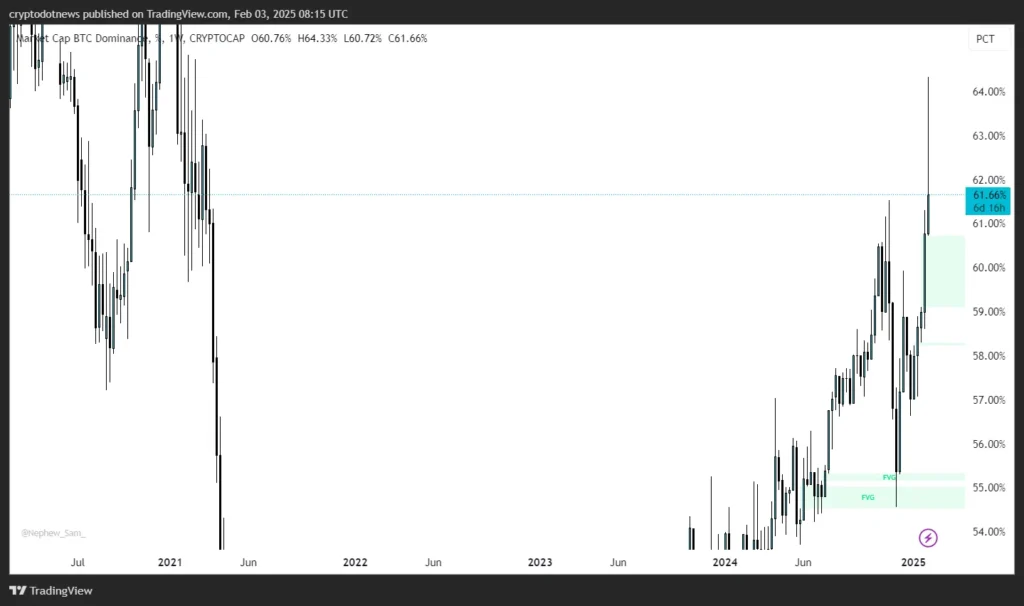

Bitcoin’s market dominance has surged to nearly 62%, its highest level since February 2021. This shift signals a challenging period for altcoins, with many investors focusing on BTC amid uncertain macroeconomic conditions.

Bitcoin Market Dominance Hits 62%

As of February 3, Bitcoin’s dominance has climbed to 62%, reinforcing its position as the leading cryptocurrency. Market dominance refers to the percentage of the total crypto market cap held by Bitcoin, and this rise suggests altcoins are losing ground.

The last time BTC held such a significant share was in February 2021, following Tesla’s announcement of a $1.5 billion investment and plans to accept BTC payments. That year, BTC’s price surged past $68,000 in November, fueled by institutional adoption and growing retail interest.

Economic Concerns Weigh on Crypto Markets

Bitcoin’s rising dominance comes amid fears of a global economic slowdown. Concerns over trade policies, including former U.S. President Donald Trump’s tariffs on Mexico, Canada, and China, have added uncertainty to financial markets.

This has led investors to favor Bitcoin over riskier altcoins, which have struggled to maintain momentum. The broader crypto market downturn has left many altcoins trading at multi-month lows, reinforcing Bitcoin’s status as the most resilient asset in the space.

Kimchi Premium Surges to 12%

One notable trend is Bitcoin’s rising “Kimchi Premium”—the price gap between BTC on South Korean exchanges and global markets. Currently, this premium stands at 12%, its highest level in three years.

This suggests strong demand for Bitcoin in South Korea, where retail traders are actively buying despite broader market volatility. Historically, a high Kimchi Premium has often preceded major price movements in BTC.

CME Gap at $102,000: A Key Level to Watch

According to crypto analyst CryptoRover, the Chicago Mercantile Exchange (CME) Gap at $102,436 is a crucial level for traders. CME Gaps occur when Bitcoin’s price moves significantly while the CME futures market is closed.

These gaps tend to be filled over time, making them key points of interest for traders looking for potential price reversals or corrections. If BTC moves toward this level, it could trigger increased market activity.

Will Altcoins Recover in 2025?

Despite Bitcoin’s growing dominance, some analysts predict an altcoin season by February 2025, mirroring past market cycles. Historically, BTC dominance surges during bear markets but declines when investors rotate into altcoins during bullish phases.

If the market follows previous trends, 2025 could see a resurgence in altcoin interest, potentially reducing Bitcoin’s dominance. However, macroeconomic conditions and regulatory developments will play a significant role in shaping the crypto landscape.

For now, Bitcoin remains the market leader, with traders keeping a close eye on key levels and economic factors that could influence its next move.