Avalanche has recorded a significant rise in blockchain activity, with analysts attributing the surge to decentralised trading, automated bots, and renewed interest from crypto whales in memecoin speculation.

Strong Growth in Transactions

According to data from Nansen, Avalanche outpaced other blockchains last week, with transactions climbing 66 per cent to 11.9 million. The number of active addresses also rose to more than 181,000, highlighting a growing investor focus on the network.

This increase coincided with the US Department of Commerce adopting Avalanche, along with nine other decentralised blockchains, to publish its real gross domestic product (GDP) data. However, Nansen research analyst Nicolai Sondergaard cautioned against linking the surge directly to government adoption.

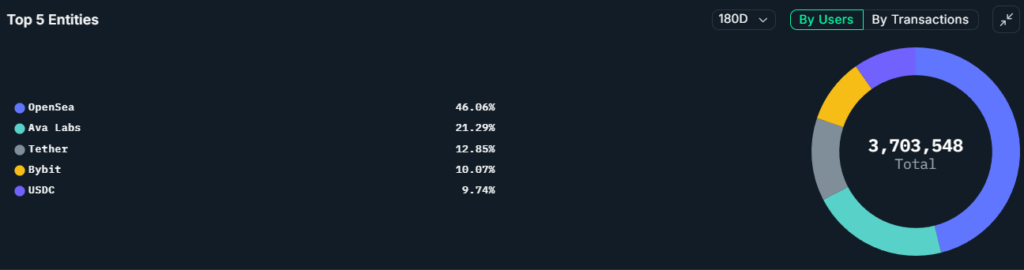

Drivers of Blockchain Activity

Sondergaard explained that most of the network’s activity was fuelled by decentralised finance (DeFi) trading and automated systems. Around 60 per cent of transactions came from DeFi protocols such as Trader Joe, Aave, and Benqi. Automated trading bots and miner extractable value (MEV) accounted for another 25 per cent, while whales engaging in memecoin speculation contributed around 10 per cent.

The remaining five per cent was linked to blockchain gaming and non-fungible tokens (NFTs). Sondergaard stressed that while government and institutional use is increasing, trading activity remains the dominant force behind Avalanche’s current momentum.

DEXs and Whales Lead the Way

Decentralised exchange trading was the largest contributor, with Trader Joe emerging as the primary driver. The platform processed over 333 million dollars worth of Avalanche Wrapped Ether (WETH.e) volume in just seven days.

High-balance traders on Nansen’s top 100 leaderboard executed multiple six-figure trades, significantly influencing activity. Meanwhile, Aave contributed through 624,000 dollars worth of flash loans executed via DEX aggregators. Benqi Protocol also played a key role, receiving more than 650,000 dollars in deposits from trading bots.

Whale addresses were particularly active in trading the Black (BLACK) token, which saw 14 million dollars in volume. Some individual wallets accumulated up to 95,000 dollars worth of the token.

Comparing Avalanche and Solana

While Avalanche gained momentum, its rival Solana recorded a decline in activity. Transactions on Solana fell 6.7 per cent last week, dropping to 433 million across 18.9 million active addresses.

Like Avalanche, Solana’s activity was dominated by DEX trading. Raydium DEX was the most active platform, boasting 12.4 million users and 297 million transactions. Fluxbeam DEX followed with 7.3 million users and 178 million transactions.

Outlook for Avalanche

The recent spike in activity underscores Avalanche’s growing appeal among decentralised traders and large investors. While institutional and governmental adoption is expanding, the blockchain’s present strength appears firmly rooted in DeFi protocols, trading automation, and speculative whale movements.

As memecoin speculation and decentralised trading continue to attract significant volumes, Avalanche is positioning itself as a leading platform for both retail traders and institutional experiments.