As the Bitcoin 2025 Conference begins in Las Vegas, market analysts and traders are growing increasingly wary of a potential price correction, possibly echoing last year’s dramatic 30% drop. The world’s largest cryptocurrency circled the $110,000 mark at the Wall Street open on 27 May, bouncing slightly after testing support near $107,000. However, concerns are mounting that this rally could soon reverse.

Market Memory of 2024 Haunts Traders

In July 2024, the Bitcoin Conference in Nashville was followed by a steep decline in BTC prices. Bitcoin fell from $70,000 to $49,000 in just two days, a nearly 30% crash. Analysts attributed the fall partly to elevated volatility and high-profile political speeches, including one by former U.S. President Donald Trump. That “market memory” is back at the forefront, with traders cautious about a similar setup in 2025.

This year’s conference runs from 27 to 29 May in Las Vegas and features a high-profile line-up, including JD Vance, Michael Saylor, Donald Trump Jr., and Eric Trump. Analysts from trading firm QCP Capital noted a noticeable uptick in short-term volatility, which they believe reflects traders bracing for headline risks surrounding the event.

“The sustained elevation in near-term vols suggests that traders are positioning around headline risk ahead of the Bitcoin Conference,” QCP wrote in a bulletin to Telegram subscribers. “Last July’s conference offers a useful analogue… that episode continues to shape market memory.”

Could History Repeat? $77K Level in Focus

If Bitcoin were to retrace 30% from its current levels, the price could fall to around $77,000, a zone that served as a multi-month bottom earlier in April. This scenario isn’t just speculative: traders recall how swiftly Bitcoin moved last year following a spike in implied volatility.

Analyst Michaël van de Poppe reminded investors on X (formerly Twitter) that corrections are a normal part of market cycles. “Corrections do happen and they’ll continue to happen,” he wrote, noting that even a 20% pullback “shouldn’t disappoint you.” With Bitcoin having already retraced from $110,000 to the mid-$70,000 range earlier this year, he cautioned against overreacting to short-term dips.

Volatility and Liquidity Magnets in Play

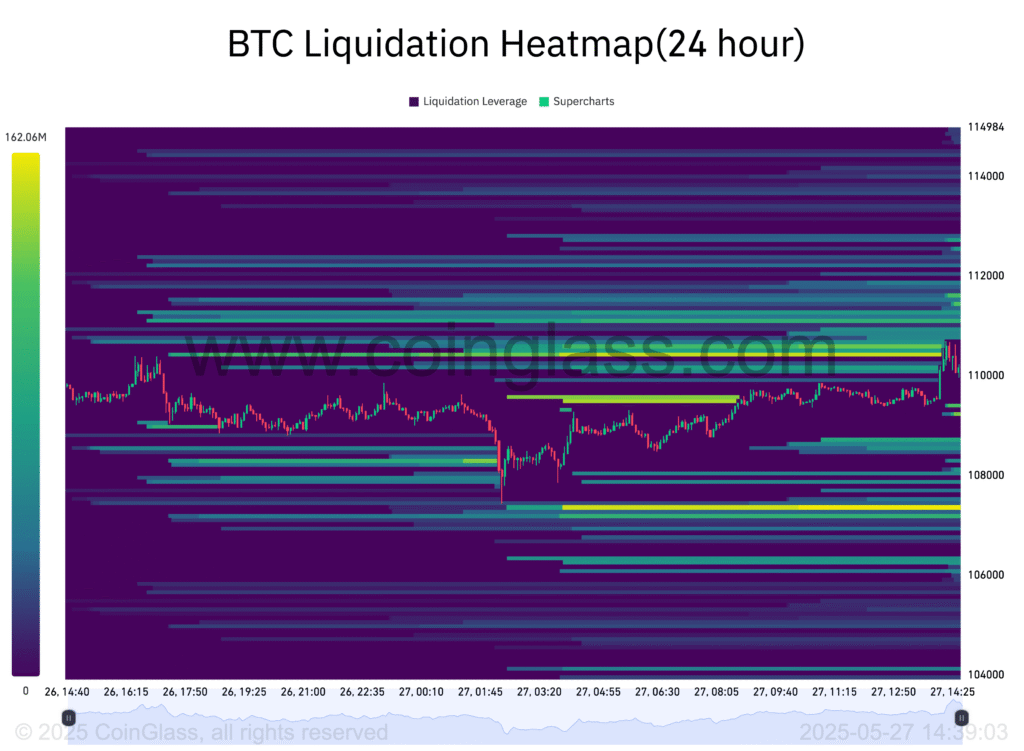

In the short term, traders are closely monitoring order book data to determine likely price targets. Daan Crypto Trades pointed to visible “liquidity clusters” on either side of Bitcoin’s current range. According to him, the longer Bitcoin hovers near $110,000, the more pronounced these clusters become, effectively acting as price magnets.

“There’s a big liquidity cluster down at ~$106K and quite a few sitting from $111K and up,” he explained, using data from CoinGlass. “Keep an eye out for when price taps either of these regions, as those usually act as a magnet when price is close.”

CoinGlass data showed some of the upper-layer sell orders being filled early in the US trading session, suggesting active movement from larger market participants.

Broader Market Risks Add to Uncertainty

Beyond the conference, other factors are also contributing to caution among investors. Concerns over US trade tariffs and uncertainty as Wall Street returns from the Memorial Day break are influencing sentiment. The combination of these elements with the looming memory of the 2024 price crash is leading many traders to approach the week with restraint.

While some analysts argue that the Bitcoin bull run may be in its final stages before a larger reversal, others maintain that dips of 10-20% are still within the bounds of healthy market behaviour. The coming days could prove critical in determining whether Bitcoin can shake off its conference-season curse, or if the déjà vu will drag prices down once again.