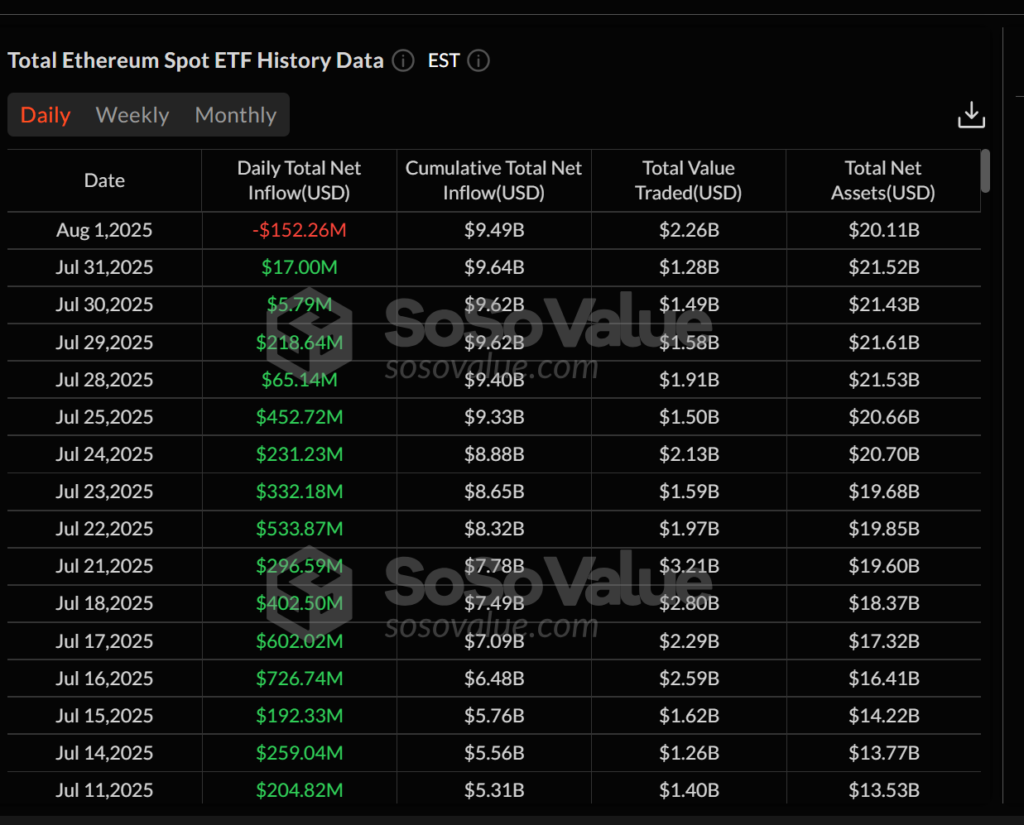

Friday also marked the end of Ether ETFs’ longest-ever streak of daily inflows. After 20 consecutive trading sessions of net gains, the funds saw a combined outflow of $152.26 million. Ether ETF AUM currently stands at $20.11 billion, representing 4.70 per cent of Ethereum’s market capitalisation.

Grayscale’s ETHE led the losses with $47.68 million in outflows, followed by Bitwise’s ETHW, which dropped by $40.30 million. Fidelity’s FETH saw $6.17 million withdrawn. BlackRock’s ETHA held steady with no net flows and remained the largest Ether ETF with $10.71 billion in assets.

Total trading across all Ethereum ETFs reached $2.26 billion, with Grayscale’s product alone seeing $288.96 million in volume. The high trading figures reflect continuing volatility and investor interest in Ether despite the outflows.

Ether ETFs Previously Set Inflow Records

Prior to the downturn, Ethereum ETFs had enjoyed an impressive run. On 16 July, they posted a record-breaking $726.74 million in daily inflows, the highest since their launch. The next day saw a further $602.02 million invested, as enthusiasm for Ether-based products surged.

The inflows were largely driven by growing institutional interest and confidence in Ethereum’s long-term prospects, bolstered by ETF approvals and favourable market trends.

Corporates Increasingly Accumulate Ether

In a recent report, Standard Chartered revealed that corporations are acquiring Ether at twice the pace of Bitcoin. Since early June, crypto treasury firms have bought approximately 1 per cent of Ethereum’s total circulating supply.

The bank attributes Ether’s recent price rally to a combination of corporate accumulation and consistent inflows into US-based spot Ether ETFs. It predicts that Ethereum could surpass its $4,000 target before the end of the year, especially as businesses are drawn to the benefits of staking and decentralised finance (DeFi) participation.

Looking ahead, Standard Chartered suggests that Ethereum treasury holdings could grow to represent up to 10 per cent of the total supply, marking a major shift in institutional interest toward Ether over Bitcoin.