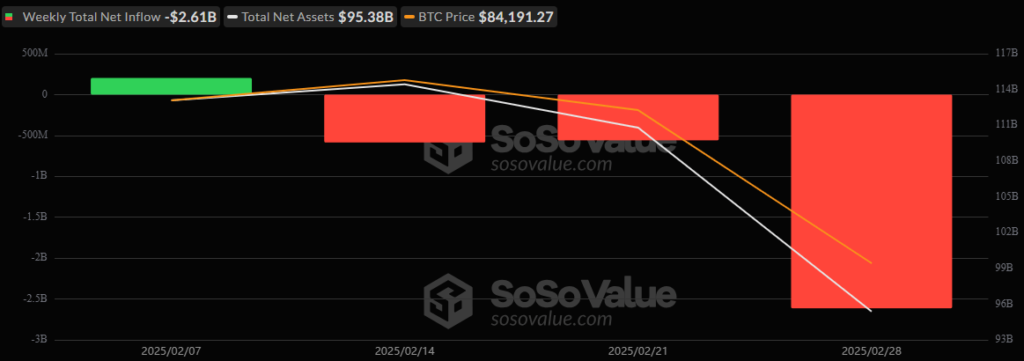

The crypto ETF market faced another turbulent week from February 24 to 28, with bitcoin ETFs recording a net outflow of $2.61 billion. This marked the third consecutive week of declines, reflecting growing bearish sentiment.

The most significant single-day withdrawal occurred on February 26, when investors pulled $1 billion from bitcoin ETFs, setting a new record for daily outflows.

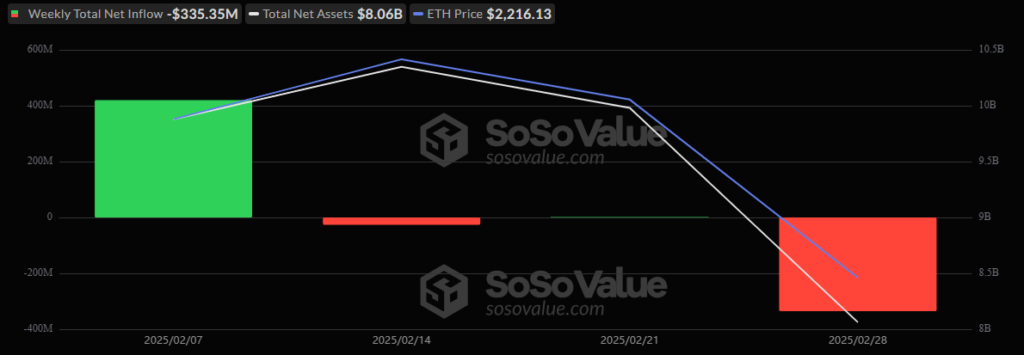

Ether ETFs Also Under Pressure

Ether ETFs were not spared from the downturn, with weekly net outflows totaling $335.35 million. This brought total ether ETF assets below $9 billion, settling at $8.06 billion.

Fidelity’s FETH led the declines, losing $56.30 million, followed by Blackrock’s ETHA ($30.16 million), Bitwise’s ETHW ($20.72 million), and Grayscale’s ETHE ($11.66 million).

Top ETF Outflows of the Week

Bitcoin ETFs saw major withdrawals from leading funds:

- BlackRock’s IBIT: $1.17 billion

- Fidelity’s FBTC: $568.65 million

- Grayscale’s GBTC: $188.84 million

- Grayscale’s BTC: $147.93 million

- Valkyrie’s BRRR: $112.84 million

- WisdomTree’s BTCW: $95.10 million

These outflows pushed the total net assets of bitcoin ETFs below $100 billion, now standing at $95.38 billion.

Reasons Behind the Decline

Analysts point to several key factors driving investor withdrawals:

- Economic Uncertainty: Global markets remain volatile, with concerns over tariffs and inflation impacting investor confidence.

- Recent Crypto Thefts: High-profile hacks, including the Bybit breach, have shaken trust in digital assets.

- Regulatory Disappointments: Many expected pro-crypto policies under President Trump’s administration, but recent developments have fallen short.

A Glimmer of Hope?

Bitcoin ETFs endured eight consecutive days of outflows before seeing a small inflow on the final day of the week. However, ether ETFs remained on a seven-day losing streak.

With macroeconomic challenges persisting, investors will be watching closely for signs of a market turnaround in the coming weeks.