Global crypto regulation took centre stage today after major policy shifts, legislative momentum in the US, and a Cloudflare outage that disrupted access to leading crypto platforms. Here is a detailed look at the key developments shaping the market.

Basel Committee Signals Shift on Strict Crypto Capital Requirements

The Basel Committee on Banking Supervision is preparing to revisit its toughest crypto rules after the United States and the United Kingdom refused to implement them. The stance challenges the long-standing global consensus among bank regulators.

Erik Thedéen, chair of the Basel Committee and governor of Sweden’s central bank, told the Financial Times that policymakers may need a “different approach” to the current 1,250% risk weighting for crypto exposures. This weighting requires banks to hold capital equal to the full value of any crypto-asset exposure.

Under the existing rules, assets issued on permissionless blockchains receive the same treatment as high-risk venture investments. This includes stablecoins such as USDT and USDC. Thedéen said the rapid rise of regulated stablecoins has changed the landscape significantly and noted that the scale of assets now circulating in the system demands updated policy thinking.

Senator Tim Scott Pushes for December Vote on Market Structure Bill

In the United States, Senate Banking Committee Chair Tim Scott announced plans for a December markup of the crypto market structure bill. He expects to move the legislation to the Senate floor early next year with the goal of having it signed by President Donald Trump in 2026.

Scott accused Democrats of slowing progress and emphasised that the bill aims to make the country a global leader in crypto innovation. The House passed the CLARITY Act in July which outlines the regulatory powers of the Commodity Futures Trading Commission and the Securities and Exchange Commission. The Senate is now working to align its own draft through the Banking and Agriculture Committees.

Coinbase chief executive Brian Armstrong also travelled to Washington to support the effort. In a video message he said there has been “a lot of progress” and that there is a “good chance” the bill will be marked up in December.

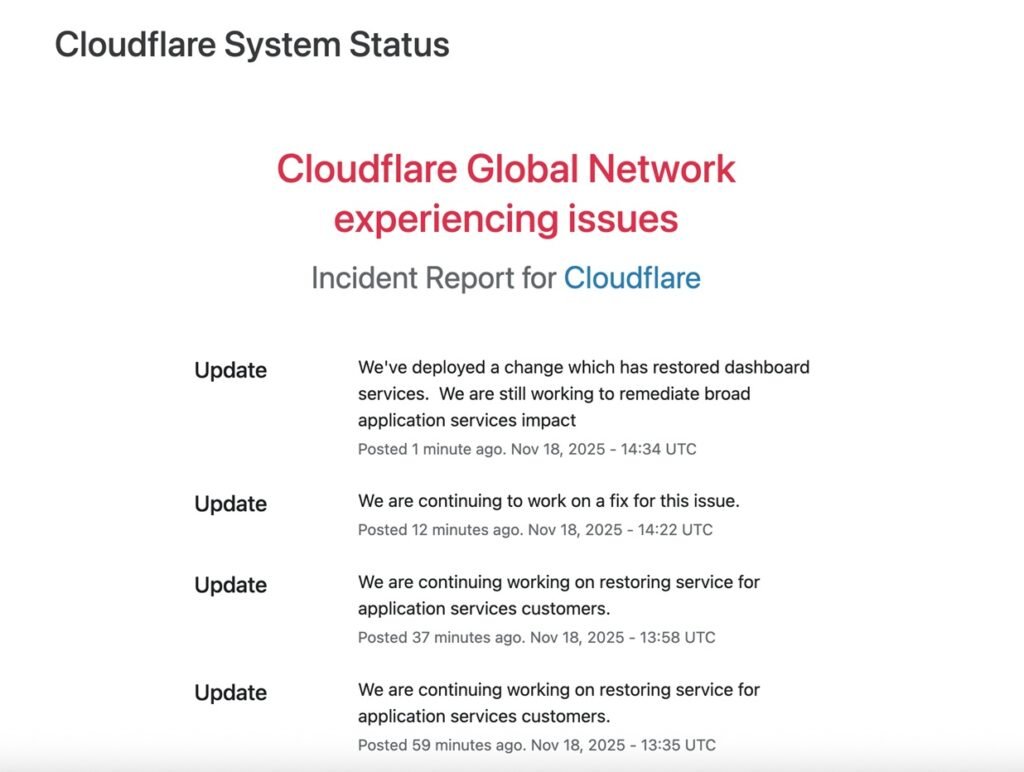

Cloudflare Outage Disrupts Crypto Platforms Worldwide

A Cloudflare service issue caused widespread disruptions across the crypto ecosystem on Tuesday. Several exchanges and blockchain services experienced temporary downtime after the company reported an internal “service degradation” that blocked access to user interfaces.

Affected platforms included Coinbase, BitMEX, Blockchain.com, Ledger, Toncoin, DefiLlama and Kraken. While Kraken later confirmed it had resolved its outage, many services reported delays throughout the day.

Cloudflare attributed the disruption to an automatically generated configuration file that had grown larger than expected. The file caused a software crash in systems responsible for managing incoming traffic.

Centralised Infrastructure Remains a Weak Spot

The outage served as a reminder that although many crypto services promote decentralisation, their front-end systems still depend heavily on centralised infrastructure. This reliance leaves platforms vulnerable to short-term interruptions despite decentralised back-end architectures.