Bitcoin has once again broken past the $100,000 mark, trading at $100,794 at the time of writing. The leading cryptocurrency surged 4.11% from an intraday low of $96,150, reclaiming six-figure territory for the third time since December 2024. The first record-breaking moment came on December 5, followed by a second spike on January 20, just before US President Donald Trump’s inauguration.

This latest milestone comes amid a shift in investor sentiment and broader market dynamics, reigniting optimism about Bitcoin’s long-term potential.

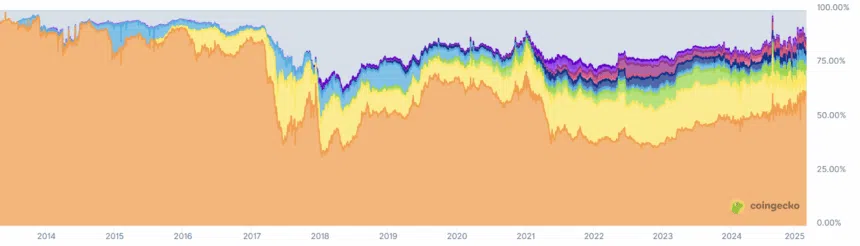

Market Dominance Strengthens Bitcoin’s Lead

One of the key indicators supporting this rally is Bitcoin’s market dominance, which has now climbed above 60%. That’s a significant rise from the 52–54% dominance levels seen during its earlier $100K milestones in December and January.

This increase suggests a pivot in market preference, with investors favouring Bitcoin over altcoins. As dominance grows, capital continues to flow into BTC, reinforcing its status as the crypto market’s anchor asset. This trend, however, could pose challenges for altcoins, many of which are seeing reduced volumes and slower recoveries.

Macroeconomic and Political Winds Fuel the Rally

Several macro factors have converged to drive the recent uptrend. A potential US–UK trade deal, teased by President Trump in a Truth Social post on May 7, has stirred fresh economic optimism. Combined with falling bond yields and a weakening dollar, these developments are pushing investors toward Bitcoin as a hedge.

Institutional interest also remains robust. According to Farside Investor, Bitcoin ETFs recorded a massive $1.8 billion in inflows over the past week alone. This influx of capital underscores the increasing role of traditional finance players in the crypto space.

Saylor, Caselin See Higher Highs Ahead

MicroStrategy’s Executive Chairman, Michael Saylor, remains as bullish as ever. Posting on X, he wrote, “You can still buy $BTC for less than $0.2 million”, urging investors to act before Bitcoin potentially doubles in value.

Echoing similar optimism, Ben Caselin, Chief Marketing Officer at VALR, predicts that Bitcoin could soon breach $110,000. Caselin believes that retail investors are yet to join the rally in full force, and that a macro top may be reached in Q4 2025, following the traditional four-year cycle.

Technical Outlook: Bulls Take Control

On the technical front, Bitcoin’s recent bounce from a key support level at $93,645 sparked the current rally. The Relative Strength Index (RSI) is currently at 76, suggesting that bulls have a firm grip on momentum, although overbought conditions may lead to short-term pullbacks.

Despite the excitement, analysts advise caution. The sustainability of this surge will depend heavily on upcoming US economic data, including the Consumer Price Index (CPI) and the federal budget report, both of which could influence investor sentiment.