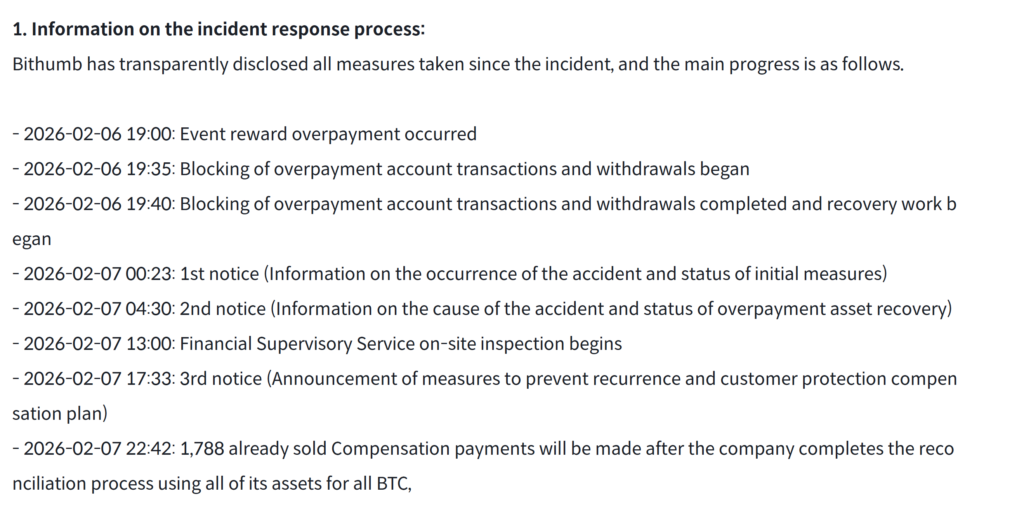

South Korea based cryptocurrency exchange Bithumb has confirmed that it has successfully recovered almost all Bitcoin that was mistakenly credited to user accounts due to a promotional system error. The exchange said it acted swiftly to contain the situation, reclaiming the majority of the excess funds on the same day the incident occurred.

Error During Promotion Leads to Excess Bitcoin Credits

The incident took place on Friday during a promotional event when a system malfunction resulted in certain user accounts receiving an unusually large amount of Bitcoin. As some users began selling the credited assets, brief price fluctuations were observed on the platform. Bithumb quickly identified the issue and restricted the affected accounts, stabilizing trading activity within minutes.

In a statement released on Sunday, the exchange clarified that the incident was purely operational and not the result of a security breach or hacking attempt. Deposits and withdrawals continued to function normally throughout the episode.

99.7% of Overpaid Bitcoin Recovered

Bithumb said it managed to retrieve 99.7% of the excess Bitcoin that had been mistakenly distributed. Most of this amount was recovered directly from user accounts before it could be traded. However, around 0.3% of the total, amounting to 1,788 Bitcoin, had already been sold in the market by users before restrictions were applied.

To address this shortfall, the exchange used its own corporate funds to cover the sold Bitcoin. Bithumb emphasized that this step ensured all customer balances remained fully backed.

“Bithumb’s holdings of all virtual assets, including Bitcoin, are equal to or exceed user deposits,” the company said, reiterating its commitment to asset security and balance integrity.

Compensation Measures Announced for Affected Users

Alongside resolving the balance mismatch, Bithumb introduced a compensation plan aimed at minimizing inconvenience to users. All users who were connected to the platform at the time of the incident will receive 20,000 Korean won, roughly $15, as compensation.

Traders who sold Bitcoin at unfavorable prices due to the sudden disruption will receive a full reimbursement of their sale value, along with an additional 10% payment. To further address user concerns, the exchange announced a seven day waiver on trading fees across all markets, starting Monday.

Exchange Responds to Market Impact and User Claims

While Bithumb did not disclose the total amount of Bitcoin involved in the error, some users on social media estimated that close to 2,000 Bitcoin had been credited during the incident. The exchange maintained that its rapid response prevented broader market damage and limited the impact to a short time frame.

The company also stressed that no customer assets were lost and that all user funds remain fully accounted for, aiming to reassure traders amid heightened scrutiny of centralized platforms.

Ongoing Operational Challenges for Centralized Exchanges

The Bithumb incident adds to a growing list of operational issues faced by centralized cryptocurrency exchanges. In recent months, several major platforms have acknowledged system related problems that affected users during periods of high activity.

In June, Coinbase revealed that account restrictions had been a persistent issue and said it had reduced unnecessary freezes by 82% after upgrading internal systems. Meanwhile, during the Oct. 10 market sell off, Binance users reported technical difficulties that prevented some traders from closing positions at peak volatility. Binance later distributed around $728 million in compensation, despite stating that its core trading engine remained functional.

As trading volumes grow and promotional campaigns become more aggressive, exchanges continue to face pressure to improve system resilience and risk controls to avoid similar incidents in the future.