CryptoQuant CEO Dismisses Bear Market Concerns Despite Potential Correction

Bitcoin’s ongoing bull market remains intact despite the possibility of a significant price correction in 2025, according to CryptoQuant CEO Ki Young Ju. In a series of posts on X (formerly Twitter) on 19 February, Ki stated that Bitcoin could experience a 30% decline from its all-time high and still maintain its bullish trajectory.

The remarks come as Bitcoin struggles to break past the psychological barrier of $100,000, with price action remaining relatively flat over the past month. However, Ki remains optimistic that the market will continue its upward trend throughout the year.

“I don’t think we’ll enter a bear market this year,” he wrote while discussing investor cost bases.

“We’re still in a bull cycle. The price would eventually go up, but the range seems broad. I personally think that the bull cycle could continue even with a -30% dip from ATH (e.g., 110K → 77K), as seen in past cycles.”

A price drop to $77,000, while significant, would still place Bitcoin well above the all-time high of the previous cycle. Many traders view this level as a strong potential support zone, reinforcing confidence that Bitcoin’s long-term uptrend remains intact.

Key Price Levels and Market Support

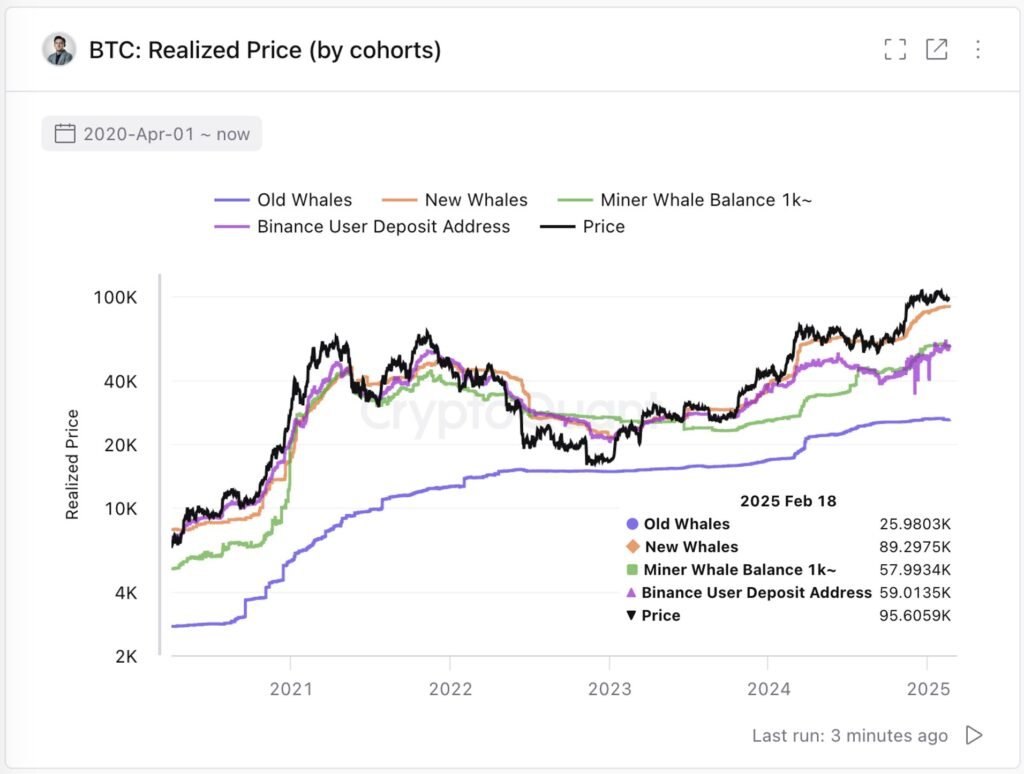

Ki also highlighted several critical price levels based on investor entry points, which could play a crucial role in determining Bitcoin’s future price movements.

US spot Bitcoin exchange-traded fund (ETF) investors, who entered the market at an average price of around $89,000, are currently sitting in profit. This level has acted as a solid support since November, providing reassurance that large-scale institutional investments continue to hold firm.

Similarly, new Bitcoin whales have entered the market at comparable price levels, making $89,000 an essential threshold. If the price were to dip, traders will closely watch this area for signs of renewed buying interest.

Further down, traders on global exchange Binance have a much lower aggregate breakeven point at approximately $59,000. Meanwhile, Bitcoin mining companies would begin to experience financial strain if prices drop below $57,000.

Ki noted that in past downturns, falling below these levels – specifically in May 2022, March 2020, and November 2018 – led to confirmed bear markets. Therefore, staying above these price zones is crucial for Bitcoin’s continued bullish momentum.

Bitcoin’s Post-Halving Performance Suggests Further Upside

Despite concerns over short-term corrections, historical data suggests that Bitcoin’s current cycle has more room for growth. CryptoQuant analyst Timo Oinonen believes the price rally following the April 2024 Bitcoin halving remains “unfinished.”

In a 17 February blog post, Oinonen pointed out that BTC/USD has only increased by approximately 60% since the latest halving event. Compared to previous halving cycles, this suggests that further price gains could be on the horizon.

“Despite the continuing halving cycle, I’d expect to see a ‘sell in May’ effect, a sideways summer, and elevated price levels by the last quarter,” Oinonen predicted.

Historically, Bitcoin has shown strong price performance in the final quarter of the year. This pattern has played out in multiple cycles, including 2013, 2016, 2017, 2020, 2021, 2023, and 2024.

While short-term corrections are possible, Oinonen believes that any major downturn is still a long way off.

“A deeper correction could be multiple months or even a year away,” he concluded.

Cautious Optimism Among Bitcoin Investors

The latest analysis reinforces the idea that Bitcoin remains in a bullish phase, even as volatility and potential pullbacks continue to loom over the market.

With institutional investors, ETF holders, and whales still accumulating at key price levels, there is strong support that could prevent a prolonged bear market. However, traders should remain cautious of short-term corrections and external market factors, including macroeconomic conditions and regulatory developments.

While Bitcoin’s price trajectory remains uncertain in the short term, analysts continue to expect a strong finish to 2025, provided the market holds above critical support zones and follows historical post-halving patterns.