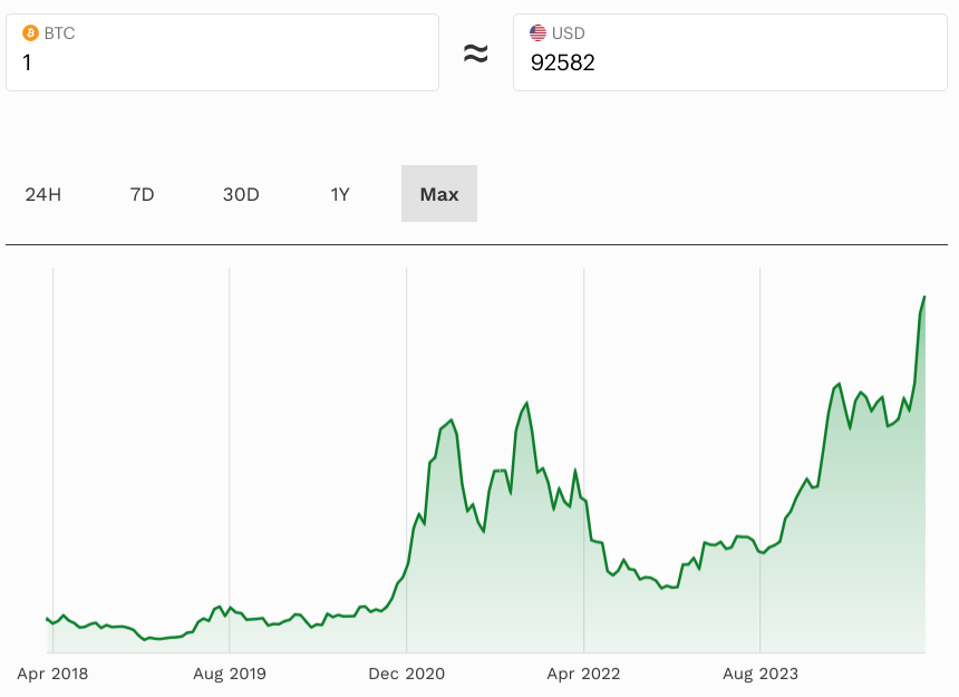

Bitcoin’s price has plummeted sharply, dragging the broader cryptocurrency market with it. The flagship digital asset fell to around $90,000 from its recent peak of nearly $100,000 earlier this week, erasing $200 billion from the total crypto market value, which now stands at $3 trillion.

Crypto billionaire Michael Novogratz attributed the correction to excessive leverage in the system. “The crypto community is levered to the gills,” the Galaxy Digital CEO told CNBC. He predicts bitcoin could dip further to $80,000 before finding its footing, a level that mirrors its pre-election price ahead of Donald Trump’s recent presidential victory.

Geopolitical and Regulatory Factors

Wall Street jitters over potential regulatory changes under Trump’s pro-crypto administration have contributed to market uncertainty. Novogratz remains optimistic about bitcoin’s long-term trajectory, suggesting that the administration’s digital asset-friendly stance could catalyse future growth. “It’s inevitable bitcoin crosses $100,000 and goes much higher,” he said, emphasising supply shortages in the market.

Technical Analysis Signals Deeper Pullback

Market analysts like FxPro’s Alex Kuptsikevich are cautious about bitcoin’s immediate future. The cryptocurrency dipped below $93,000, marking its fourth consecutive day of losses. Kuptsikevich highlighted critical support levels at $91,800 and $87,000, cautioning traders to watch momentum closely.

What’s Next for Bitcoin?

Despite the current turmoil, experts suggest this correction is part of a broader profit-taking cycle following November’s rally. While the market remains volatile, many believe bitcoin will recover and resume its upward trajectory in the months ahead.

The crypto market’s resilience will likely be tested further as traders brace for more turbulence.