Jack Dorsey led payments firm Block Inc. is preparing for a possible round of job cuts that could impact up to one tenth of its global workforce, as the company pushes ahead with a broader restructuring strategy aimed at improving efficiency and sharpening its product focus.

Performance Reviews Trigger Possible Layoffs

Block has started notifying hundreds of employees that their roles may be at risk as part of its annual performance review cycle, according to a Bloomberg report citing people familiar with the matter. The process is expected to determine which positions may be eliminated as the company reassesses internal priorities.

If carried through fully, the move could affect as many as 10 percent of Block’s employees. The company had just under 11,000 staff members as of late November, based on comments made by a senior executive at the time. While Block has not publicly confirmed the final number of job cuts, the scale signals a meaningful shift in how the company plans to operate going forward.

Reshaping Operations and Product Focus

The potential layoffs are part of a wider reorganization that Block began rolling out in 2024. The overhaul is designed to streamline operations and better align its major business units, particularly its consumer focused Cash App and merchant services platform Square.

Management has been working to bring these two ecosystems closer together, allowing products and services to complement each other more directly. The idea is to create a more integrated payments and financial services experience for both users and sellers, while reducing overlapping roles and costs within the organization.

As part of this restructuring, Block is also reallocating resources toward areas it sees as long term growth drivers, even as it trims back in others.

Continued Push Into Bitcoin and AI Projects

Despite the cost cutting measures, Block is continuing to invest in newer initiatives. One of its key focus areas remains Bitcoin, including its mining division Proto. The company has long positioned itself as a strong supporter of Bitcoin infrastructure, both through direct holdings and through product development.

Block is also building an internal artificial intelligence initiative known as Goose. While details around the project remain limited, it is understood to support product development and operational efficiency across the company’s platforms. These investments suggest that while Block is tightening its workforce, it is not pulling back from experimental or future facing technologies.

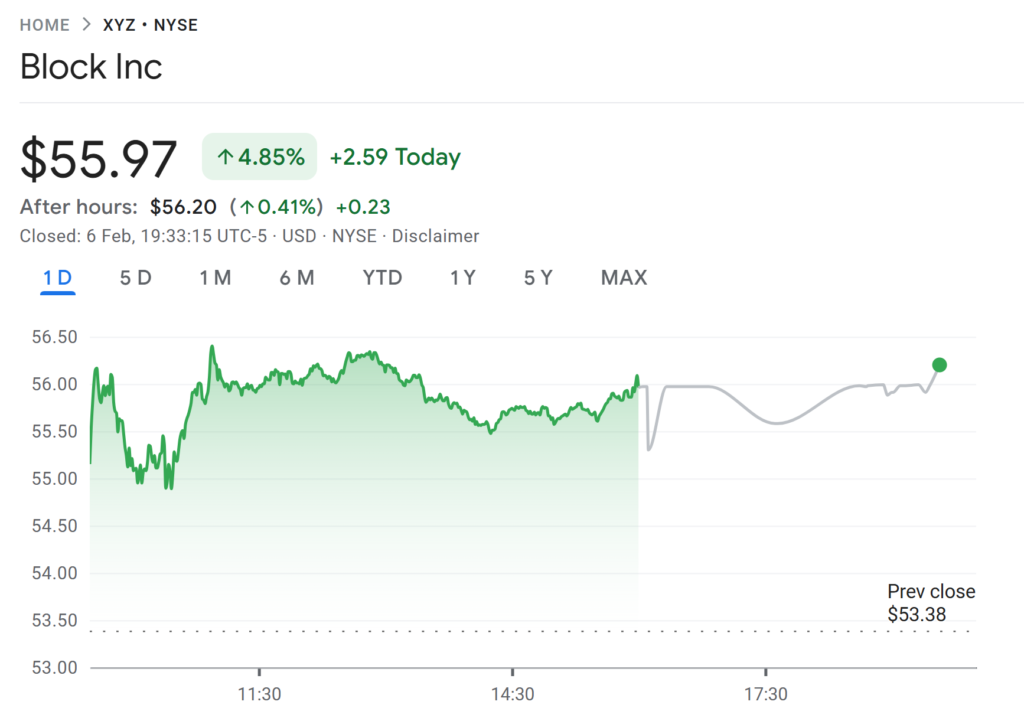

Earnings Expectations and Market Performance

Block is scheduled to report its fourth quarter earnings on February 26. Analysts expect the company to post an adjusted profit of around $403 million, or 68 cents per share, on revenue of approximately $6.25 billion.

In the previous quarter, Block reported net income of $461.5 million on revenue of $6.11 billion. Gross profit rose 18 percent year over year, helped by strong performance from Cash App, which grew 24 percent, and Square, which saw 9 percent growth. Even so, the stock declined after the earnings release as some metrics fell short of Wall Street expectations.

Bitcoin related activity remained a significant contributor during the third quarter. The company generated about $1.97 billion in Bitcoin revenue, down from $2.4 billion a year earlier, but still ranking as Block’s second largest revenue stream. By the end of September, Block held 8,780 Bitcoin valued at over $1 billion, though it recorded a $59 million valuation loss during the quarter.

Square Expands Bitcoin Payments for Merchants

Block has also continued to expand Bitcoin use within its merchant ecosystem. In November, Square launched a new feature allowing sellers to accept Bitcoin payments directly at checkout using its point of sale terminals. Merchants can choose to receive payments in Bitcoin or automatically convert them into fiat currency.

The feature builds on earlier tools that let sellers allocate a portion of their daily card sales into Bitcoin, reinforcing Square’s broader payments and digital wallet offering. Square now serves more than four million sellers across eight countries, making it one of the largest merchant platforms experimenting with Bitcoin based payments at scale.

As Block balances restructuring with ongoing investment, the coming quarters will be closely watched to see whether the operational overhaul delivers improved performance without undermining its growth ambitions.