Binance has issued a strong warning to crypto projects and users about fraudulent actors posing as token listing agents. The exchange said that projects seeking a listing must apply directly through official Binance channels and should never engage third party intermediaries claiming to guarantee or accelerate listings.

In a public statement released on Wednesday Binance clarified its token listing framework and stressed that it does not authorise any external individuals or firms to offer listing related services. The company urged the community to remain cautious as scams linked to false listing promises continue to circulate across social media platforms.

Fake listing agents identified

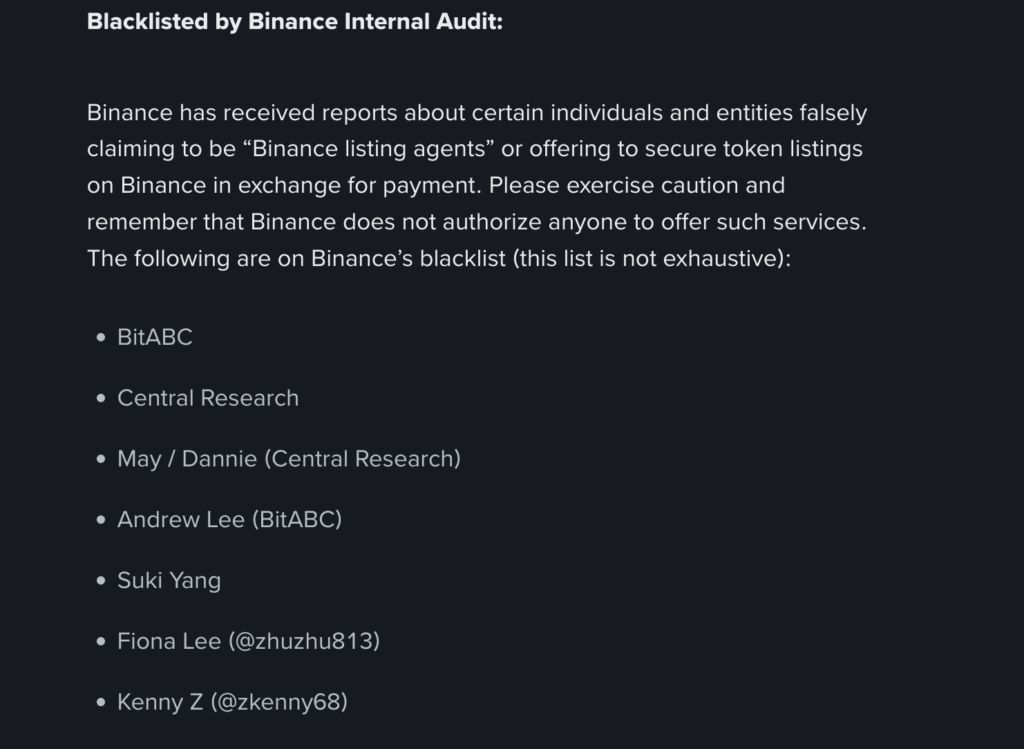

As part of the announcement Binance published a partial blacklist of entities and individuals who allegedly misrepresented themselves as Binance listing agents. The exchange said these actors attempted to solicit payments from projects in return for supposed listing access.

Among those named were Central Research which claims to represent an investment research organisation and crypto incubator BitABC. Binance also identified individuals such as Fiona Lee who describes herself on a Chinese language X account as a former A share trader and altcoin liquidity provider.

Binance emphasised that the list is not complete and warned that other fraudulent agents may still be active. The exchange encouraged users to verify all communications claiming to be linked to Binance.

Whistleblowers offered up to $5 million

To strengthen enforcement Binance announced a whistleblower programme that offers rewards of up to $5 million for valid information leading to the identification of listing fraudsters.

The exchange said it would take strong measures against verified offenders including legal action where appropriate. Binance added that anyone contacted by a party claiming to be a Binance employee affiliate or representative who asks for fees or compensation should report the approach immediately.

Official listing routes reaffirmed

Binance reiterated that projects interested in listing on its platform can apply only through official application forms. These include pathways for Spot Listing Futures Listing and Alpha Featuring. The exchange said these processes are designed to ensure fairness transparency and compliance with internal standards.

Founded in 2017 Binance remains the largest cryptocurrency exchange by trading volume. According to CoinGecko data the platform processes roughly $11 billion in daily trading volume and lists around 440 crypto assets.

Ongoing criticism of listing process

Despite its dominant position Binance has faced long standing criticism over its listing practices. Founder Changpeng Zhao previously described the process as flawed and suggested that centralised exchanges should move towards more automated listing systems similar to those used by decentralised exchanges.

In a post on X earlier this year Zhao said that Binance typically announces listings only hours before they go live. He argued that this short notice period can lead to sharp price increases on decentralised platforms before trading opens on centralised exchanges leaving retail traders at a disadvantage.

Binance has not commented publicly on whether its latest crackdown will lead to structural changes in how listings are handled. At the time of publication the exchange had not responded to questions regarding its previous handling of fraudulent listing agents.