The Avalanche Foundation, the non-profit behind the Avalanche blockchain, is working on a bold fundraising initiative aimed at raising up to $1 billion. The organisation is in advanced discussions with investors to establish two cryptocurrency-hoarding investment vehicles in the United States. These entities are intended to purchase discounted AVAX tokens directly from the foundation, reinforcing Avalanche’s push to become a leading digital ledger for capital markets.

The fundraising is split across two deals. The first involves a private investment in a Nasdaq-listed company, led by Hivemind Capital and advised by crypto investor and former White House press secretary Anthony Scaramucci. This deal, expected to raise up to $500 million, could be finalised by the end of September. The second initiative, sponsored by Dragonfly Capital, is a special purpose acquisition company (SPAC) aiming to secure another $500 million, though this may conclude only in October.

Why the Raise Matters for Avalanche

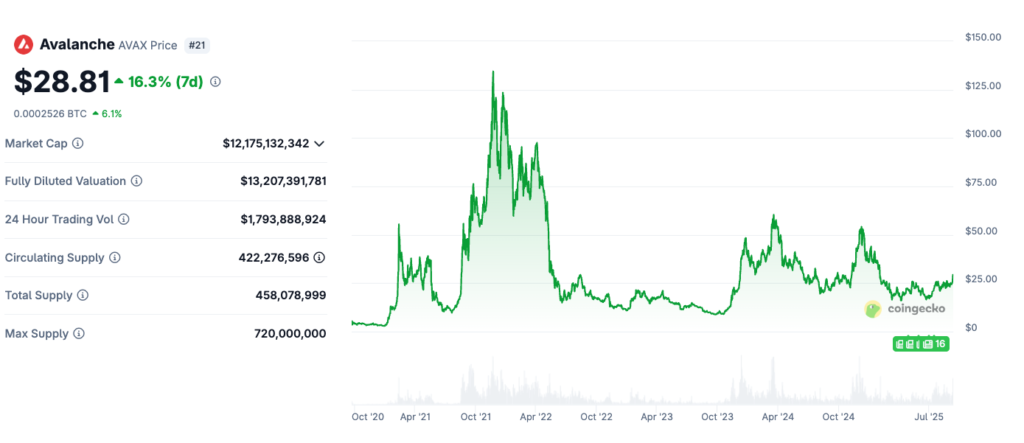

The Avalanche Foundation’s decision comes at a pivotal moment for blockchain networks. Despite strong adoption by institutional players such as BlackRock, Apollo, Visa and Wellington Asset Management, who have trialled tokenised fund versions on Avalanche, its native token AVAX has lagged behind rivals like Ethereum and Solana in recent rallies.

By channelling capital into crypto-treasury style vehicles, Avalanche hopes to replicate the success seen in other blockchain ecosystems. According to Kaiko data, similar companies have raised more than $16 billion in 2025, following a model inspired by Bitcoin treasuries such as MicroStrategy. These vehicles sell shares or bonds to fund token purchases, fuelling price growth and investor interest. However, Avalanche is entering this market as enthusiasm for such companies shows signs of cooling, with some publicly traded crypto treasuries suffering recent share price declines.

Still, by offering AVAX at discounted prices, the foundation aims to incentivise large institutional purchases, potentially driving liquidity and strengthening the token’s market performance.

AVAX Hits 7-Month High on Fundraising Buzz

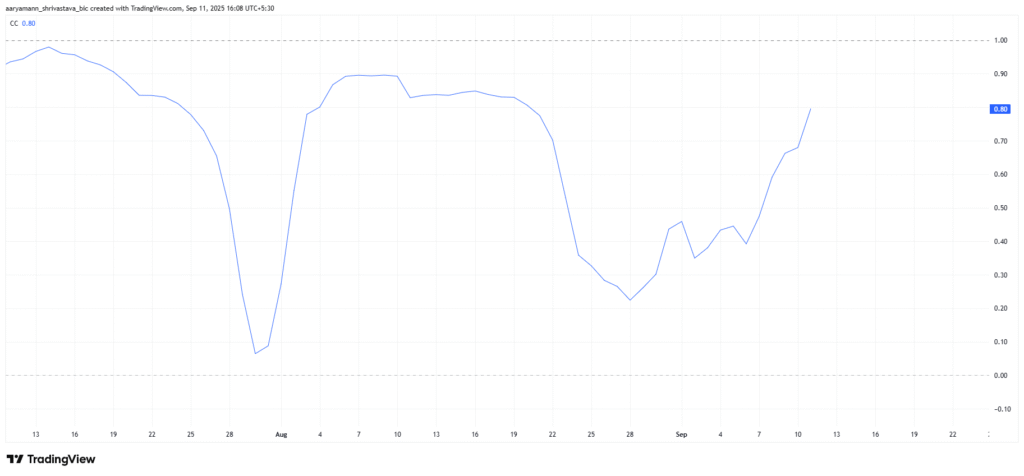

The fundraising news has already sparked a strong market reaction. AVAX surged by more than 11% in the past 24 hours, climbing to $29, a seven-month high. Technical indicators also suggest growing investor confidence. The Chaikin Money Flow (CMF), a measure of capital inflows, has reached its highest level in nearly two months, pointing to steady accumulation by traders.

AVAX’s rally is further supported by its strong correlation with Bitcoin, currently at 0.80. This means that as long as Bitcoin maintains its recovery and trades above key support levels, Avalanche is likely to track its gains. Traders now see Avalanche as a promising candidate for both short-term speculation and long-term holdings.

Despite the momentum, AVAX faces immediate resistance at the $30 level. A successful break above this threshold could pave the way for further gains toward $31.15 or higher. However, profit-taking at current levels may lead to a pullback, with key support sitting at $27 and deeper downside risk near $25.86.

Institutional Backing and Strategic Positioning

The involvement of heavyweight firms underscores Avalanche’s growing role in financial innovation. The blockchain has already been tested for tokenising traditional investment funds, positioning it as a potential backbone for the digital transformation of capital markets. By aligning with established investors like Hivemind and Dragonfly Capital, Avalanche seeks not only capital but also credibility and institutional trust.

Foundations supporting blockchains are often structured as non-profits, operating in low-tax jurisdictions to avoid falling under US securities law scrutiny. Avalanche’s model is no exception, but its scale sets it apart. With a maximum supply of 720 million AVAX tokens and around 420 million currently in circulation, the planned $1 billion raise could lock in a substantial amount of supply, tightening availability in the market.

Looking Ahead

Avalanche’s dual fundraising effort signals an ambitious strategy to reassert itself among leading blockchain ecosystems. If successful, it could reshape AVAX’s market dynamics, driving both liquidity and price momentum. At the same time, the reliance on discounted token sales raises questions about sustainability and long-term investor appetite, especially as the market cools on similar crypto-treasury ventures.

For now, momentum is firmly on Avalanche’s side. With AVAX trading near key resistance levels and institutional investors circling, the coming weeks will be crucial in determining whether the network can secure its $1 billion goal and establish itself as a dominant force in tokenised finance.