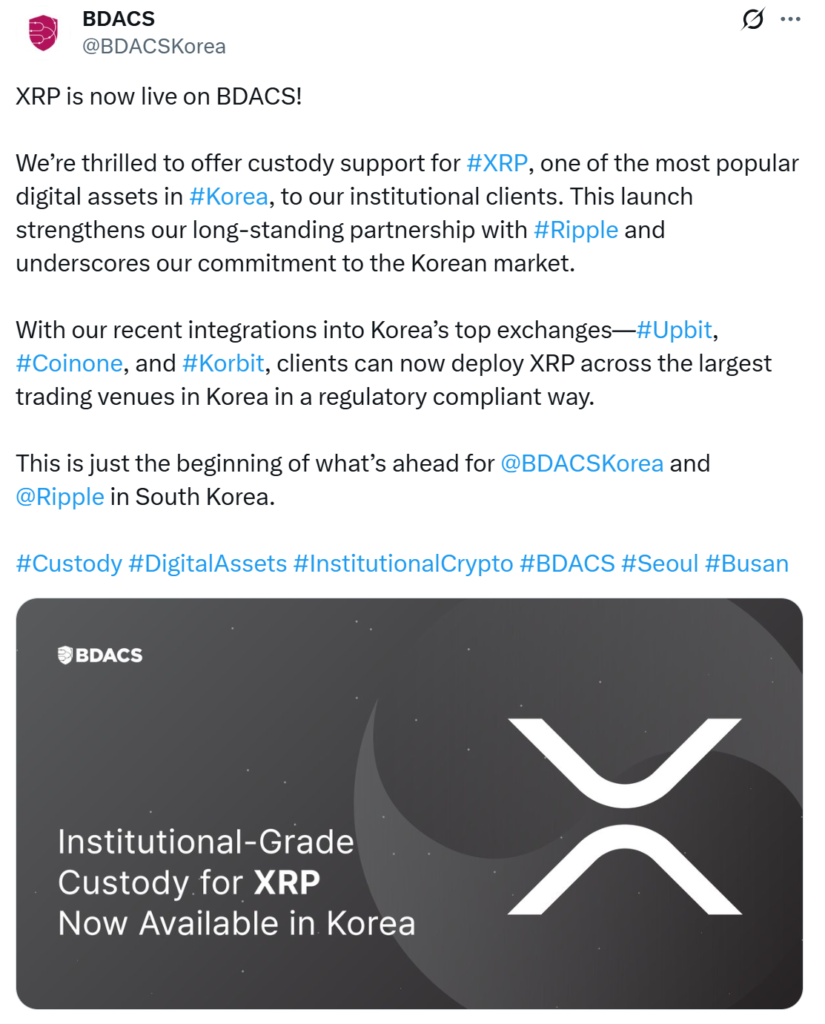

South Korea’s BDACS has officially launched institutional custody services for XRP, signalling a major development in the country’s digital asset infrastructure. The rollout follows a partnership with Ripple and integration with leading South Korean exchanges, providing institutional clients with secure and regulated access to one of the world’s most actively traded cryptocurrencies.

BDACS Expands Institutional Access to XRP

The announcement was made on Tuesday through BDACS’s official X account. The move allows institutions to store and manage XRP using Ripple Custody, a secure, enterprise-grade custody solution.

“We’re thrilled to offer custody support for XRP, one of the most popular digital assets in Korea, to our institutional clients,” BDACS stated. “This launch strengthens our long-standing partnership with Ripple and underscores our commitment to the Korean market.”

As part of this development, BDACS has integrated its custody services with South Korea’s leading crypto exchanges, including Upbit, Coinone and Korbit. This enables institutions to deploy XRP across top trading platforms in a way that complies with local regulations.

Ripple and BDACS Strengthen Partnership

The custody rollout builds on the February partnership between Ripple Labs and BDACS, aimed at enhancing institutional access to XRP and Ripple’s US dollar–backed stablecoin, RLUSD.

Ripple noted that this collaboration is aligned with South Korea’s regulatory roadmap for digital asset adoption, as outlined by the country’s Financial Services Commission. The company added that the initiative would support the broader XRP Ledger ecosystem and promote use cases for RLUSD, particularly in Busan’s blockchain regulation-free zone.

Ripple cited industry projections that digital asset custody could reach $16 trillion by 2030. Tokenised assets are expected to account for around 10 per cent of global GDP by then, underscoring the strategic importance of developing robust custody solutions.

Rising Institutional and Government Interest

Industry experts suggest that South Korea is positioning itself as a key hub in the evolving digital asset landscape. Agne Linge, Head of Growth at decentralised on-chain bank WeFi, commented on the growing legitimacy of crypto in Asia’s financial systems.

“South Korean politicians have been demonstrating strong interest in making the digital asset ecosystem a legitimate part of the financial infrastructure,” Linge said. She noted that XRP is becoming a serious candidate for core infrastructure in Asia, highlighting that 80 per cent of Japanese banks are reportedly set to adopt XRP for global payments.

This cross-border interest signals the increasing role of XRP beyond just retail trading, positioning it as a key player in international financial operations.

Crypto Adoption Among South Koreans Continues to Surge

A recent study by the Hana Institute of Finance found that more than 25 per cent of South Koreans aged 20 to 50 now hold digital assets. Among these age groups, individuals in their 40s showed the highest participation rate at 31 per cent, followed by those in their 30s and 50s.

Cryptocurrencies now make up 14 per cent of the average financial portfolio among these groups. The study also revealed that a growing number of South Koreans view crypto as a viable wealth-building tool, particularly for retirement planning.

Seventy per cent of respondents indicated plans to increase their exposure to digital assets. Furthermore, 42 per cent said they would be more willing to invest if traditional banks played a more active role in the crypto sector.

Traditional Banks Enter the Crypto Arena

The growing demand for crypto services has not gone unnoticed by South Korea’s traditional financial institutions. At least three major banks, including Kakao Bank, Kookmin Bank and the Industrial Bank of Korea, have recently filed for Korean won–backed stablecoin trademarks.

This trend reflects a broader shift within the financial industry as traditional banks look to bridge the gap between conventional finance and digital assets. Their entry could provide an added layer of legitimacy and safety for retail and institutional investors alike.

Conclusion

The launch of XRP custody services by BDACS represents a significant milestone in South Korea’s journey towards mainstream crypto adoption. Backed by Ripple and integrated with top local exchanges, the move aligns with the country’s regulatory ambitions and rising institutional interest. As more banks and financial institutions explore crypto solutions, South Korea is fast emerging as a central player in the global digital asset economy.