BTC price tests December lows as traders identify historical patterns, with macro conditions providing mixed signals.

Bitcoin Slides to $92,000 Before Partial Recovery

Bitcoin (BTC) experienced significant price turbulence on Dec. 20, plunging to $92,000 on Bitstamp before recovering past $96,000. Despite being down 1.5% on the day, the cryptocurrency continued to present challenging trading conditions, with a sharp leverage wipeout targeting late bullish positions.

Analyst Rekt Capital highlighted a familiar pattern in Bitcoin’s market behaviour, noting that bull market corrections typically occur six to eight weeks after breaking all-time highs. He suggested the current pullback, down 15% from recent highs, mirrors similar corrections seen in 2021.

“This is the first Price Discovery Correction in this cycle, offering an optimal re-accumulation opportunity with a high probability of reversal to the upside,” Rekt Capital explained.

Data from CoinGlass revealed that the total liquidation across the crypto market reached $1.4 billion over the past 24 hours, underscoring the volatility.

US Exchanges Lead Sell-Side Pressure

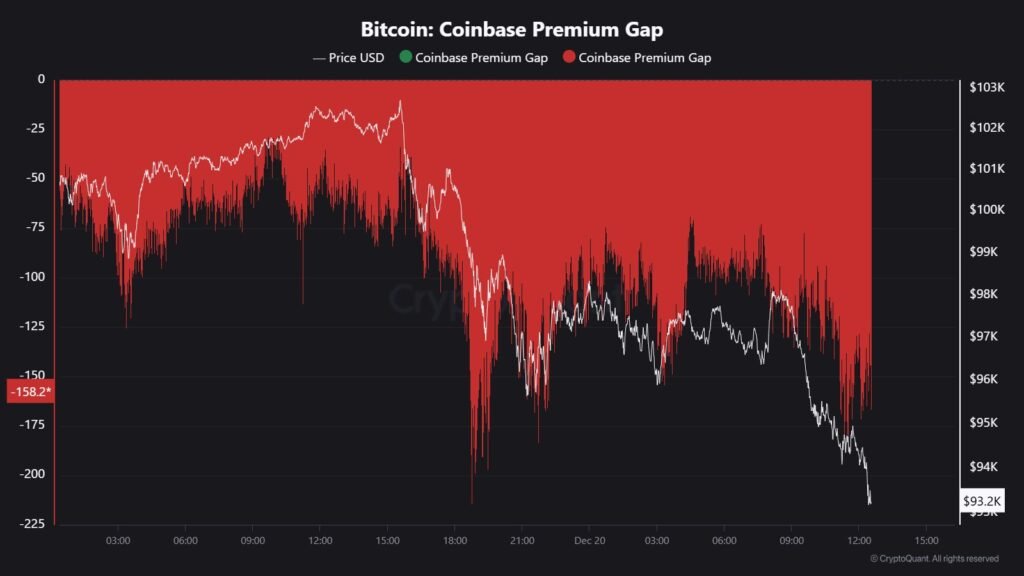

On-chain analytics pointed to significant sell-side pressure on Coinbase, the largest US exchange. The Coinbase premium, which tracks the price difference between BTC/USD on Coinbase and BTC/USDT on Binance, remained in negative territory, a bearish signal.

“When the Coinbase premium is negative, it’s best to stay on the sidelines and wait for clearer market signals,” recommended CryptoQuant analyst BQYoutube.

PCE Inflation Data Provides Mixed Macro Signals

Meanwhile, macroeconomic conditions offered a glimmer of relief as US Personal Consumption Expenditures (PCE) inflation came in at 2.4%, slightly below the expected 2.5%. The PCE index, considered the Federal Reserve’s preferred inflation gauge, provided markets with some optimism.

“This provides markets with some relief but confirms inflation is on the rise, suggesting a bumpy road ahead,” observed The Kobeissi Letter.

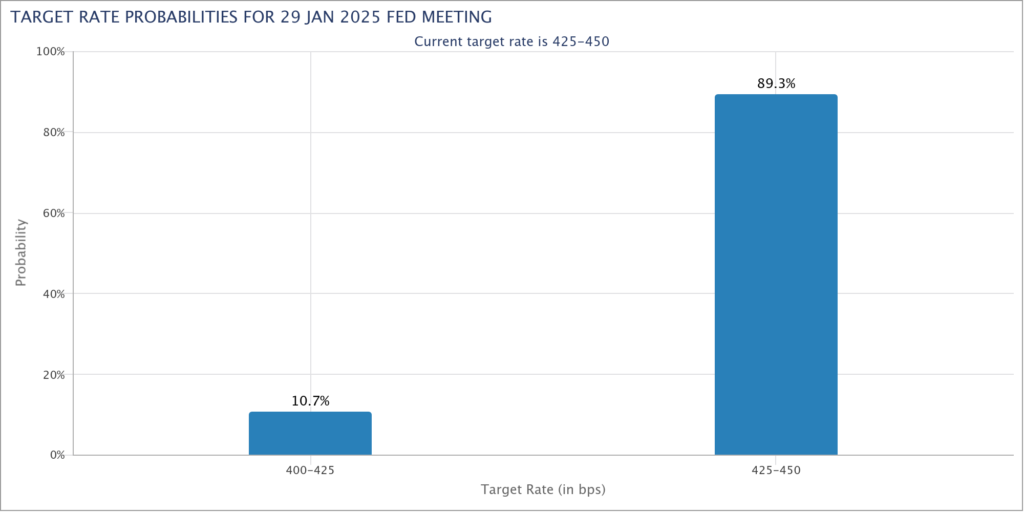

Market expectations for the Federal Reserve’s policy showed a slight shift, with the likelihood of an interest rate cut in January increasing to 10.7% from 8.6% the previous day, according to CME Group’s FedWatch Tool.