Analysts Flag Rising Threat to Traditional Banking

Stablecoins are becoming a serious challenge to traditional banking systems, particularly in the United States, according to a new report from Standard Chartered. The bank’s global head of digital assets research, Geoff Kendrick, has warned that the rapid growth of stablecoins could significantly reduce bank deposits in the coming years.

Kendrick said that stablecoins now represent a “real risk” to banks worldwide. He linked this concern to recent delays in passing the US CLARITY Act, which aims to ban interest payments on stablecoin holdings. The delay, he said, highlights ongoing uncertainty around regulation and the increasing influence of digital assets.

Based on current trends, Standard Chartered estimates that US bank deposits could fall by around one third of the total stablecoin market value. At present, US dollar backed stablecoins are worth about 301.4 billion dollars, according to CoinGecko.

Regional Banks Face Higher Exposure

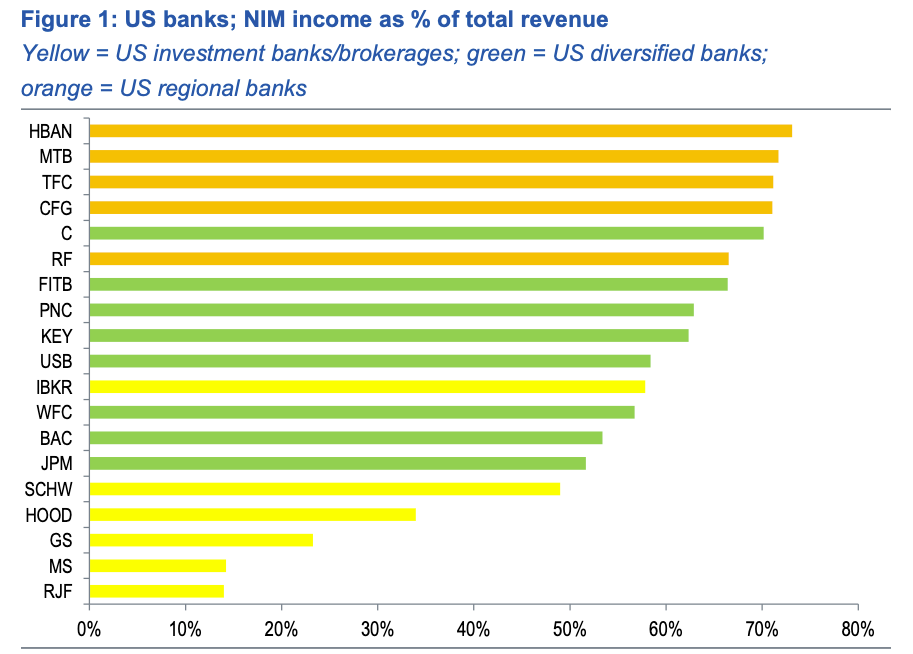

The report suggests that regional banks in the United States are more vulnerable than large diversified institutions or investment banks. Kendrick focused on net interest margin income, a key measure of bank profitability that reflects the difference between interest earned and interest paid.

Since deposits play a central role in generating this income, any movement of funds into stablecoins could weaken banks’ earnings. Kendrick described net interest margin income as the most accurate indicator of exposure to stablecoin risks.

According to the analysis, banks such as Huntington Bancshares, M and T Bank, Truist Financial and CFG Bank are among the most exposed. In contrast, investment banks appear to be the least affected because they rely less on retail deposits.

The scale of potential losses, however, depends on several factors. These include where stablecoin issuers keep their reserves, whether demand is domestic or foreign and whether usage is driven by wholesale or retail customers.

Limited Reinvestment in Traditional Banks

One factor that could reduce pressure on banks is if stablecoin issuers hold most of their reserves in traditional bank deposits. In theory, this would mean that money leaving one bank would re enter the system through another channel.

Kendrick explained that if a customer moves funds into stablecoins, but the issuer stores those funds in bank accounts, there would be little overall loss to the banking sector. However, the current situation suggests that this is not happening to any significant extent.

The two largest stablecoin providers, Tether and Circle, hold very small portions of their reserves in bank deposits. Tether reportedly keeps just 0.02 per cent of its reserves in banks, while Circle holds around 14.5 per cent. As a result, most funds flowing into stablecoins are not returning to traditional banking institutions.

Kendrick said this limited reinvestment increases the risk of deposit outflows, especially during periods of financial stress.

Global Demand Shifts and Emerging Markets

The report also highlights the importance of geographical demand. Kendrick noted that domestic demand for stablecoins tends to drain local bank deposits, while foreign demand has less direct impact.

At present, around two thirds of stablecoin usage comes from emerging markets. Only one third originates in developed economies. This means that banks in developing countries are likely to face greater pressure in the long term.

Standard Chartered projects that the stablecoin market could reach a value of 2 trillion dollars by 2028. If this happens, about 500 billion dollars could leave banks in developed markets, while roughly 1 trillion dollars could exit banks in emerging economies.

These figures suggest that stablecoins may reshape global banking patterns, particularly in regions where access to traditional financial services is limited or unstable.

Regulation and Future Risks

Despite current delays, Standard Chartered still expects the US CLARITY Act to be approved by the end of the first quarter of 2026. The proposed law would prohibit stablecoin issuers from paying interest, which could reduce their attractiveness compared with bank accounts.

The debate around the bill has intensified in recent months. Some companies, including Coinbase, have withdrawn support, while Circle’s chief executive Jeremy Allaire has dismissed concerns about stablecoin driven bank runs as “totally absurd”.

Kendrick disagrees with this assessment. He argued that risks are real and likely to grow as digital assets become more integrated into financial systems. He also pointed out that stablecoins are not the only concern. The expansion of tokenised real world assets could create similar pressures on banks.

According to the report, traditional financial institutions must prepare for a future in which digital currencies play a much larger role. Without effective regulation and adaptation, banks could face sustained pressure on deposits, profits and long term stability.