ETF inflows return after sharp weekly outflows

Spot Bitcoin exchange-traded funds recorded $562 million in net inflows on Monday, marking a brief recovery after a rough week for digital asset investment products. The inflows helped offset part of the $1.5 billion that exited Bitcoin ETFs over the previous four trading sessions, according to data from SoSoValue. It was the first day of positive flows after four consecutive days of selling, offering a short-term boost to sentiment in an otherwise cautious market.

The rebound came amid ongoing weakness across crypto markets, where investor confidence remains fragile due to macroeconomic uncertainty and continued institutional de-risking. While the inflows were significant, analysts cautioned that they do not yet signal a clear reversal in trend.

Bitcoin price rebounds, but remains under pressure

Bitcoin prices recovered alongside ETF inflows, bouncing sharply on Monday after dipping below $75,000 over the weekend. The asset climbed to an intraday high above $79,000 before cooling off, according to CoinGecko data. Despite the bounce, Bitcoin continues to trade well below recent highs and remains vulnerable to further downside if selling pressure resumes.

Market participants noted that the recovery appeared more technical than structural, driven by short-term positioning rather than a shift in broader risk appetite. With global markets facing uncertainty around interest rates, geopolitics and liquidity conditions, Bitcoin has struggled to regain sustained momentum.

Year-to-date ETF flows still negative

Even after Monday’s inflows, spot Bitcoin ETFs remain firmly in the red for the year. Year-to-date outflows now stand at roughly $1 billion. Total outflows have reached $4.6 billion so far this year, while inflows have amounted to around $3.6 billion, highlighting the uneven and fragile nature of investor demand.

Ether ETFs continue to lag behind Bitcoin products. On the same day that Bitcoin ETFs saw strong inflows, Ether ETFs posted minor outflows of $2.9 million, extending a trend of weaker interest in Ethereum-focused funds. The divergence suggests that investors are currently more selective, favoring Bitcoin over other major digital assets.

ETF cost basis turns into a key support level

Adding to market caution, Galaxy Digital head of research Alex Thorn noted that Bitcoin has fallen below the average ETF flow cost basis. According to Thorn, the average creation cost for Bitcoin ETFs sits near $84,000, meaning Bitcoin is currently trading about 7.3 percent below that level. Over the weekend, the discount briefly widened to nearly 10 percent.

This marks the first time Bitcoin has traded below the ETF cost basis since mid-2024. Historically, Thorn pointed out, this level has acted as near-term support during previous pullbacks. While not guaranteed, the $84,000 zone could again become an area where buyers step in to defend prices.

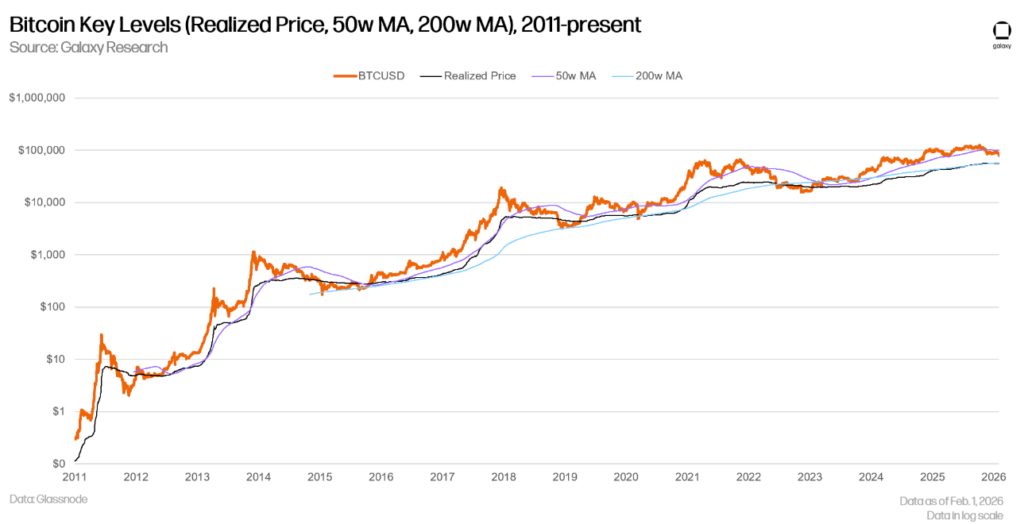

Thorn also highlighted Bitcoin’s realized price near $56,000, a level that has often served as a longer-term support during past market cycles before renewed uptrends emerged.

Macro uncertainty continues to weigh on sentiment

Despite short-term optimism from ETF inflows, analysts remain cautious about the broader outlook. James Butterfill, head of research at CoinShares, said the crypto market is facing several headwinds, including unfavorable capital flows, Bitcoin’s recent decoupling from global money supply trends, rising geopolitical tensions and uncertainty around US monetary policy.

Concerns have intensified following Kevin Warsh’s designation as Federal Reserve Chair, which has added to speculation about the future path of interest rates. Higher-for-longer rate expectations tend to pressure risk assets, including cryptocurrencies.

Still, Butterfill noted that the longer-term outlook remains constructive. Structural concerns around currency debasement continue to support Bitcoin’s investment case, and the current lag behind liquidity trends could set the stage for a catch-up phase if financial conditions ease.

Reflecting the broader weakness, CoinShares reported that crypto exchange-traded products saw $1.7 billion in outflows last week, doubling the outflows recorded the week before. The data underscores that, while sporadic inflows may appear, investor conviction remains fragile for now.