US demand for Bitcoin surges as institutional investors return and exchange reserves dwindle.

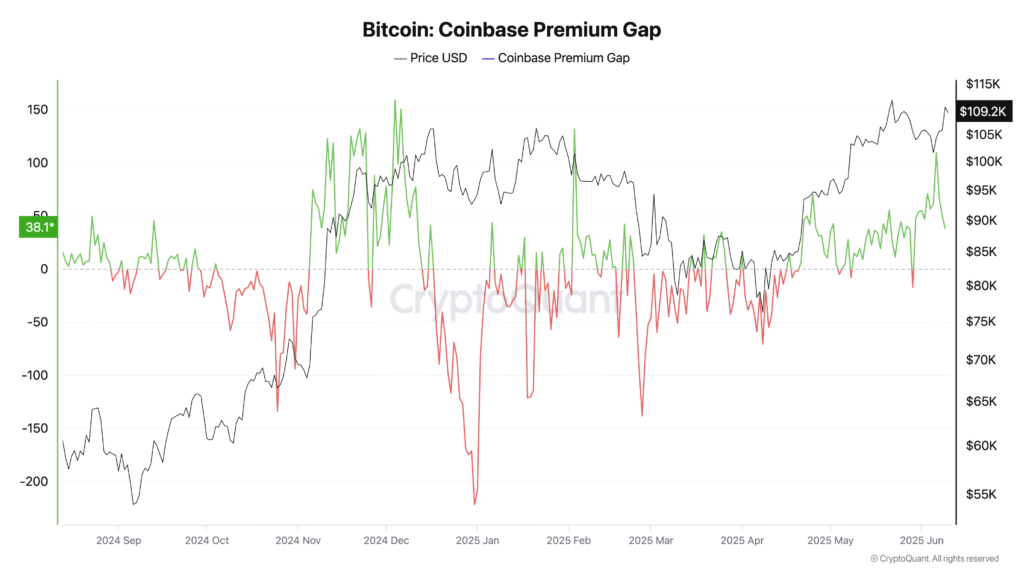

Coinbase Premium Signals Renewed US Buying Interest

Bitcoin’s rising momentum in 2025 has received a new boost as the Coinbase Premium metric, a key gauge of US investor demand, has reached its highest level in four months. According to on-chain analytics platform CryptoQuant, the Premium, which measures the price difference between Coinbase’s BTC/USD pair and Binance’s BTC/USDT, hit $109.55 on June 6. This marks the largest gap between the two exchanges since 3 February.

This metric is widely used as a proxy for US buying pressure, and the latest spike reflects a resurgence of interest among American investors. In a June 10 market update, CryptoQuant analyst Crypto Dan suggested this development was typical of a market entering a bullish recovery phase.

“This positive movement, without signs of overheating, is a typical pattern seen in a rising cycle following a correction,” he said. “It suggests optimistic movements in the cryptocurrency market in the second half of 2025.”

Institutional Demand Returns with BlackRock ETF Surge

Adding to the bullish sentiment is the resurgence of institutional interest, particularly in the wake of Bitcoin’s brief dip below the $100,000 mark. Despite the temporary correction, investors appear to be doubling down on their positions.

The US’s largest spot Bitcoin ETF, BlackRock’s iShares Bitcoin Trust (IBIT), continues to attract significant capital. As of early June, it has become the fastest ETF to reach $70 billion in assets under management. This milestone reflects strong confidence in Bitcoin’s long-term prospects, especially among traditional financial institutions.

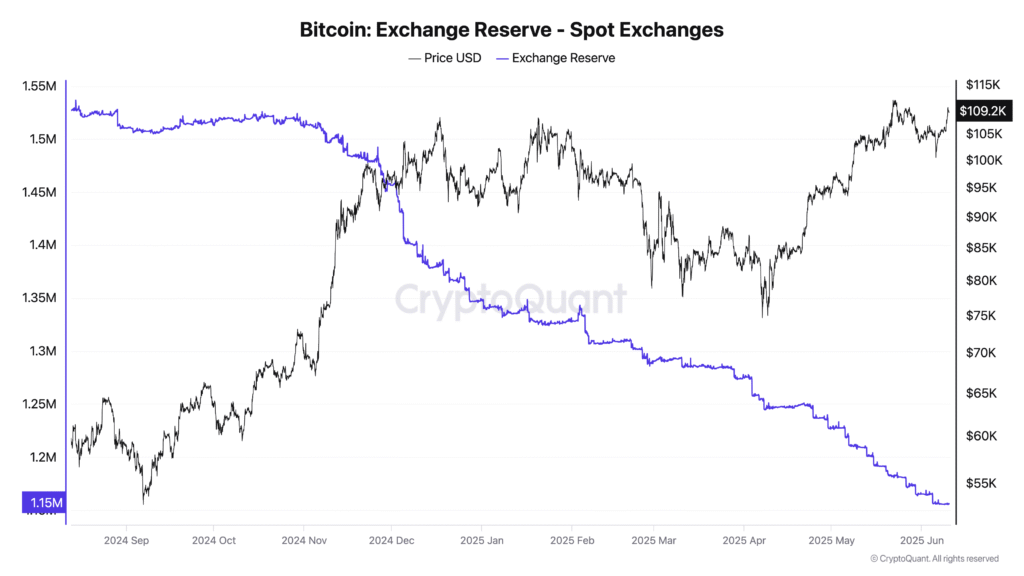

Declining Exchange Reserves Boost Bullish Sentiment

Supporting this bullish trend is a sharp decline in Bitcoin held on spot exchanges. Since July 2024, over 550,000 BTC have been withdrawn from exchanges, according to CryptoQuant data. This pattern indicates growing investor preference for long-term holding over short-term trading.

CryptoQuant contributor Baykuş noted in a recent update, “Every rally is the result of unseen preparation… Investors are pulling BTC off exchanges. Slowly but surely, with steady determination.”

He further added, “This isn’t just a routine move. People aren’t selling, they’re holding. They’re not day trading, they’re holding for the long term.” The decline in exchange reserves is often viewed as a precursor to supply squeezes, which can push prices higher as demand continues to rise.

No Signs of Overheating Yet

Despite the growing bullish signals, analysts remain cautious but optimistic. The absence of signs indicating market overheating suggests that the current uptrend could be sustainable. Historical trends show that such conditions, increased demand, declining reserves, and minimal speculative froth often precede extended bull runs.

Crypto Dan’s analysis supports this view, indicating that the recent uptick is not a flash rally but part of a more significant structural recovery. With both retail and institutional investors showing renewed interest, the outlook for Bitcoin in the latter half of 2025 appears increasingly positive.

Conclusion: A Strengthening Foundation

As Bitcoin eyes the $110,000 level once more, a combination of rising US demand, strong institutional inflows, and reduced exchange supply is laying the groundwork for continued growth. While macroeconomic uncertainty still lingers, current market indicators point towards a strengthening foundation rather than speculative excess.

If current trends persist, Bitcoin could be entering a new, sustained phase of bullish momentum, driven not by hype but by steady accumulation and long-term confidence.