Bitcoin and the wider cryptocurrency market saw a sharp downturn on 12 February after US inflation data came in higher than forecast, raising concerns over macroeconomic pressures on digital assets.

Bitcoin Reacts to CPI Data

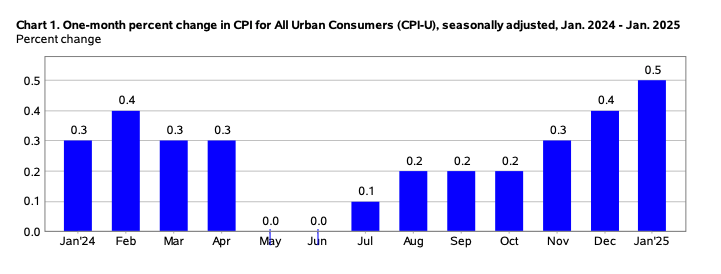

Bitcoin (BTC) briefly dropped below $95,000 following the release of the US Consumer Price Index (CPI) report, which showed an annual inflation rate of 3% in January 2025—0.1% higher than expected. The US Bureau of Labor Statistics reported a monthly CPI increase of 0.5%, surpassing Dow Jones’ forecast by 0.2%. This marked the largest monthly rise in inflation in a year.

Despite the latest inflation figures, analysts believe the data is unlikely to influence the Federal Reserve’s interest rate decision in March.

Trump Pushes for Interest Rate Cuts

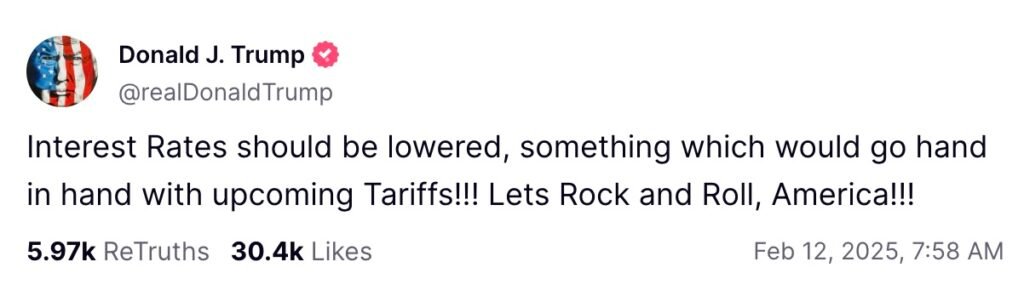

The inflation report coincided with renewed calls from US President Donald Trump for interest rate cuts. In a post on his social media platform, Truth Social, Trump wrote:

“Interest rates should be lowered, something which would go hand in hand with upcoming tariffs! Let’s Rock and Roll, America!”

His remarks came just a day after Federal Reserve Chairman Jerome Powell signalled no immediate need for rate adjustments. Powell emphasised that with policy already significantly less restrictive and the economy remaining strong, there was no urgency to alter interest rates.

Trump has been critical of Powell and the Fed, accusing them in January of failing to address inflation properly and mishandling bank regulations.

Impact of Trump’s Tariffs on Inflation

Some analysts argue that the inflation increase in January was expected due to seasonal price rises rather than the impact of Trump’s tariffs. Coin Bureau founder Nic Puckrin dismissed concerns that the president’s policies were driving inflation, suggesting instead that they could have an “unexpected disinflationary effect.”

Puckrin also noted that the latest CPI figures were unlikely to sway the Fed’s interest rate decision in March. Instead, policymakers will focus on upcoming economic indicators, including unemployment data on 7 March and the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) index, due on 28 February.

Bitcoin Faces Pressure Amid Inflation Concerns

The higher-than-expected inflation data has put pressure on risk assets like Bitcoin. Crypto analytics firm Steno Research previously warned that rising US inflation could trigger further sell-offs in Bitcoin, as an unfavourable macroeconomic environment tends to drive investors away from riskier assets.

However, historical trends suggest that potential interest rate cuts could lead to increased inflows into crypto investment products. For now, all eyes remain on upcoming economic data and the Federal Reserve’s response in the coming months.